Articles

Increasing blue hydrogen production affordability

N. LIU, Shell Catalysts & Technologies, The Hague, the Netherlands

Large-scale, affordable, “blue” hydrogen production from natural gas, along with carbon capture, utilization and storage (CCUS), is necessary to bridge the gap until large-scale H2 production using renewable energy becomes economic. The cost of carbon dioxide (CO2) already makes blue H2 via steam methane reforming (SMR) competitive against gray H2 (without CCUS), and a newly available processa based on gas partial oxidation (POX) technology and pre-combustion CO2 capture solvent technology further increases the affordability of blue H2 for greenfield projects.

Why blue H2?

A growing number of national governments and energy companies, including Shell,1 have announced net-zero-emission ambitions. Although renewable electricity is expanding rapidly, without low-carbon H2 as a clean-burning, long-term-storable, energy-dense fuel, a net-zero goal is difficult to achieve, especially when it comes to decarbonizing fertilizer production and hard-to-abate heavy industries such as steel manufacturing and power generation. H2 also has potential as a transport and heating fuel that could repurpose existing gas distribution infrastructure or be introduced into existing natural gas supplies.

Consequently, H2 plays an important part in many green strategies. The EU’s H2 strategy,2 published in July 2020, describes it as “…essential to support the EU’s commitment to reach carbon neutrality by 2050 and for the global effort to implement the Paris Agreement while working towards zero pollution.”

Momentum is building with a succession of commitments to H2 by various companies and governments. For example, in June 2020, Germany announced a €9-B H2 strategy,3 and the International Energy Agency stated, “Now is the time to scale up technologies and bring down costs to allow hydrogen to become widely used.”4 Over the past 3 yr, the number of companies with membership in the international Hydrogen Council—which predicts a tenfold increase in H2 demand by 20505—has jumped from 13 to 81 and includes oil and gas companies, automobile manufacturers, trading companies and banks.

In 2018, global H2 production was 70 MMtpy.4 Today’s demand is split between use for upgrading refined hydrocarbon products and as a feedstock for ammonia production for nitrogen fertilizers. Nearly all H2 production comes from fossil fuels: it accounts for 6% of natural gas and 2% of coal consumption, as well as 830 MMtpy of CO2 emissions6—more than double the UK’s emissions.7 Gray H2 is a major source of CO2 emissions. If H2 is to contribute to carbon neutrality, it must be produced on a much larger scale and with far lower emissions levels.

Over the long term, the answer is likely to be “green” H2, which is produced from the electrolysis of water powered by renewable energy. This supports the integration of renewable electricity generation by decoupling production from use. H2 becomes a convertible currency enabling electrical energy to be stored and used as an emissions-free fuel and chemical feedstock.

Green H2 projects are starting. For example, a Shell-led consortium is at the feasibility stage of the NortH2 wind-to-H2 project in the North Sea, and a Shell–Eneco consortium secured the right to build the 759-MW Hollandse Kust Noord project at a subsidy-free Dutch offshore wind auction in July 2020; this project will include a green H2 technology demonstration.

However, electrolysis alone will not meet the forecast demand. It is expensive at present, and there is insufficient renewable energy available to support large-scale green H2 production. To put the scale of the task into perspective, meeting today’s H2 demand through electrolysis would require 3,600 TWh of electricity, more than the EU’s annual use.4 Moreover, using the current EU electricity mix would produce gray H2 from electrolysis with 2.2 times the greenhouse gas emissions of producing gray H2 from natural gas.8 This is because nearly half (45.5%) of the net electricity generated in the EU comes from burning natural gas, coal and oil,9 and generating electricity from natural gas, for example, has a 44% efficiency.10

An alternative is blue H2 produced from natural gas, coupled with CCUS. H2 production via electrolysis has a similar efficiency to blue H2 production, but the levelized cost of production is significantly higher for electrolysis at €66/MWh, compared with €47/MWh for SMR–CCUS.11

In addition, it is widely acknowledged that scaling up blue H2 production will be easier than delivering green H2. For example, the EU strategy2 states, “Other forms of low-carbon hydrogen [i.e., blue] are needed, primarily to rapidly reduce emissions … and support the parallel and future uptake of renewable [green] hydrogen.”

