Articles

Best environment, social and governance practices: Technical safety studies in capital projects

Safety and Sustainability

K. VILAS, BakerRisk, Houston, Texas

As gas prices spike worldwide, proponents of fossil fuels and alternative energy are speaking out. Companies providing alternative energy solutions such as hydrogen (H2), ammonia (NH3), methanol, biofuels and renewables (wind, solar, etc.) see this as a chance to demonstrate the need to move away from a reliance on oil. Supporters of oil and gas are voicing the need to increase domestic production and create strategic alliances to decrease dependence on international supplies. The prevailing opinion of fossil fuel boosters is that restrictive policies and environmental regulations constrain energy production. Concurrently, investments and government funding are propping up the establishment of alternative energy sources.1 Are governments doing too much to limit the ability to produce more oil and gas in favor of cleaner alternatives?

Oil and gas executives gathered for a conferencea in the first week of March 2022 and offered differing opinions. The conversation was not focused on government subsidies and funding; the executives were discussing the impact of environment, social and governance (ESG) strategies on their ability to secure investment in projects and business. ESG strategies now appear to be influencing the business strategies of the energy sector with the same urgency as the push for climate change.

Why ESG? ESG is not a new concept. With ties to corporate social responsibility (CSR), ESG is a concept that can be traced back several decades, with formal publications and literature showing up as early as the 1930s. A literature review on the topic2 tracks CSR and its evolution, providing the context for CSR from being limited to generating profits to the belief that companies should focus on developing shared value. This shared value is a major component of responsible investing, which is widely understood as the integration of ESG factors into investment processes and decision-making.3

In 2021, some$120 B was poured into sustainable investments—up from $51 B in 2020—and estimates indicate that one-third of all assets contain sustainable investments. With approximately 72% of U.S. adults expressing interest in ESG, it is not surprising that experts predict that within the subsequent 5 yr, 100% of assets under management will incorporate ESG factors.4 It is this investment focus on ESG that is making companies take notice, with most major industries quickly incorporating ESG into their corporate focus and reporting.

More climate transparency leads to more profitable investment, and better sustainability disclosures benefit companies and investors.5 The financial sector has spoken—businesses with more genuine ESG profiles have and will continue to exceed their peers, therefore receiving funding from managed investment companies.

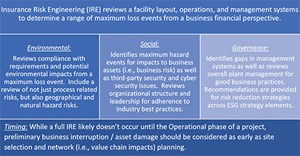

The ability to obtain large amounts of funding at favorable rates is essential, considering that low-carbon projects are capital intensive compared to traditional fossil fuel assets.6 As a result, many young companies being established in the low-carbon space are defining ESG metrics and reporting expectations up front in support of funding applications. This takes us full circle back to the comments from oil and gas majors.a It is becoming easier for ESG-focused startup companies to obtain funding than established major private and public companies that have been slower to place ESG strategies at the core of their business. A brief overview of the core concepts of ESG is summarized in FIG. 1.

Capital projects: A focus on technical safety studies. The focus of ESG is to identify and manage business risks, including impacts on the environment, employees and local communities. Similarly, from an operational standpoint, the field of process safety includes a range of technical safety studies focused on analyzing, quantifying and mitigating hazards and risks to the environment, assets, employees and local communities. Process safety specifically evaluates potential fires, explosions, toxins and other accidental releases of hazardous materials from facility operations. In addition, process safety addresses items critical to mitigating risk, including facility siting, system controls, passive and active fire protection systems, emergency response plans and many others. In summary, the discipline of process safety involves effective management systems comprising practices, procedures and responsible human performance and behaviors applied to equipment design/installation and the facility during operations.7

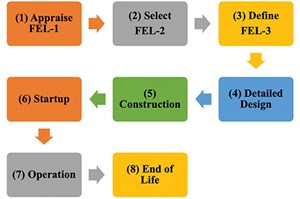

Process safety is one of many areas of focus during a capital project, which is divided into phases that make up the project lifecycle, covering the project from onset to completion.8 Depending on a company’s publication or specific guidelines, the terminology for the lifecycle of capital projects in the oil and gas and chemical industries may differ. However, the terminology presented in this section will apply to this article. The main capital project stages are presented in FIG. 2. These phases include key activities that are sometimes addressed as separate stages and are, therefore, included as follows:

- Feasibility and conceptual planning—front-end loading (FEL) phases, including FEL-1, FEL-2 and FEL-3

° Sometimes called front-end engineering design (FEED)

- Project execution—detailed design/detailed engineering, construction and commissioning/startup

° Construction phase—pre-commissioning

° Operation phase—stable production achieved

° End of life—project for decommissioning is initiated.

The objectives of each phase must be understood in business terms8 to understand the importance of conducting process safety studies at the optimal time as well as periodic stage-gate reviews. When conducted in an organized and proactive manner, technical process safety analyses can be efficiently and cost-effectively updated at each stage to ensure costly last-minute changes are not required. One way to mitigate the likelihood and impact of late-stage changes is to introduce a safety plan that includes stage-gate process safety reviews throughout the design phases. Embedding the safety plan within the stage-gate review process minimizes risk while controlling costs and schedule impacts to ensure successful project implementation.

