Articles

Regional Report: Striving to net-zero: Europe bets big on H2 to decarbonize the region

Lee Nichols, Editor-in-Chief/Associate Publisher

For decades, Europe has been the leader in establishing new directives and initiatives to promote cleaner transportation fuels and power generation. Over the past few years, the region had made significant strides to establish and expand the use of H2 within the European Union’s (EU’s) borders. This initiative was the result of the Paris Agreement drafted at COP21 in 2016. The aim of the agreement—which has been ratified by nearly 190 countries, representing nearly 97% of global emissions—is to reduce global greenhouse gas (GHG) emissions to limit global warming to 1.5°C–2°C in this century.1,2

To combat GHG emissions in the EU, the region has and will continue to invest heavily in new H2 production and infrastructure capacity. According to the European Commission (EC), H2 is forecast to reduce Europe’s GHG emissions by at least 55% by 2030 and reach net-zero emissions by 2050.3 Since H2 does not produce carbon dioxide (CO2) when used, it can be an efficient feedstock for power generation and for use in the industrial and transportation sectors to mitigate, and eventually eliminate, carbon emissions. The EU intends to create a vast H2 supply/value chain to help decarbonize the EU’s industrial, mobility and energy sectors to reach net-zero goals by 2050.

According to the EC’s H2 strategy,4 the EU will conduct a phased approach for implementing H2 infrastructure and production to 2050. These phases include:

- Phase 1 (2020–2024): Install at least 6 GW of renewable H2 electrolyzers to produce up to 1 MMtpy of renewable H2. This phase includes scaling up electrolyzer production and capacity, the start of H2 infrastructure builds for the transportation sector (e.g., H2 fueling stations), and finalizing a regulatory framework for the EU’s H2 sector.

- Phase 2 (2025–2030): Install at least 40 GW of renewable H2 electrolyzer capacity to produce up to 10 MMtpy of renewable H2. Due to the scale-up of clean H2 production, renewable energy costs are forecast to decrease, making it a more affordable option for use in industrial sectors (e.g., steel, transportation and power).

- Phase 3 (2030–2050): Renewable H2 production reaches maturity and can be deployed at a wide scale throughout the EU. This phase envisions the use of green H2 in nearly all sectors of the EU, including aviation, shipping, and in industrial and building applications.

According to the EC’s H2 strategy report, EU investments in electrolyzer capacity builds could range between €24 B ($27 B) and €42 B ($47 B) by 2030. In addition, increasing and connecting renewable power sources (i.e., solar and wind) to the region’s electrolyzers for power generation could cost €220 B–€340 B ($248 B–$384 B) within the same timeframe. Another €65 B ($73 B) is needed to enhance the EU’s H2 transportation and storage systems.

Regardless of the capital costs, nearly all EU nations are investing in new H2 infrastructure and production capacity to fulfill the obligations set out in the Paris Agreement to decarbonize the region by 2050.

EU H2 project investments

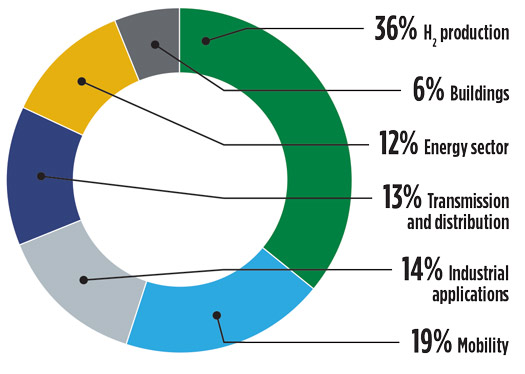

At the European Clean Hydrogen Alliance’s Hydrogen Forum event in late 2021, the alliance unveiled more than 1,000 projects to promote a H2 value chain in Europe. These investments include projects for H2 production, transmission and distribution, and use in industry, transport, energy systems and buildings.5 Most of these projects, approximately 36%, are H2 production facilities (FIG. 1). This includes several different avenues towards H2 production, the primary path being through green H2 production (i.e., using renewable sources to produce H2). At 19%, the mobility sector holds the second largest market share in active projects, followed by industrial applications (14%) and transmission and distribution (13%).

FIG. 1. Europe’s H2 project pipeline by sector. Source: European Clean Hydrogen Alliance.

