Articles

Seven questions to consider about H2 hubs

Hydrogen Infrastructure Development

M. BRANDT, 1898 & Co., part of Burns & McDonnell, Chicago, Illinois; and H. M. BROWN, 1898 & Co., part of Burns & McDonnell, Kansas City, Missouri

Hydrogen (H2) is poised to become a crucial part of the decarbonization equation as countries strive to reach net-zero carbon emissions. To date, electrification has been the primary focus for decarbonization—the increasing use of electric vehicles is a clear example of that. While there are many instances of how electricity can be used to decarbonize, it is not applicable in every sector or industry. H2 offers yet another alternative for decarbonization where electrification is not as suitable.

H2 already helps power our world and is most commonly used in petroleum refining, petrochemicals, fertilizer production and other industries. As new ways of producing H2 with little or no carbon dioxide (CO2) emissions are developed, transportation, industrial users and utilities could become high-priority markets.

Blue H2—produced by a steam methane reforming (SMR) process that converts natural gas into primarily H2, water and CO2—is presently considered the most viable option for economical low-carbon production. Blue H2 is considered a low-carbon process because the CO2 is captured on the back end and routed to geological storage or used in enhanced oil recovery.

Green H2 is another low-carbon H2 solution, using electrolysis to divide the water molecule H2O into its H2 and oxygen (O) elements. While green H2 production is more energy-intensive than blue H2 production, it can be less carbon-intensive if the electricity utilized for the electrolysis is provided solely by solar, wind or hydroelectric power. Pink H2 is similar to green H2 in that it is generated by electrolysis but produced using low-carbon electricity generated by nuclear power.

Clean H2 sources like these are being reimagined by investors, utility companies, communities, states, regions and governments as a fuel source for various industries. Each method of low-carbon H2 production has its own benefits and challenges, and all are attracting interest because of their potential to reduce greenhouse gas (GHG) emissions.

One of the many initiatives the U.S. federal government is embracing is the development of a nationwide H2 hub network. The U.S. Congress has appropriated $8 B through the Department of Energy (DOE) for the establishment of six–10 regional hubs, dubbed Hydrogen Hubs, to provide DOE grants for clean H2 in the U.S. under the Infrastructure Investment and Jobs Act (IIJA). In simple terms, each hub will receive between $500 MM and $1 B of DOE funding in the form of cooperative agreements and other incentives.

The development of H2 hubs is intended to be the first step toward the creation of a national network of clean H2 producers and customers that could help facilitate the emergence of a clean H2 economy. To kick off the effort, in September 2022, the DOE Office of Clean Energy Demonstrations issued DE-FOA-0002768 titled “Regional Clean Hydrogen Hubs.” This funding opportunity announcement (FOA) called for proposals from prospective hubs.

Seventy-nine H2 hub proposals were submitted, with 33 of them getting an “encourage” stamp of approval from the DOE to move forward in the application process. The authors’ company actively supported two regional H2 hubs in the process.

Although there is broad agreement on the need for a robust clean energy economy that includes H2 hubs, there is much to be considered. Seven key questions that industry players are considering as the clean H2 industry develops are detailed in the following sections.

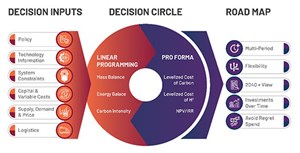

How is a H2 hub defined? Each H2 hub is a network of clean H2 producers, potential consumers and connective infrastructure. A detailed work process is needed to navigate the feasibility of H2. An example work process is shown in FIG. 1.

The mission of a H2 hub is to provide clean and affordable H2-based energy. This is a new opportunity for states to garner investment, whether through generation, end use or logistics. An optimum hub is one where all the producers and consumers are within a 200-mi radius and work in a precise balance to produce, store and convert H2 into usable energy sources to help meet regional needs.

While it may be reasonable to assume that certain areas have a lock on securing H2 hub status, the reality is that all regions of the country are on equal footing to participate in the H2 economy. To help realize this outcome, the DOE has included an environmental justice component to its program to encourage participation from all types of communities and regions.

Among the 40 environmental justice guidelines issued by the DOE, nine burden metrics are in place to enable the department to determine disadvantaged communities. None of these metrics is based on population density. Instead, the metrics are designed to ensure that disadvantaged communities are not disproportionally affected in a negative way by the incremental deployment of new infrastructure.

What does a H2 hub energy future look like and what must happen to get there? The energy sector continues to look for opportunities for expansion and diversification to secure a clean energy future. Innovation in any industry is the long-term key to success and early adopters in most industries are rewarded—they often shape an industry’s path. As with any new industry endeavor, early adopters who take risks could be rewarded, while late adopters could lose out on capturing new markets.

The U.S. DOE is providing up to 50/50 cost share incentives, tax credits and other enticements to help advance the H2 hub sustainability model. Layering different H2 incentives on top of each other helps drive H2 production costs down, making the undertaking more viable and competitive with existing energy sources.