- Appraise FEL-1: Identify a range of development options and evaluate commercial viability.

- Select FEL-2: Select the site layout based on evaluating threats and uncertainties.

- Define FEL-3: Develop a basic design, including preliminary plot plans, equipment layout drawings and preliminary process flow diagrams; heat, material and energy balance sheets; and equipment data sheets. This stage also improves costs and schedule, and the project typically receives financial investment.

- Detailed design: Detailed engineering of options chosen in FEL; materials/equipment are procured.

- Construction: Facility is built, pre-commissioning is completed and operational readiness is performed.

- Commissioning: The project team hands over the facility and documentation to the operations company/team.

- Operation: The operations team takes control of the facility and normal operations continue as the project closes.

- End of life: The facility is decommissioned or repurposed.

Proactively implementing process safety activities at the optimal time has been covered in detail7, as has reactively conducting reviews to ensure nothing significant has been missed.8 The early incorporation of process safety studies and the stage-gate review process in a capital project can minimize personnel exposure, asset damage and business interruption while also controlling costs and ensuring ease of project implementation. In a best practice approach, the capital project safety plan should run parallel to the project’s ESG strategy and inform on reportable metrics concerning risks to the environment, employees and community.

Capital project safety plan. At the onset of the Appraise FEL-1 phase, a safety plan should be created and implemented in the form of a living document that lays out the strategy and schedule of process safety activities over the project lifecycle.8 This plan should be updated throughout the project lifecycle as project clarity is established. While risk-based process safety is designed for operations, the framework can be appropriately implemented in the project safety plan.

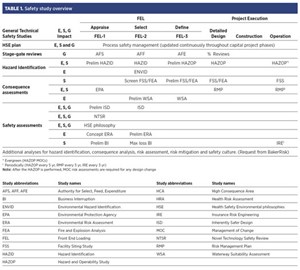

Depending on the capital project specifics, several technical safety studies are commonly used to identify hazards and assess and mitigate risk throughout the project lifecycle. The intent of a phased approach to technical safety studies—coupled with stage-gate reviews—is to help ensure maximum value is achieved in early design phases by reducing implementation costs, risks and project schedules.8 A selection of studies to be included in a capital project safety plan, the ideal time to conduct those studies, and their influence on environmental, social and/or governance aspects of ESG are included in TABLE 1. The author’s company9 can provide a complete list.

Typically, oil and gas, chemical and similar energy-related industry companies will have a standard that provides practical guidance on the types of technical safety studies required for capital projects. This standard intends to ensure that the correct studies are performed at the right time. However, suppose that safety studies are left to detailed design phases. In these cases, costly change orders and schedule impacts attributed to a redesign can cause frustration simply because the appropriate safety studies were not conducted to the level of detail best suited to the available project data throughout the process. Embedding this process into the ESG strategy will ensure that the safety of key stakeholders is addressed with the rigor required to ensure the reduction of operational-related risks to the business.

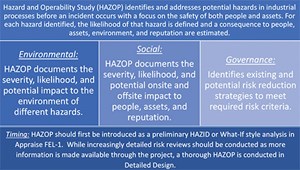

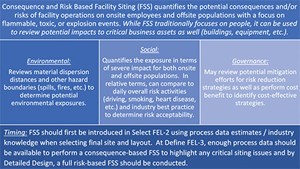

ESG meets safety in capital projects. Each technical safety study can be aligned with one or more of the environmental, social and governance aspects of ESG, as shown in FIG. 3.11 The key to successful integration of safety in a capital project is the stage-gate review process, which should have a dedicated team with representation from various key stakeholders as well as external subject matter experts (SMEs) and a corporate senior management representative who oversees health, safety and environment (HSE). This stage-gate review committee should be an integral part of a capital ESG project strategy and part of the reporting plan. Getting this right is the first step to ensuring that your stakeholders (internal and external) see leadership’s dedication to the environmental and social aspects of process safety.

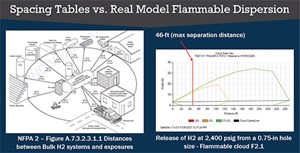

H2 is a fuel with unique properties10, making it a challenging concern for safe operations. With a high potential of ignition and the probability of high blast impacts, H2 is a life safety issue onsite and offsite and can potentially cause catastrophic injury to personnel, business interruption and financial risk. Simply meeting regulatory requirements is likely insufficient to demonstrate a safety commitment to a company’s key stakeholders, especially considering some technologies are in a grey area regarding regulatory requirements, including size and scale of operations. An example of the misalignment between regulatory requirements and potential impacts on the environment, onsite employees, offsite population and, ultimately, the business is provided in FIG. 3.

Following the proposed capital project safety plan helps close the gaps important to internal and external stakeholders. FIGS. 4–6 highlight examples of how three key technical safety studies impact a company’s ESG strategy for a given capital project; these examples are not intended to be all-inclusive.

