Articles

The future of H2: A regional outlook—Part 3: The Middle East and U.S.

Business Trends

LEE NICHOLS, Vice President, Content/Editor-in-Chief

Nations around the world are investing in new technologies and pathways to limit carbon emissions and adhere to ambitious net-zero goals. Part of this strategy includes the massive scale-up of hydrogen (H2) production capacity, primarily green routes that use renewable energy for production.

Part 1 of this work—published in the June issue of H2Tech—detailed current and future H2 demand, active H2 project numbers and capital spending globally, as well as an examination of major H2 trends, programs, regulations and capital projects in Africa, Asia and Canada. Part 2—published in the July issue of H2Tech—focused on Western and Eastern Europe, Russia, the Commonwealth of Independent States (CIS), and Central and South America. This final article will examine major H2 developments in the Middle East and the U.S.

MIDDLE EAST

With abundant solar and wind energy potential, the Middle East is keen on developing its renewable energy generation and H2 production potential. According to the Gulf Petrochemicals and Chemicals Association (GPCA), the Gulf Cooperation Council’s (GCC’s) H2 market could experience a compound annual growth rate (CAGR) of 15% between 2022 and 2050, resulting in potential revenues of $120 B/yr–$200 B/yr.30

However, achieving this forecasted growth will require significant capital expenditures (CAPEX) in renewable energy capacity, infrastructure, electrolyzer development and installation, and H2 deployment in various industries within the region. According to the MENA Hydrogen Alliance’s “The Potential for Green Hydrogen in the GCC Region” report, installing renewable and electrolysis capacities would require $16 B/yr–$60 B/yr over the next 25 yr, with approximately 30%–40% attributed to renewable energy capacity—the Middle East’s renewable energy capacity reached 40 GW in 2020 and is expected to double by the mid-2020s.31,32

Active projects. Regardless of the costs, the Middle East is investing heavily in developing its H2 value chain, including contracts to export green and blue H2 to demand markets in regions such as Western Europe. At the time of this publication, Gulf Energy Information’s Global Energy Infrastructure (GEI) database was tracking nearly 50 active H2 projects in the Middle East. These projects represent a total CAPEX of more than $200 B.

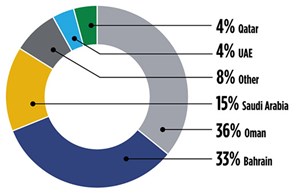

According to the GEI database, most projects are in Oman (36%), followed by the United Arab Emirates (33%) and Saudi Arabia (15%). Although Saudi Arabia ranks third in active H2 projects in the Middle East, the country represents more than half of the total CAPEX in the region. Nearly 70% of active H2 projects in the Middle East are through green production pathways, followed by blue routes (22%). A breakdown of total active H2 project market share in the Middle East by country is shown in FIG. 11.

Oman. The country has ambitious goals of producing approximately 1.25 MMtpy of green H2 by 2030, increasing production to 3.75 MMtpy by 2040 and up to 8.5 MMtpy by 2050. This initiative will cost upwards of $140 B to become a reality, according to Oman’s Ministry of Energy and Minerals’ Green Hydrogen Strategy.33 A significant portion of this CAPEX will be for the scale-up of renewables capacity. According to Oman Vision 2040, the country is targeting the ramp-up of renewables capacity market share in the country’s energy mix from 1% today to 20% by 2030 and up to 35%–39% by 2040.34

The nation plans to develop green H2 in three regions: Al Wusta, Dhofar and Duqm. These development plans will be instituted in a phased approach. Phase 1 includes the Al Wusta and Dhofar regions—the Omani government has set aside more than 50,000 km2 for renewable energy and green H2 project development in these areas.

In June, Oman awarded three renewable energy and green H2 production projects totaling $20 B. These projects will increase Oman’s renewable energy capacity by 12 GW and green H2 production by 500,000 tpy:

- Copenhagen Infrastructure Partners, Blue Power Partners and Al Kadra are building 4.5 GW of renewable energy to help produce 200,000 tpy of green H2.

- bp Oman will install 3.5 GW of renewable capacity to produce 150,000 tpy of green H2. The green H2 will be used for ammonia production and exported to international demand centers.

- Green Energy Oman plans to build 4 GW of renewable capacity to produce 150,000 tpy of green H2.