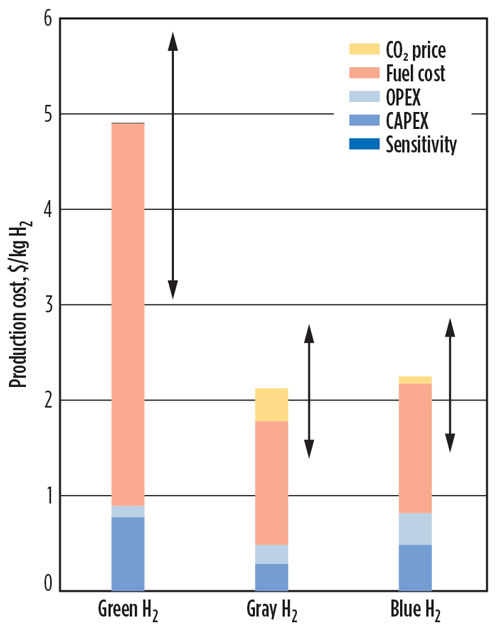

However, the strategy goes on to claim that neither green nor blue H2 production is cost-competitive against gray; the H2 costs estimated for the EU are €1.5/kg for gray, €2/kg for blue and up to €5.5/kg for green.4 These costs are based on an assumed natural gas price for the EU of €22/MWh, an electricity price of €35/MWh–€87/MWh and a capacity cost of €600/kW.

With the cost of CO2 at $25/t–$35/t, blue H2 becomes competitive against gray even with higher capital costs, and green H2 still may be more than double the price of blue H2 by 2030 (FIG. 1).4 Some forecasts indicate that cost parity will occur around 2045.12

Fig. 1 Estimated H2 production costs in 2030.

This competitiveness between blue and gray H2 (when considering CO2 costs) is based on SMR technology, but other technologies are available to further increase blue H2 affordability for greenfield projects.

Greenfield technology options

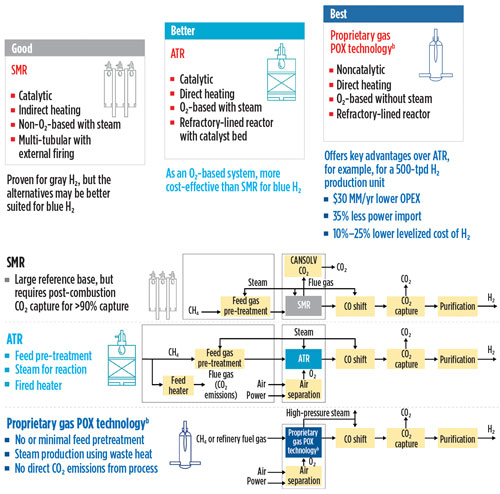

This article considers three technology options for greenfield blue H2 projects: SMR, autothermal reforming (ATR) and a proprietary gas POX technology (FIG. 2).

Fig. 2 Blue H2 technologies and process lineups.

SMR. SMR, a proven catalytic technology widely applied for gray H2 production, uses steam in a multi-tubular reactor with external firing for indirect heating. More than 48% of H2 production is from natural gas, with SMR being the most common production technology.13 Post-combustion carbon capturec can be retrofitted to convert gray H2 production to blue and is proven to capture nearly all the CO2 (99%) from low-pressure, post-combustion flue gas.