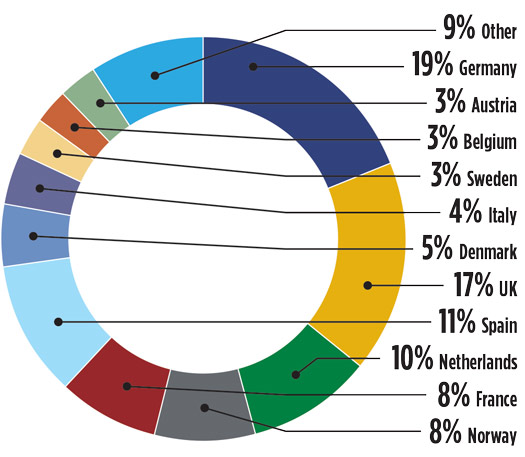

According to Gulf Energy Information’s Global Energy Infrastructure database, most active H2 projects in Europe are in Germany, followed by the UK, Spain, Netherlands, Norway and France (FIG. 2).

FIG. 2. Active H2 project market share by country. Source: Global Energy Infrastructure database.

However, these projects, and the wide-scale use of H2, face several hurdles, chiefly:

- A large-scale infrastructure buildout, requiring a critical mass in investment and cooperation among corporate and country partners

- The development of an enabling regulatory framework for H2 markets and source certification

- Technology breakthroughs to offer new solutions for producing, using, storing and transporting green molecules

- A significant scale-up in renewable power capacities

- Necessary, further reductions in H2 production costs.

The following will provide major H2 projects and initiatives by both region and individual countries in the EU.

European Hydrogen Backbone

For the large scale consumption of H2 in the EU, an intricate, vast H2 infrastructure and delivery system is needed. The European Hydrogen Backbone initiative is to build a network of supply lines to connect H2 supplies to demand centers throughout Europe. If built, the vast network would include the construction of 6,800 km of pipelines by 2030, reaching nearly 23,000 km by 2040.6 Depending on the use of existing pipelines in the region (i.e., converting existing assets to transport H2 vs. building new pipelines), the total costs for the system could range between €27 B–€64 B.

A separate investment that could complement the European Hydrogen Backbone project is the Central European Hydrogen Corridor. The capital-intensive project would include the construction of more than 1,700 km of pipeline that would deliver green H2 supplies from the Ukraine to Germany and other EU nations. At the time of this publication, the project partners—EUSTREAM, Gas TSO of Ukraine, NET4GAS and OGE—are conducting a technical feasibility study. If built, the H2 highway could be operational by 2030.

Denmark

The GreenHyScale project’s goal is to test the deployment of electrolysis in both onshore and offshore applications. Phase 1 includes the installation of a 6-MW electrolyzer, followed by Phase 2 which will expand the electrolyzer module to 100 MW. Phase 2 is scheduled to begin operations by 2025. The project will help test the factory-assembled modules for rapid onsite installation, helping to bring cost parity of green H2 generation and fossil fuels.

Finland

To reduce emissions at the Porvoo refinery, Neste is investing in the green H2 and CO2 capture and storage project. The project, currently in the feasibility stage, will increase both carbon capture and storage (CCS) and electrolysis solutions to decarbonize refining operations.

France

The nation has initiated several plans to increase H2 production and usage in the country. First, several companies are investing in new electrolyzer capacity to decarbonize the country’s transportation sector. This includes the construction of new H2 fueling stations to power a carbon-free mobility sector. Hype plans to deploy 10,000 zero-emission cabs in Paris by 2025. The company also plans to expand the use of H2-powered cabs to several other cities in the EU.

Storengy, Armines/Polytechnique, Inovyn, Esk, Element Energy and Axelera are developing the Hydrogen Pilot Storage for Large Ecosystem Replication (HyPSTER) project in Etrez. HyPSTER is the first EU-supported project for large-scale green H2 underground storage in salt caverns. The H2 will be used in the industrial and mobility sectors. Engineering studies began in 2021. Construction of an electrolysis unit for green H2 production will happen this year, with studies on storing H2 in salt caverns to take place in 2023.

The Masshylia project at TotalEnergies’ 500,000-metric-tpy Le Mède biorefinery in France is a JV between TotalEnergie and Engie to design, develop, build and operate an H2 production site, powered by solar farms with a total capacity of more than 100 MW. The 40-MW electrolyzer will produce approximately 1,825 metric tpy of green H2 to meet the needs of the plant’s biofuel production process and simultaneously avoid 15,000 metric tpy of CO2 emissions.

A large-scale solution for H2 storage will be implemented to manage the intermittent production of solar electricity and the biorefinery’s need for continuous H2 supply. Construction is slated to start this year, with operations targeted for 2024. Beyond this first phase, new renewable farms may be developed by the partners for the electrolyzer, which will have the capacity to produce up to 5,500 metric tpy of green H2.

