Articles

Executive Viewpoint: Digital technology will accelerate innovation and profit for H2

Hydrogen has been in the spotlight for the past 2 years. In a survey of approximately 340 global companies, conducted by AspenTech in June 2021, 65% of respondents said they were planning to invest in hydrogen in the next 5 years as one solution to greenhouse gas emissions. On the scale of large energy projects, that is really tomorrow or even today. Two thirds of companies intend to move into H2! The only area garnering a higher investment level is renewables.

Even more startling is the divergence of approaches—there is no consensus. With respect to what leading carbon mitigation expert Robert Socolow, of Princeton University, calls the “color wars,” 56% of companies are planning a move into green H2, 49% into blue H2, and 25% in the established approach of gray H2. (Note: Some are planning multiple initiatives, which is why percentages add up to over 100%).

The sustainable investment community is pushing the “green” approach (largely H2 synthesis with electrolysis fueled exclusively by renewable energy), while many energy pragmatists, including regulators in Europe, are pushing a “blue” approach (H2 from known reforming processes, with retrofitted carbon capture of flue gases).

Having spoken to executives at leading global players over the past 18 months, what I have learned is that one should think of H2 as a time-to-market, scaling and economic innovation game. The most astute players see a market that is available to win, from a low-cost and non-friction scaling point of view.

Several barriers are preventing speedy adoption, but digital technology is a magic bullet to help overcome these obstacles. With the amount of capital being released to fuel the growth of the H2 economy, the smartest players are seeing that combining innovation brainpower, project execution capability and industrial AI-fueled digital technology can be the ticket to growth and market share.

Maximize H2 investments with digital technology. Turning H2 investments into economic successes is not without challenges. Digital technologies will be instrumental in surmounting these challenges:

- De-risking the H2 economy as a system. What makes H2 so exciting—but also full of risk—is that it requires an end-to-end systems view. This includes producing green or blue H2, powering H2 production through renewables, carbon capture, H2 storage and transport, and H2 end use. Individual companies are pursuing each part, but it needs to be scaled up and succeed as a system. Strong alliances and joint ventures are needed, but more important is a quantitative approach to solving the weak points in the system. Systemwide, end-to-end risk modeling is a crucial digital technology to unlock the answer to where the most intellectual and financial capital should be applied.

- Improving the economics of the renewable power to H2 electrolysis system. Today, the electrolysis technology itself has been proved out, but the economics need much improvement. Rigorous and AI-assisted models, combined with economic models, are important. They can accelerate and multiply the efforts of technology innovators to reach new levels of economic and technical breakthrough in looking at renewables, power storage and H2 synthesis as one system that is subject to the stochastic variabilities of wind and solar.

- Improving the efficiency, and therefore the economics, of reforming processes combined with carbon capture. Technology must be able to capture and remove a higher percent of CO2 produced, and with better energy efficiency. Predictive rigorous models and optimization technology are the key digital elements that will accelerate progress and blue H2 results.

- Advancing the safe handling and transport of H2. Simpler and safer approaches to cryogenic H2 and streamlining the use of ammonia as a carrier still require considerable engineering effort and innovation, as well as new process ideas. To achieve the speed and scale of progress in scaling up the proliferation of the H2 economy, hybrid models combining AI with engineering domain expertise can be the crucial digital enablers.

- Driving the economics up, and driving down the size of fuel cells, will expand the economically advantageous use cases for H2. Bringing advanced data analytics and hybrid models online will allow manufacturers to learn from generations of fuel cell design and accelerate economic progress.

H2 economy and energy transition. The energy transition, coupled with a global drive for sustainability in the energy and chemical industries, is already impacting the economy and all players across the energy value chain. These geopolitical forces will create winners and losers across these industries over the next 10 years.

Achieving energy transition leadership with industrial-scale H2 production and carbon-capture technologies will require unmatched levels of innovation, creativity, agility and execution. This is a clear area where digital technology innovations will complement and add value to industry participants, individually and collectively helping those that are the most innovative and digitally native, win.

Areas where companies will win with digital technology include:

- Time to market: Accelerating innovation, optioneering, concept selection and capital investment decision-making by up to 50%

(or 6–12 months). - Cost of production: Reducing capital cost through visual estimating, reducing operating costs by saving energy and water through optimized designs, and incorporating new technology to seamlessly and effectively integrate the new into existing facilities.

- Uptime, safety and risk: Employing AI and analytics

to reduce risk while improving uptime, safety and reliability. - Customer satisfaction: Maximizing agility and resilience

in the supply chain.

At the World Economic Forum’s Davos Agenda in January 2021, Bill Gates talked about the need to create a trusted global carbon market, which will spur the need to shift very large capital investments into low-carbon areas.1 He talked specifically about the H2 economy, carbon capture and energy storage, as well as “green premiums” and the need to drive the economics of new technologies through scaling and investment.2

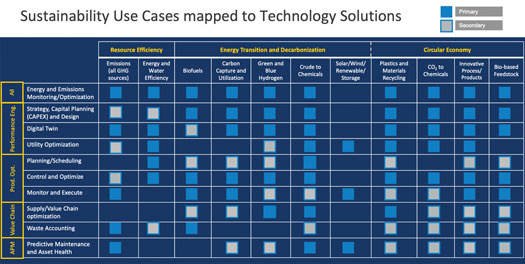

The extent of the energy transition complexity requires a balance of the many objectives across a company’s assets, as well as a data-based and quantitative approach. Digitalization and industrial AI will be crucial tools in this balancing act (FIG. 1). At the same Davos event in January 2021, Al Gore stated, “The sustainability revolution will be powered by digital technology.”H2T

Literature Cited

1 World Economic Forum’s Davos Agenda, Online: https://www.weforum.org/events/the-davos-agenda-2021

2 Gates, B., “Bill Gates: Here’s a formula that explains where we need to invest in climate innovation,” TIME, January 22, 2021, Online: https://www.time.com/5930098/bill-gates-climate-change/