While an ESG strategy looks at far broader topics than technical safety studies, the three examples listed provide the context of how stakeholders can find value in including key safety plan studies in project reporting.

Application to H2 and other low carbon energy. Experts say ESG is here to stay. As a requirement for investments for private and public corporations, ESG’s focus on investing in responsible technologies and capabilities is not just a necessity—it can also provide a competitive advantage with watchful investors and consumer communities.11 While there are no set global standards for ESG reporting, regulators such as the U. S. Securities and Exchange Commission (SEC) have introduced preliminary guidelines on investment product reporting and disclosure recommendations. Now is the time for companies to be both proactive and strategic.

It is easy to document your ESG strategy and talk about commitments to the process in an annual report or request for funding. Reporting your ESG impacts in public filings is one of the most concrete ways to prove that your organization is taking action. A large part of that action is demonstrating a commitment to climate and sustainability-related activities; however, demonstrating a safe operational facility for the local community is a close second. A best practice approach to thoroughly assessing operational safety will go beyond regulatory requirements. It can be effectively managed through collaboration with a safety-focused consultancy experienced with the unique safety challenges of low-carbon fuels—especially H2 (highly flammable and explosive) and NH3 (highly toxic).12 While low-carbon fuel hazards are unique, select companies have studied these hazards for years (FIG. 7).

Through the early application of process safety design reviews, capital projects can optimize designs that meet geographic constraints and corporate safety goals around risk reduction, while minimizing project and facility lifetime cost impacts. In summary, having a safety plan that starts at the onset of a capital project may take more time, effort and investment early in the project lifecycle, but it inherently proves to stakeholders (investors, employees, communities, partners, etc.) that you are not just putting an ESG strategy on paper, but are actively striving for best practices to limit risks to the environment, people (onsite and offsite), assets and the business.H2T

REFERENCES

a CERAWeek by S&P Global

LITERATURE CITED

1 Worland, J., “The bulletin: Environmental regulations aren’t preventing oil drilling,” Time Magazine, Vol. 199, Nos 11-12, March 2022, pp. 12.

2 Latapí Agudelo, M.A., L. Jóhannsdóttir and B. Davídsdóttir, “A literature review of the history and evolution of corporate social responsibility, International Journal of Corporate Social Responsibility, 2019, online: https://doi.org/10.1186/s40991-018-0039-y

3 Kell, G., “The remarkable risk of ESG,” 2018, online: https://www.forbes.com/sites/georgkell/2018/07/11/the-remarkable-rise-ofesg/?sh=14d885851695

4 Visram, T., “ESG investing continued to soar in 2021: The government could boost it even more,” Fast Company, 2021, online: https:// www.fastcompany.com/90706552/esg-investingcontinued-to-soar-in-2021-the-government-couldboost-it-even-more#:~:text=2021%20was%20a%20record%20year,all%20assets%20contain%20sustainable%20investments

5 Greenstone Blog, “Blackrock’s 2021 letter to CEOs and what it means for ESG report,” 2021, online: https://www.greenstoneplus.com/blog/blackrocks-2021-letter-to-ceos-and-what-is-meansfor-esg-reporting

6 Radhakrishnan, S. and A. Mifflin, “Framework development Week 1: Introduction to ESG, sustainability, and CSR,” ESG in Energy: Framework development, February 2022, University of Houston.

7 CCPS, “Guidelines for integrating process safety into engineering projects,” Center for Chemical Process Safety, American Institute of Chemical Engineers, New York, New York, 2018.

8 Vilas, K. and M. Broadribb, “Leveraging process safety techniques in capital projects,” 2020, Global Congress for Process Safety (GCPS) Conference.

9 Baker Engineering and Risk Consultants Inc., (BakerRisk), online: www.BakerRisk.com

10 Vilas, K. and D. Malik, “Myth busting: Hydrogen vapor cloud explosions,” Center for Hydrogen Safety, Virtual Conference, September 2020, online: https://www.bakerrisk.com/br-published-paper/myth-busting-hydrogen-vapor-cloud-explosions/

11 Finario, “ESG + Capex,” Blog, accessed March 2022, online: https://www.finario.com/esg-capex-wheredo-we-go-from-here/

12 Malik, D., “Hydrogen and ammonia—the unique safety challenges,” OPERA, virtual webinar, October 2021, online: https://www.bakerrisk.com/br-published-paper/hydrogen-and-ammonia-theunique-safety-challenges/

KAREN VILAS is the Director of Business Development North America at Baker Engineering and Risk Consultants Inc. in Houston, Texas. She is also a Principal Consultant in the Houston Process Safety Group, specializing in consequence and risk modeling. Vilas has worked extensively with clients in the refining and petrochemical industries, focusing on risk quantification and mitigation of blast, toxic, flammable and fire hazards. In addition to servicing clients’ process safety needs, she oversees the business development and marketing group, focusing on industry education of key risk management topics through conference technical content coordination and media content development.