Germany

The country is aggressively moving forward on new H2 infrastructure builds. Germany has ambitious goals to increase domestic electrolyzer capacity to 10 GW by 2030. If built, this amount of capacity will significantly boost domestic H2 production and help Germany meet its GHG emissions reduction targets set out in the Paris Agreement.

The Lingen Green Hydrogen project at bp’s 100,000-bpd oil refinery in Lingen, Germany is a collaboration with wind power developer Ørsted slated for startup in 2024. Wind power from Ørsted’s North Sea wind farm is planned to generate the power for a 50-MW electrolyzer to produce 9,000 tpy of H2, which would replace 20% of the natural gas-based H2 used at the refinery and avoid 80,000 metric tpy of CO2-equivalent emissions.

The planned project is a step toward bp’s promise to reduce its fossil fuel production by 40% through 2030 and increase its investment in sustainable energy solutions. bp will take a final investment decision (FID) on the project this year, depending on EU funding. The project is also intended to support a longer-term ambition to build more than 500 MW of renewable-powered electrolyzer capacity at Lingen.

Italy

According to Italy’s National Development Plan, H2-powered vehicle sales—referred to as fuel cell electric vehicles—could reach approximately 27,000 by 2025. The sales forecast for H2-powered buses and heavy machinery is much lower at just 1,110 and 2,000, respectively—the outlook for heavy machinery sales extends to 2030. The development plan also forecast the increased use of H2 to power train travel.

To increase Italy’s H2 fueling network, Air Liquide and Eni have partnered together to build H2 fueling stations throughout the country. Several companies—Snam, Toyota Motor Europe, Toyota Motor Italia and CaetanoBus—are joining together to promote H2 mobility in Italy, as well. The group plans to increase the production and distribution of green H2 for the light- and heavy-duty transport sector in Italy and possibly other EU countries.

Snam, in partnership with Sagat SpA, is also developing a 1.2-MW H2 fuel system for use at the Torino airport. The project, scheduled to be completed in 2Q 2023, will produce H2 to help fuel the airport’s electricity and heating.

Netherlands

The nation is investing in several initiatives to increase green H2 production. Shell plans to take a FID on the Hydrogen Holland 1 project this year. The initiative includes the construction of a 200-MW electrolysis plant at the Port of Rotterdam. The green H2 produced will be used for industry and the transport sector.

Also in Rotterdam, the MultiPLHY project—led by a consortium comprised of Neste, Sunfire, CEA, Paul Wurth and ENGIE—aims at installing, integrating and operating the world’s first high-temperature electorlyzer system in a multi-watt scale (2.4 MW). The project will be located at Neste’s renewables product refinery in Rotterdam. The green H2 produced will help power the refinery’s operations.

Norway

The Norwegian government plans to provide more than $110 MM in funding to three projects in the country to produce green H2 and ammonia. The three projects include:

- Yara’s pilot project to produce green H2 and ammonia at its fertilizer facility in Heroeya

- Horisont Energi’s green ammonia project, which includes CO2 emissions capture

- TTI’s conversion of its smelting plant from coal-power to H2.

Portugal

In Sines, 13 companies are developing the GreenH2Atlantic project. The project—which will use a 100-MW electrolyzer to produce green H2—will convert a coal-fired power plant in Sines to an H2 production facility. The plant’s construction will begin in 2023, with startup scheduled for 2025.

Spain

The country is investing in several projects to boost the use of H2 in the country. For example, the Win4H2 project includes the development of green H2 production and distribution infrastructure for the country’s transportation sector. The project—currently in the feasibility study phase—will establish H2 supply points around the country. The project’s first phase includes supply points in the cities of Madrid, Valencia, Mercia and Cartagena.

Iberdola and H2 Green Steel are developing a $3.1-B project to use green H2 to produce steel. The capital-intensive project includes the construction of a 1-GW green H2 plant to aid in the production of approximately 2 MMtpy of green steel ore.

Sweden

Liquid Wind and Ørsted are developing the FlagshipONE project. This project will use a 70-MW electrolyzer—feed will be provided by onshore wind turbines and biogenic CO2 collected from the Hörneborgsverket heat and power plant in Örnsköldsvik—to produce 50,000 tpy of e-methanol. The e-methanol will be used to power marine vessels to decarbonize the seas. The project partners plan to take FID this year. If greenlighted, operations on FlagshipONE are scheduled to begin in 2024.