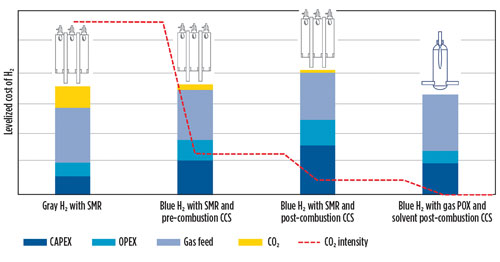

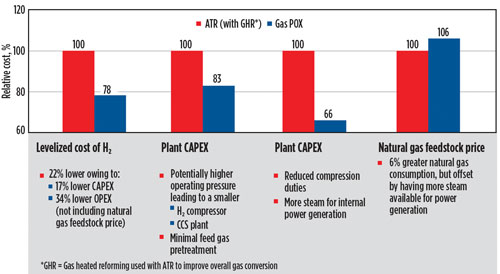

However, for greenfield blue H2 applications, oxygen (O2)-based systems, such as ATR and gas POX technology, are more cost-effective than SMR (FIG. 3), a conclusion backed by numerous studies and reports.14 Note: The cost of CO2 makes gray H2 via SMR more expensive than blue H2 from SGP technology. The cost advantage of O2-based systems over SMR increases with scale because the relative cost of the air separation unit decreases with increasing capacity. Another advantage is that more than 99.9% of the CO2 can be captured using the lower-cost, pre-combustion solvent technology.d

Fig. 3 Relative CO2 intensity and cost of gray and blue H2 via SMR with pre- and post-combustion capture, and blue H2 via proprietary gas POXa and pre-combustion capture solventd technologies.

ATR. ATR uses O2 and steam with direct firing in a refractory-lined reactor with a catalyst bed. It is more cost-effective than SMR, but it requires a substantial feed gas pre-treatment investment, and the fired heater produces CO2 emissions (FIG. 2). ATR can be combined with pre-combustion carbon-capture technology to convert gray H2 production to blue.

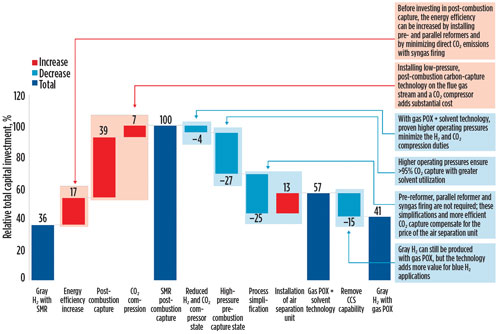

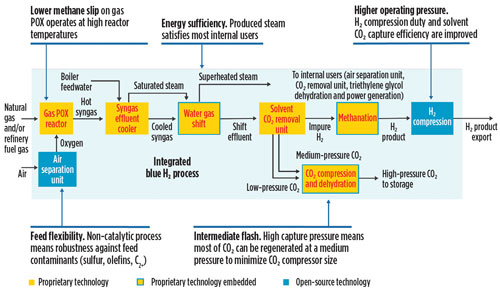

Gas POX technology. Gas POX technology is also an O2-based system with direct firing in a refractory-lined reactor, but it is a noncatalytic process that does not consume steam and has no direct CO2 emissions. It, too, can be combined with pre-combustion carbon-capture technology for blue H2 production. Compared with SMR, gas POX technology saves money by maximizing the carbon-capture efficiency and simplifying the process lineup, both of which offset the cost of O2 production (FIG. 4).

Fig. 4 Relative capital investment comparison between gray and blue H2 via SMR and gas POX technology.

POX vs. ATR for blue H2. As O2-based systems offer clear benefits over SMR, this article considers the advantages of the proprietary gas POX technologyb over ATR for blue H2 production.

A key advantage is that the POX reaction does not require steam as a reactant. Instead, high-pressure steam is generated by using waste heat from the reaction, which can satisfy the steam consumption within the blue H2 process, as well as some internal power consumers.

With no need for feed gas pre-treatment, gas POX technology has a far simpler process lineup than ATR (FIG. 2). Also, as a noncatalytic, direct-fired system, it is robust against feed contaminants such as sulfur and can accommodate a large range of natural gas qualities, thereby giving refiners greater feed flexibility to decarbonize refinery fuel gas.

Gas POX technologyb provides substantial savings compared with ATR—a 22% lower levelized cost of H2 (FIG. 5). These savings come from a 17% lower CAPEX owing to the potential for a higher operating pressure leading to a smaller H2 compressor (single-stage compression), CO2 capture and CO2 compressor units, and a 34% lower OPEX (excluding the natural gas feedstock price) from reduced compression duties and more steam generation for internal power. Gas POX technology consumes 6% more natural gas, but this is offset by power generation from the excess steam.