These projects will be complemented by other major green H2/ammonia projects, including the large-scale HYPORT project, which will produce nearly 3 GW of renewable energy and more than 650,000 tpy of green ammonia; ACWA Power, Air Products and OQ’s multi-billion-dollar H2Oman project; ACME and Scatec’s 1.1-MMtpy green ammonia project; the Hydrogen Oman and Salalah Hydrogen projects in the Salalah Free Zone; Hydrom’s $7-B–$8-B green H2/ammonia project in Duqm, which will produce 220,000 tpy of green H2 and 1.2 MMtpy of green ammonia; and other green H2 production plants, infrastructure (e.g., pipelines) and export facilities.

Saudi Arabia. The Kingdom has ambitious plans to be a dominant player in low-/zero-carbon H2 production and in global H2 trade, all the while striving for a net-zero economy by 2060—this green initiative is expected to cost upwards of nearly $190 B. Saudi Arabia is making great strides to incorporate more renewable energy capacity into its energy mix. According to the Saudi Green Initiative, Saudi Arabia plans to boost its renewables’ market share in the country’s power generation mix to at least 50% by the end of the decade. The additional renewable energy will aid the country in meeting its H2 production targets of 2.9 MMtpy by 2030 and 4 MMtpy by 2035.35

The nation’s most ambitious initiative is the $500-B NEOM project. As part of Saudi Arabia’s Vision 2030, NEOM is a city being built on the Red Sea that will run entirely off renewables. NEOM Green Hydrogen Co. is developing a world-scale green H2 production facility to provide power to parts of the city and transportation network. The $8.4-B plant will utilize solar power from a nearby 4-GW solar farm to produce 600 tpd of green H2. The produced green H2 will not only be used to provide power to the city’s industry, but will also be utilized to fuel buses and trucks.

Saudi Arabia also plans to tap into its vast natural gas reserves to increase blue H2/ammonia production. For example, Saudi Aramco, the nation’s national oil and gas company, announced plans to boost blue ammonia production to 11 MMtpy by 2030. To help achieve this goal, the country is developing the $110-B Jafurah unconventional gas project. The project’s initial phase—production is scheduled to begin in 2024—will process more than 1.1 Bft3d of natural gas, increasing significantly to more than 2.2 Bft3d by 2036.36 Portions of Jafurah’s natural gas will be used to produce blue H2. However, due to the high costs of producing blue H2, Saudi Aramco is evaluating using the gas for LNG exports should the company be unable to find suitable customers for blue H2/ammonia.

United Arab Emirates (UAE). Like other countries around the world, the UAE plans to invest in carbon-abating technologies and infrastructure to reach net-zero emissions by 2050. According to the UAE’s H2 roadmap, the nation is focusing on three key objectives:

- Generate new sources of value through low-carbon H2 and derivatives exports

- Provide low-carbon H2 and industrial derivative opportunities

- Reach net-zero targets by 2050 in hard-to-abate sectors of the economy.37

A clear regulatory framework will enable these objectives, as will the development of new H2 technologies through partnerships and research and development, allocated land for H2 production facilities, access to financing and international capital markets, and government support to build H2 infrastructure.37

To help reach its 2050 targets, the UAE plans to invest approximately $160 B in clean and renewable energy over the next 30 yr. The significant boost in renewable energy capacity will help fuel the production of green H2/ammonia. According to Dipak Sakaria, an energy transition expert with the UAE’s Ministry of Energy and Infrastructure, there were nearly 30 active H2 projects under some form of development (e.g., proposed, planning, engineering, construction), with seven already passing through the financing stage.38 The following are some of the more notable H2 production projects under development in the UAE:

- Engie and Masdar formed a $5-B partnership to explore different routes to a green H2 economy in the UAE. The JV aims to establish 2 GW of renewable energy capacity by 2030. For example, Engie and Masdar are working with Fertiglobe to build a 200-MW green ammonia production facility. Fertiglobe will be the sole offtaker, and plans to use it for carbon-neutral fertilizer production.

- Masdar is also working with Uniper to build a 1.3-GW solar plant to produce green H2.

- Abu Dhabi National Oil Co. (ADNOC) is developing a 1-MMtpy blue ammonia plant at the TA’ZIZ Industrial Facility in Ruwais. The plant is scheduled to begin operations in 2025. ADNOC also plans to utilize a portion of natural gas from its multi-billion-dollar Hail and Shasha sour gas development to produce low-carbon H2/ammonia. Although major onshore/offshore contracts were canceled in late April/early May, ADNOC is pursuing the mega project’s development.