Historically, the government has driven decarbonization efforts through incentives and legislation that allow emerging technologies to be competitive. By defraying some of the risk that private investors could incur, momentum is created for a broad-based system that will drive needed economies of scale. With economies of scale, the market can take advantage of costs being spread out across many participants. As technologies and supply chain innovations evolve, market costs will decrease, opening new pathways for adopting H2 as a major clean energy source—it will just take time.

How are hubs established and what are the different types? It is important to begin hub development with the element that is creating demand and then working upstream. Two prime examples of demand-leading H2 development could be an airline committing to a long-term agreement to purchase sustainable aviation fuel (SAF) from a production facility that sources clean H2 from a hub; and an agricultural enterprise that sources clean ammonia from a hub. In these instances, demand fuels the need for SAF and low-carbon ammonia. These market forces drive the concerted efforts of H2 hub entities to deliver these essential components of SAF and ammonia.

With solid demand, the next step is to consider a hub’s existing resources and how to leverage them to produce, transport and use H2. When it comes to hub development, the options are endless, and much depends on resources within a given area. Some hubs are being established around state and municipality resources, while some are being established around public/private industry resources. Successful hubs will likely be a hybrid of both.

The availability of regional resources and end users will drive the economics and decision-making regarding H2 production and hub logistics. Geography and an area’s electricity mix—including renewable energy resources—play a significant role. Production that results in end uses like renewable diesel, SAF, methanol or ammonia works well from a logistics standpoint that relies on trucks, rail yards and pipelines. Some hubs may choose green H2 production rather than blue because they lack the geography or pipeline access to sequester CO2. Numerous potential underground storage sites, both geological and enhanced oil recovery, are located along the Gulf Coast and Upper Midwest, so hubs there might focus on blue H2 production because of the CO2 storage capacity.

In states such as California, Louisiana and Texas, unique infrastructure assets already exist that may be successfully converted for use in a hub network. These may include pipeline and port facilities. In some situations, significant H2 producers in these states could negotiate agreements from end users for more than 50% of their production output, or they could conceivably integrate customers directly into their regional hubs.

No matter the location of a potential hub, the more a participant leverages its assets and partnerships, the more successful the overall hub endeavor is likely to be.

What challenges do H2 hub participants face? States, municipalities and companies must determine their appetite for risk when considering participation in a H2 hub. A multitude of moving parts are involved and many challenges may arise. The availability of renewable feedstocks to fuel the whole H2 economy is a major concern, as is the abundance, or potential lack, of end users. Another key challenge is that approximately 70% of the cost of producing H2 through electrolysis is driven by the cost of power, which raises concerns.

Additionally, for hubs trying to establish new CO2 pipelines, a “not-in-my-backyard” mentality can be a barrier. This has proven to be pervasive in many regions, and opposition can emerge anywhere. For hub primes—the primary recipient of funding—there is also the question of whether necessary funding will materialize, as well as concerns about liability. What happens if a project within the hub loses money or fails to meet project standards approved by the DOE or other funding sources? What is the recourse for perceived failed and/or mismanaged projects in the hub network?

Another significant challenge is that H2 hubs are a new concept for the DOE. The DOE usually has stringent accountability standards and reporting mechanisms over the lifetime of a grant or loan. For H2 hubs, the funding opportunity announcement from the DOE provides a brief overview of the DOE’s process for analyzing emissions during the selection phase. However, there is ambiguity when calculating emissions during the planning stage, and the DOE has yet to define what tracking and evaluating of emissions should look like once projects are fully established and operating.

Another issue is the Buy America stipulation, which requires all hub producers to source steel, iron, manufactured products and construction materials from U.S. producers. This restriction only applies to nonfederal institutions, including state and local governments, tribes, universities and nonprofit groups as identified by the Office of Management and Budget’s Uniform Guidance. H2 hubs that are run by the private sector and are not required to abide by this restriction will likely benefit in terms of lower costs.

It is vital to remember that H2 hubs will not take shape overnight—they will take time to develop and evolve. National Environmental Policy Act (NEPA) reviews, state and other permitting, right-of-way, land ownership, and carbon capture sequestration issues can take years to navigate. With the potential for changing government administrations, funding and political will can ebb and flow. However, as is the case with most industries, the details will work themselves out in time, making this a highly viable solution for entities to add to their greenhouse gas reduction portfolio.

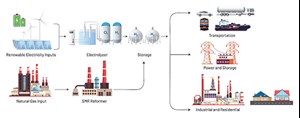

What infrastructure is needed to support a H2 hub system? Hubs are a sophisticated and intricate ecosystem that spans the full supply chain, as seen in FIG. 2. H2 hub developers seek to utilize electrolyzer requirement energy from zero- or low-carbon sources to maximize GHG reductions. One way this can be achieved is by entering into purchase agreements, connecting directly with renewable energy generators or using book-and-claim mechanisms like renewable energy credits.