Fig. 5 The cost of gas POX technology relative to ATR.

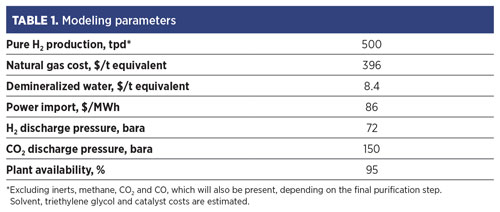

The proprietary blue H2 processa is an end-to-end lineup that maximizes the integration of the gas POX and solvent technologies. Compared with an ATR unit, modeling shows (based on the parameters in TABLE 1) that a lineup producing 500 tpd of pure H2 would have:

- $30 MM/yrlower OPEX

- 35% less power import

- > 99% CO2capture

- 10%–25% lower levelized cost of H2.

The gas POX–solvent process is the best option for large-scale blue H2 projects. FIG. 6 shows the principle advantages of integrating it with other proprietary and open-source technologies.

Fig. 6 The advantages of integrating the proprietary blue H2 process with other technologies, with Shell as the master licensor.

The choice between a methanator or a pressure-swing absorption (PSA) unit for the H2 purification step depends on the required H2 purity. For example, a PSA unit is necessary to achieve the > 99.97% purity required for the H2 used in fuel cells. The offgas is predominantly H2, with trace containments such as CO, CO2 and nitrogen. In the ATR process, this offgas is typically burned to preheat the natural gas, which produces direct CO2 emissions.

In a methanator, the purity of the final H2 is lower (> 98%, depending on the feed gas properties). However, it avoids the direct CO2 emissions from burning the PSA offgas. The main advantage of choosing a methanator is that H2 is not lost via the PSA offgas. Consequently, it reduces natural gas consumption for the same H2 production. In addition, a methanator is commonly applied in industry, as it satisfies the H2 purity requirements of most industrial consumers.

History of gas POX oxidation technology

Gas POX technologyb is mature and “low-carbon,” which makes it eligible for government funding. It has a long history of development and usage. For example, research into oil gasification was being conducted in Amsterdam, the Netherlands as early as 1956.

Today, the proprietary gas POX technologyb has more than 30 active residue and gas gasification licensees, and more than 100 gasifiers using the technology have been built worldwide. For example, the Pearl gas-to-liquids (GTL) plant in Qatar has 18 trains, each with an equivalent pure H2 production capacity of 500 tpd. Pearl GTL has been operating since 2011. The product is defined as pure H2 production—i.e., not including any inerts, methane, CO2 or CO, which will also be present, depending on the final purification step.

Since 1997, the Pernis refinery in the Netherlands has been operating a 1-MMtpy carbon-capture program using the technology. The CO2 is used in local greenhouses. The CO2 stream is an essential part of the Pernis CCS project.

No matter how cost-effective the H2 production and carbon-capture technologies, without sequestering the CO2 directly or through enhanced oil recovery, the H2 remains gray. Many CCUS projects are in operation at various stages throughout the world. For example, since 2015, the Shell Quest facility in Canada has captured and stored more than 5 MMt of CO2.

Key takeaways

H2 will be part of the future energy mix, and several mature technologies are available for producing cost-effective, low-carbon blue H2. For greenfield applications, SMR is an inefficient method of producing blue H2 owing to poor CO2 recovery and scalability; O2-based systems offer better value (an independently backed conclusion).