- Abu Dhabi plans to build a $1-B green ammonia production facility in the Khalifa Industrial Zone Abu Dhabi (KIZAD). The facility includes an 800-MW solar farm to produce green H2, which will be converted into 200,000 tpy of green ammonia. The product is destined for the export market.

- Brooge is working with several companies to build a solar park and green ammonia production plant in Abu Dhabi. The projects will be built in two phases. Once fully operational, the export-oriented facility will produce 1,950 tpd of green ammonia.

The UAE is also conducting feasibility studies on using low-carbon H2 for mass transportation. This includes a network of H2-fueling stations and a fleet of H2-powered buses, among other H2 infrastructure.

THE U.S.

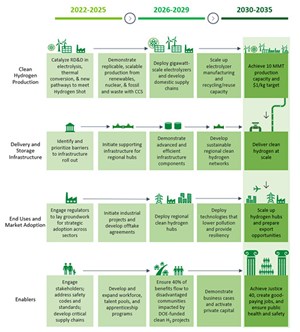

In June, the U.S. Department of Energy (DOE) released the U.S. National Clean Hydrogen Strategy and Roadmap. This report builds on the Bipartisan Infrastructure Law (BIL) passed in November 2021, which allocated more than $60 B for the U.S. DOE, including $9.5 B to boost domestic green H2 production. The report provides various pathways for U.S. producers to incrementally increase clean H2 production to 10 MMtpy by 2030, 20 MMtpy by 2040 and up to 50 MMtpy by 2050. The roadmap39—part of the U.S.’s national decarbonization goals of 100% carbon pollution-free electricity by 2035 and net-zero greenhouse gas emissions by 2050—details three key strategies to effectively maximize the U.S.’s clean H2 production potential:

- Target strategic, high-impact uses for clean H2. This aspect focuses on using green H2 to decarbonize heavy-to-abate industrial sectors, such as chemicals and petrochemicals production, oil refining, steelmaking and heavy-duty transportation, as well as increasing clean H2 exports.

- Reducing the production cost of clean H2. This initiative is part of the U.S. DOE’s Energy Earthshot’s Hydrogen Shot program to reduce the cost of green H2 production to $1/kg within one decade (i.e., the 1-1-1 plan). Significant investments must be made in green H2 production, infrastructure, storage and distribution, and supply chains, among several other areas to reach this goal.

- The development of H2 hubs. These regional networks will enable producers and consumers to share infrastructure (e.g., distribution, production, storage) to facilitate green H2 usage and build H2 economies around major demand centers. The U.S. DOE has allocated $8 B to establish six–10 regional clean H2 hubs in the country. Of the nearly 80 concept papers received, the U.S. DOE invited more than 30 groups to submit a full application for potential funding. The U.S. DOE plans to begin announcing funding awards in Q4. According to the U.S. H2 roadmap, midstream infrastructure investments must scale to $2 B/yr–$3 B/yr from 2023–2030, increasing to $15 B/yr–$20 B/yr from 2030–2050. These investments will not only grow regional H2 networks to distribute green H2 to demand centers but will also build a national H2 network.

The overall national action plan for clean H2 in the U.S. is shown in FIG. 12.

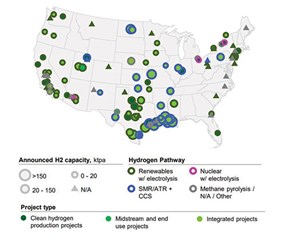

Active projects/initiatives. Numerous H2 projects have been announced or have already commenced operations to meet these ambitious goals. FIG. 13 shows a snapshot of operational H2 production installations and announced projects in the U.S. These production plants and announced projects represent approximately 12 MMtpy of H2 production capacity in the U.S.

At the time of this publication, the GEI database was tracking more than 170 active H2 projects in the U.S. These projects represent a total CAPEX of more than $200 B. When broken down by location, most active H2 projects are in Texas (18%), California (16%) and Louisiana (7%)—nearly 20% of active H2 projects are still in early planning/proposal stages, and exact locations have not been publicly announced (e.g., U.S. Gulf Coast). Most projects under development will take a green pathway (55%) to produce H2, followed by a blue route (41%).