Logistically, to transport H2, a buildup of H2 economy infrastructure is needed and should include transportation via rail, truck and pipeline as well as compression and storage operations.

Because the H2 economy build-out will require an abundant supply of renewable and decarbonized energy, there must be an abundant supply of low-carbon renewable energy resources such as wind, solar, geothermal and H2. This can be challenging, since at its best wind power is available on average only 50% of the time and solar a little less than that. With these capacity factors, a H2 plant may be forced to run intermittently, or augment its power supply with energy storage or another clean energy source.

Who will manage the H2 hub system and regional interconnection? The Regional Clean Hydrogen Hubs program is funded by the U.S. Congress and run by the DOE. The program’s purpose is to aid in the generation, handling, distribution, storage and use of clean H2 throughout the country. The program is noteworthy because it has the potential to significantly transform energy policy.

The federal government has allocated $9.5 B in funding for H2 projects, including $8 B for H2 hubs. This is intended to jump start the clean H2 economy, with tax incentives helping H2 become a competitive solution in hard-to-decarbonize industries. These subsidies include 45V tax credits, where the value of credits is based on lifecycle emissions. Additionally, tax credits are available for carbon capture and sequestration efforts (Section 45Q of the tax code). Each of these tax credits can reduce the price difference between clean H2 and more carbon-intensive energy alternatives. As part of the 45V tax credits for H2 production, the U.S. Department of the Treasury will establish rules for calculating lifecycle emissions in determining the value of the tax credit. The DOE has also issued a proposal for a Clean H2 Production Standard that is based on lifecycle emissions. The IIJA requires that hubs meet this standard.

It remains to be seen what government involvement and support will look like as the H2 economy takes shape. Ultimately, as with all free-market economics, it will take regional hubs working together to optimize interconnectivity and the success of this sustainability model.

What role do consultants play in the development of hubs? Every firm is different, and a thorough assessment of a firm’s capabilities is critical. As an example, the authors’ company offers a holistic, evergreen approach to evaluating multi-state H2 production and end-use pathways. The approach leverages strong technical, financial and policy resources with a toolset that supports clients as they work to establish their overall hub vision, understand short-term and long-term hub feasibility, and capture potential market opportunities.

When working with a H2 hub consultant, entities should look for firms that can handle technical studies, permitting, financing, grant writing, technical economic analysis and lifecycle analysis. A knowledgeable firm can help determine both the technical operations of the hub and the financial sustainability of the hub, inclusive of how federal policy will impact short- and-long-term viability. Most importantly, the consultant should be able to determine the strategy and structure of the hub based on determining how to leverage all assets, including regional partnerships.

Companies interested in considering a H2-hub-related investment need fit-for-purpose techno-economic and lifecycle analyses. Considerations should include developing time-adjustable investment plans, which identify optimum configurations and the right mix of feedstocks, products, technologies and supporting infrastructure to achieve hub goals (e.g., decarbonization, profitability, long-term viability). Financial outputs, including levelized costs of H2 production and the costs of H2 earmarked for transportation, cement or steel production, as well as products derived from H2 such as renewable diesel, sustainable aviation fuel, methanol and ammonia, should all be a key part of any analysis. In instances where hub development moves forward, working with a consultant that not only can advise on the hub’s development, but can also help with its design and construction offers a clear advantage.

The pathway to H2 hub success. The process of establishing a H2 hub can be a daunting and complicated one, but it is becoming ever-more critical as energy providers and others search for ways to achieve a cleaner energy future. Finding a partner with the appropriate technical, financial and policy experience is essential. In addition to helping potential project owners determine when a hub does not make sense, a knowledgeable consultant should be able to identify alternatives for achieving sustainability goals. H2T

About the authors

Martin Brandt is Managing Director at 1898 & Co., a part of Burns & McDonnell. He leads an exceptional team that delivers high-value consulting to the process-intensive oil, gas and chemicals and overlapping power industries by supporting the improvement of the company’s clients’ base operations as well as the energy transition and sustainability of their value chains. In conjunction with 1898 & Co.'s Renewable Power group, Brandt’s team delivers world-class master planning that integrates the disciplines of power generation and process technologies, public policy and proforma.

Hannah Morrey Brown is a Senior Energy Policy Consultant at 1898 & Co. and brings IIJA and IRA grant consulting leadership to the team. She is actively engaged as strategy lead for utilities and oil and gas clients. Brown is also experienced in researching and writing fact sheets and policy memos on relevant issues. She recently completed her master’s degree in public policy from Carnegie Mellon University, specializing in energy systems, and spent a year in Washington DC working on Capitol Hill: one semester with the Senate Energy and Natural Resources Committee and the other with the House Transportation and Infrastructure Committee. Prior to graduate school, Brown spent 5 yr working as a Project Manager in commercial construction and earned an undergraduate degree in civil engineering.