Articles

The future of H2: A regional outlook—Part 2: Europe, Russia, the CIS and Latin America

Business Trends

LEE NICHOLS, Vice President, Content/Editor-in-Chief

Nations around the world are investing in new technologies and pathways to limit carbon emissions and adhere to ambitious net-zero goals. Part of this strategy includes the massive scale-up of H2 production capacity, primarily green routes that use renewable energy for production.

Part 1 of this work—published in the June issue of H2Tech—detailed current and future H2 demand, active H2 project numbers and capital spending globally, as well as an examination of major H2 trends, programs, regulations and capital projects in Africa, Asia and Canada. This article will focus on Western and Eastern Europe, Russia, the Commonwealth of Independent States (CIS), and Central and South America.

WESTERN EUROPE

Gulf Energy Information’s Global Energy Infrastructure (GEI) database has been tracking H2 projects globally for more than 2 yr. Since the database’s inception in early 2021, active H2 projects have increased more than 10-fold to nearly 1,300—a nearly 380% increase in project announcements. These active projects are valued at more than $1.13 T.

Holding a nearly 50% market share in active H2 projects, Western Europe more than doubles its closest competitor Asia (21%). For decades, Western Europe has been the leader in establishing new directives and initiatives to promote cleaner transportation fuels and power generation. Over the past few years, the region has made significant strides to establish and expand the use of H2 within the European Union’s (EU’s) borders—a result of the Paris Agreement to reduce greenhouse gas (GHG) emissions to limit global warming to 1.5°C–2°C in this century.

To combat GHG emissions in the EU, the region will continue to invest heavily in new H2 production capacity and infrastructure. This H2 supply/value chain will help decarbonize the region’s industrial, mobility and energy sectors to reach net-zero goals by 2050.

According to the European Commission’s (EC’s) H2 strategy and REPowerEU, the EU will conduct a phased approach to implementing H2 infrastructure and production to 2050:

- Phase 1 (2020–2024): The first phase calls for the installation of at least 6 GW of renewable H2 electrolyzers in the EU, with up to 1 MMtpy of green H2 production. In April, the EU proposed a pilot auction program to subsidize green H2 projects in the region. The proposal will make available €800 MM for green H2 project developers to help subsidize the cost for building new H2 production capacity in the region. H2 project developers could receive up to a €4/kg subsidy for up to 10 yr. However, there are several caveats to qualify:

- The project must have (at least) 5 MW of electrolyzer capacity

- Project developers cannot bid for more than 33% of the €800-MM budget

- The project must reach 100% capacity within 3.5 yr of a winning bid

- The project must have pre-contractional arrangements in place, such as a Memorandum of Understanding (MoU) or Letter of Intent (LoI).17,18

The program, which will take place under the EU Innovation Fund, is the initial step to the establishment of the EU’s Hydrogen Bank in 2024. According to the EC, the €3-B European Hydrogen Bank will be used to “unlock private investments in H2 value chains, both domestically and in other countries, by connecting renewable energy supply to EU demand and addressing initial investment challenges.”18

- Phase 2 (2025–2030): Due to Russia’s invasion of Ukraine, the EC has revised the EU’s goal for both domestically-produced green H2 and green H2 imports for Phase 2. According to the most recent initiative, the EU plans to install up to 40 GW of renewable H2 electrolyzer capacity to produce 10 MMtpy of green H2. The region also intends to import up to 10 MMtpy of green H2 within this phase. However, the additional infrastructure and production capacity comes with a large price tag. According to the EC, total investments in domestic H2 infrastructure could top more than €470 B by 2030, with an additional €200 B–€300 B in costs to build out renewable energy capacity in the region. These costs are in addition to approximately €500 B that will be needed to build value chains outside of the EU to secure additional green H2 imports.19

- Phase 3 (2030–2050): In this last phase, renewable H2 production reaches maturity and can be deployed at a wide scale throughout the EU. This phase envisions the use of green H2 in nearly all sectors of the EU, including aviation, shipping, and in industrial and building applications.