More than two dozen H2 projects under development in the U.S. have a CAPEX of more than $1 B. These projects range from green H2 production to fuel power generation to help decarbonize domestic industrial sectors (e.g., refining, petrochemicals production) and establish a robust green ammonia value chain for domestic use and exports, and energy storage, among others. Several examples of these capital-intensive projects include the $7.5-B Ascension Clean Energy project; the $4.6-B St. Charles Clean Fuels project; Air Products’ $4.5-B Clean Energy Complex and $4-B Wilbarger H2 production facility; the Advanced Clean Energy Storage (ACES) project; ExxonMobil’s 1-Bft3d blue H2 facility in Baytown, Texas; the $4-B Lake Charles Methanol blue methanol complex; Nutrien’s $2-B, 1.2-MMtpy clean ammonia facility in Geismar, Louisiana; CF Industries’ multi-billion-dollar green ammonia facilities in Oklahoma and Louisiana; Yara and Enbridge’s nearly $3-B blue ammonia plant; and several others.

These capital-intensive projects—along with numerous infrastructure investments (e.g., H2 fueling centers, H2 pipelines)—are only a portion of the more than 170 active H2 projects in the U.S. With the enactment of the BIL and subsequent funding from the U.S. DOE to support clean H2 development, additional public and private investments will likely be made to significantly boost low-/zero-carbon H2 production and distribution domestically.H2T

LITERATURE CITED

30 Olabi, V., “The role of hydrogen in the GCC’s green future,” GPCA, March 26, 2023, online: https://www.gpca.org.ae/2023/03/26/the-role-of-hydrogen-in-the-gccs-green-future/

31 Kourkejian, V., et al., “The potential for green hydrogen in the GCC region,” Dii and Roland Berger, May 2021, online: https://dii-desertenergy.org/wp-content/uploads/2021/06/The-potential-for-green-hydrogen-in-the-GCC-region.pdf

32 Bradstock, F., “The Middle East is looking to dominate the green hydrogen market,” OilPrice.com, March 16, 2023, online: https://oilprice.com/Alternative-Energy/Renewable-Energy/The-Middle-East-Is-Looking-To-Dominate-The-Green-Hydrogen-Market.html#:~:text=The%20Middle%20East%20Is%20Looking%20To%20Dominate%20The%20Green%20Hydrogen%20Market,-By%20Felicity%20Bradstock&text=Several%20countries%20in%20the%20Middle,carbon%20hydrogen%20market%20by%202030

33 Al Maashani, Q., “Oman targets $140bln investment in green hydrogen industry,” ZAWYA, October 23, 2022, online: https://www.zawya.com/en/projects/industry/oman-targets-140bln-investment-in-green-hydrogen-industry-y03w4ork

34 International Energy Agency, “Renewable hydrogen from Oman: A producer economy in transition,” June 2023, online: https://iea.blob.core.windows.net/assets/338820b9-702a-48bd-b732-b0a43cda641b/RenewableHydrogenfromOman.pdf

35 Bell, J., “NEOM’s green hydrogen plant will secure Saudi Arabia’s clean energy transition: CEO,” Al Arabiya, May 31, 2023, online: https://english.alarabiya.net/News/2023/05/25/Saudi-s-green-hydrogen-plant-will-put-Kingdom-on-global-map-for-clean-energy-CEO#:~:text=A%20world%20leader%20in%20hydrogen&text=Saudi%20Arabia%20is%20pivoting%20toward,diversifying%20away%20from%20oil%20exports

36 Ugal, N., “Saudi Arabia poised to tap $110bn Jafurah gas project for blue hydrogen,” Upstream Online, October 25, 2021, online: https://www.upstreamonline.com/energy-transition/saudi-arabia-poised-to-tap-110bn-jafurah-gas-project-for-blue-hydrogen/2-1-1087974

37 UAE Ministry of Energy and Infrastructure, “UAE hydrogen leadership roadmap,” November 4, 2021, online: https://u.ae/-/media/Documents-2022/UAE-Hydrogen-Roadmap--Eng.ashx

38 Benny, J., “UAE to launch national hydrogen strategy in April, official says,” The National News, March 1, 2023, online: https://www.thenationalnews.com/business/energy/2023/03/01/uae-to-launch-national-hydrogen-strategy-in-april-official-says/

39 U.S. DOE, U.S. National Clean Hydrogen Strategy and Roadmap, June 2023, online: https://www.hydrogen.energy.gov/pdfs/us-national-clean-hydrogen-strategy-roadmap.pdf