The proprietary blue H2 process,a which integrates proprietary gas POXb and solventc technologies, offers key advantages over ATR, including a 10%–25% lower levelized cost of H2, a 20% lower CAPEX, a 35% lower OPEX (excluding natural gas feedstock price), > 99% CO2 captured and overall process simplicity. The process, which is now available to third-party refiners, is proven at the 500-tpd scale.H2T

NOTES

a Refers to the Shell Blue Hydrogen Process (SBHP)

b Refers to the Shell gas partial oxidation process (SGP)

c Refers to the Shell CANSOLV CO2 Capture System (CANSOLV is a Shell trademark)

d Refers to Shell ADIP ULTRA solvent technology

LITERATURE CITED

1 Van Beurden, B., “A net zero emissions energy business,” Shell, April 16, 2020, Online: https://www.shell.com/media/speeches-and-articles/2020/a-net-zero-emissions-energy-business.html

2 European Commission, “A hydrogen strategy for a climate-neutral Europe,” July 7, 2020, Brussels, Belgium.

3 Press and Information Office of the German Federal Government, “German government adopts hydrogen strategy,” June 10, 2020, Online: https://www.bundesregierung.de/breg-en/news/wasserstoffstrategie-kabinett-1758982

4 International Energy Agency, “The future of hydrogen,” June 2019.

5 Hydrogen Council, “Hydrogen scaling up: A sustainable pathway for the global energy transition,” November 13, 2017, Online: https://hydrogencouncil.com/en/study-hydrogen-scaling-up/

6 International Energy Agency, “Hydrogen,” 2021, Online: https://www.iea.org/fuels-and-technologies/hydrogen

7 EU Science Hub, 2018, Online: https://ec.europa.eu/jrc/en

8 Adolf, J. et. al, “Shell hydrogen study: Energy of the future? Sustainable mobility through fuel cells and hydrogen,” January 2017.

9 Europa, Eurostat, “Electricity production, consumption and market overview (based on 2018 data),” June 2020, Online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Electricity_production,_consumption_and_market_overview#Electricity_generation

10 U.S. Energy Information Administration, “Table 8.1: Average operating heat rate for selected energy sources,” (Assuming a heat rate of 7,800 Btu/kWh for natural gas power plants), Online: https://www.eia.gov/electricity/annual/html/epa_08_01.html

11 Pöyry Management Consulting, “Hydrogen from natural gas—The key to deep decarbonisation,” July 2019, Online: https://www.poyry.com/sites/default/files/zukunft_erdgas_key_to_deep_decarbonisation_0.pdf

12 European Zero Emission Technology and Innovation Platform, “Commercial scale feasibility of clean hydrogen,” April 25, 2017, Online: https://zeroemissionsplatform.eu/wp-content/uploads/ZEP-Commercial-Scale-Feasibility-of-Clean-Hydrogen-report-25-April-2017-FINAL.pdf

13 International Renewable Energy Agency (IRENA), “Hydrogen from renewable power: Technology outlook for the energy transition,” September 2018, Online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Sep/IRENA_Hydrogen_from_renewable_power_2018.pdf

14 IEA Greenhouse Gas R&D Programme (IEAGHG), “Reference data and supporting literature reviews for SMR based hydrogen production with CCS,” IEAGHG Technical Review 2017-TR3, 2017, Online: https://ieaghg.org/publications/technical-reports/reports-list/10-technical-reviews/778-2017-tr3-reference-data-supporting-literature-reviews-for-smr-based-hydrogen-production-with-ccs

NAN LIU is the Licensing Technology Manager for Gasification at Shell Catalysts & Technologies. She has fulfilled roles throughout the project lifecycle, from initial feasibility and front-end development to project execution and plant operations, on major capital projects around the globe. These projects include the startup of the gasification unit at the Fujian refinery and ethylene project in China, as well as performance optimization at the gasification and hydrogen plant at Shell’s Pernis refinery in the Netherlands. Ms. Liu has a strong commercial mindset and is a keen advocate of gasification as a value-adding investment.

Fig. 1. Estimated H2 production costs in 2030.

Fig. 2. Blue H2 technologies and process lineups.

Fig. 3. Relative CO2 intensity and cost of gray and blue H2 via SMR with pre- and post-combustion capture, and blue H2 via proprietary gas POXa and pre-combustion capture solventd technologies.

Fig. 4. Relative capital investment comparison between gray and blue H2 via SMR and gas POX technology.

Fig. 5. The cost of gas POX technology relative to ATR.

Fig. 6. The advantages of integrating the proprietary blue H2 process with other technologies, with Shell as the master licensor.