UK

The UK Government’s goal is to establish 5 GW of green H2 production by 2030. To accomplish this ambitious goal, the nation is developing several projects and partnerships to boost green H2 production and use within its borders.

In Q3 2021, bp, ADNOC and Masdar signed an agreement to develop low-carbon H2 hubs in both the UK and the United Arab Emirates (UAE). This agreement includes decarbonizing oil and gas operations, increasing green H2 supplies to their respective transportation sectors, increasing the use of CCS, among others.

In Teesside, bp is developing the HyGreen Teesside and H2Teesside projects. The HyGreen Teesside project includes the construction of a large-scale H2 production facility. bp plans to take FID on the project in 2023. If built, the facility’s goal is to produce up to 500 MWe (MW electrical input) of H2 production by 2030. The project’s initial phase will see 60 MWe of H2 production, which will be scaled-up to 500 MWe by the end of the decade.

Also in Teesside, bp aims to produce 1 GW of blue-H2 production by 2030. The project would convert natural gas into H2 and CO2. The facility would use the H2 for various applications, simultaneously capturing and storing up to 2 MMtpy of CO2. FID is scheduled to be taken in 2024, with operations slated for 2027. The HyGreen and H2Teesside projects will help Teesside become a major H2 hub in the UK.

bp has also partnered with Daimler Truck AG to build 25 H2 fueling stations in the UK by 2030. These H2 fueling stations would be geared toward fueling heavy freight trucks. To help decarbonize the freight transport industry, Daimler Truck AG plans to offer only CO2-neutral trucks by 2039.

INEOS plans to invest more than $1.3 B to reduce GHG emissions at its Grangemouth, Scotland integrated refining and petrochemicals complex. The capital-intensive plan includes several emissions-reducing investments, including CCS and increased H2 production. The company has also announced plans to invest an additional $1 B at its other sites in Europe. For example, INEOS plans to build a 100-MW electrolyzer at its site in Cologne to produce green ammonia, a 20-MW electrolyzer in Norway, and additional projects in Belgium and France.

Other projects include the Zero Carbon Humber project, Cadent’s HyNet North West project and Vertex Hydrogen Ltd.’s H2 hub. The Zero Carbon Humber project includes several projects to decarbonize the Humber region of the UK. This includes green H2 production and CCS projects. The first project in the initiative is Equinor’s 600-MW H2H Saltend low-carbon H2 production plant. The facility will produce H2 from natural gas and CCS. The produced H2 will fuel the nearby Keadby Hydrogen power station to provide power to the region. Equinor plans to award the engineering, procurement and construction contract by the end of this year. FID is scheduled for 2023. If built, Equinor plans to deliver H2 to the Keadby power station in 2028.

Cadent’s HyNet North West project’s scope includes the production, storage and distribution of H2 in Northwest England. Once operational, the system is forecast to reduce CO2 emissions by 10 MMtpy by 2030.

Lastly, Vertex Hydrogen Ltd., a JV between Essar and Progressive Energy, plan to build the UK’s largest H2 hub. The $1.3-B project will build two H2 units to produce 1 GW of H2. The produced green H2 will be used to heat homes and fuel the region’s transportation sector (buses, trains and trucks).H2T

LITERATURE CITED

- France Diplomacy, “COP21: The key points of the Paris Agreement,” Ministry for Europe and Foreign Affairs, December 2020, online: https://www.diplomatie.gouv.fr/en/french-foreign-policy/climate-and-environment/the-fight-against-climate-change/2015-paris-climate-conference-cop21/cop21-the-paris-agreement-in-four-key-points/

- United Nations, “The Paris Agreement,” online: https://www.un.org/en/climatechange/paris-agreement

- European Commission, “Supporting clean hydrogen,” online: https://ec.europa.eu/growth/industry/strategy/hydrogen_en#:~:text=Hydrogen%20is%20expected%20to%20play,to%20contribute%20to%20climate%20neutrality

- European Commission, “Communications from the commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions: A hydrogen strategy for a climate-neutral Europe,” Brussels, Belgium, August 2020, online: https://ec.europa.eu/energy/sites/ener/files/hydrogen_strategy.pdf

- European Commission, “Project pipeline of the European Clean Hydrogen Alliance,” online: https://ec.europa.eu/growth/industry/strategy/industrial-alliances/european-clean-hydrogen-alliance/project-pipeline_en

- Wang, A., K. van der Leun, D. Peters and M. Buseman, “European Hydrogen Backbone,” Guidehouse, July 2020, online: https://gasforclimate2050.eu/wp-content/uploads/2020/07/2020_European-Hydrogen-Backbone_

Report.pdf