To help unlock both public and private investments, the EU has also initiated important projects of common European interest (IPCEI). This cross-border initiative will help provide funding to build a H2 value chain in the EU. At the time of this publication, two IPCEI initiatives—Hy2Tech and Hy2Use—have been awarded funding. These two initiatives will provide more than €10.5 B in funding to more than 75 projects in 16 EU nations. Hy2Tech and Hy2Use are expected to secure nearly €16 B in private investments, as well.20

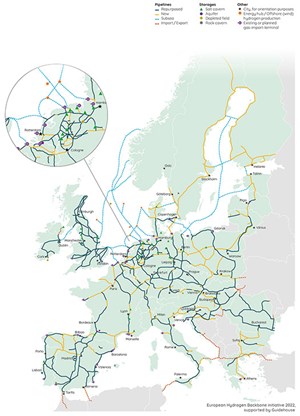

Lastly, to move vast amounts of H2 around the EU, an intricate supply network is needed in the region. To supply demand centers with H2 supplies, the European Hydrogen Backbone (EHB) initiative has been implemented (FIG. 8). This capital-intensive program includes more than 30 energy infrastructure operators across northern, central and southern Europe. By 2040, the EHB is expected to traverse approximately 53,000 km at a total cost of €80 B–€143 B.21 This includes onshore and offshore pipelines to deliver H2 to various demand centers in the EU for domestic/regional use.

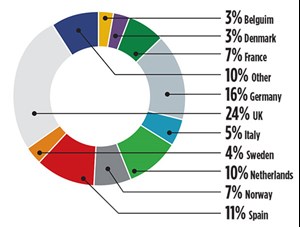

Country analysis. At the time of this publication, the GEI database was tracking nearly 590 active H2 projects in Western Europe. At 24%, the UK holds the largest market share in active H2 projects in the region, followed by Germany (16%). A breakdown of active H2 project market share in Western Europe is detailed in FIG. 9. The following are notable active projects and initiatives being developed in Western Europe.

France. In 2020, France unveiled its H2 strategy, which called for 6.5 GW of electrolysis capacity to be installed in the nation by 2030. However, in 2022, the French government announced plans to unveil a new H2 strategy that will emphasize the use of green H2 to decarbonize hard-to-abate industries such as aviation, cement and steel production (e.g., GravitHy’s €2.2-B, 2-MMtpy green steel plant and the Power4Steel program), long-haul transport (e.g., several companies are investing in new green H2 fueling centers) and fertilizer production.

At the time of this publication, France’s new H2 strategy is expected to be announced mid-year. The new strategy is in response to numerous new green H2 projects that have been announced since France unveiled its first H2 strategy in 2020—the country’s first H2 plan was announced in 2018. Since the release of the country’s H2 program, the following notable projects have been announced to help France meet its 2050 net-zero ambitions:

- Horizeo’s 1-GW solar farm

- Hydrogen Pilot Storage for large Ecosystem Replication (HyPSTER) project: This project is the first EU-funded project to test storing H2 in underground salt caverns.

- TotalEnergies’ Masshylia project that will supply green H2 to the operator’s La Mède refinery to help decarbonize biofuels production.

- Grande Region Hydrogen project: This cross-border H2 ecosystem consists of several projects to provide green H2 to decarbonize various industrial sectors of France and Germany’s economies. These projects include H2V Fos and Thionville projects, GazelEnergie’s Emil’Hy project, Steag GmbH’s project, the HyPower Moselle/Saar projects and the CarlHYng project, and the 100-km MosaHYc H2 pipeline project that will provide up to 50,000 tpy of H2 to cities in France and Germany by 2030.

- DOMO Chemicals and Hynamics’ 11,000-tpy low-carbon H2 plant that will provide feedstock for DOMO Chemicals’ plastics production process at Belle-Étoile.

- Occitanie H2 Corridor project: This €110-MM initiative includes the construction of green H2 plants (Lhyfe’s 2-tpd plant in Bessières and Hyd’Occ’s 3,000-tpy plant in Port-la-Nouvelle) and H2 fueling stations to help decarbonize long-haul and passenger vehicles in the Occitanie region of southern France.

Germany. The country is second only to the UK in active H2 projects in Western Europe. Like the rest of the EU nations, Germany has vowed to be a carbon-neutral economy by 2050, and the nation’s H2 strategy will help make this ambitious goal a reality.

First unveiled in 2020, Germany’s National Hydrogen Strategy focused on increasing renewable power generation to provide feedstock for green H2 production, as well as the massive scale-up of domestic green H2 production capacity. The green H2 would be used to decarbonize industrial and mobility sectors of the German economy. In the report, nearly €12 B has been provided by various federal organizations and programs—the National Innovation Program on Hydrogen and Fuel Cell Technology, the Energy and Climate Fund, the Regulatory Sandboxes for the Energy Transition, and the Coalition Committee’s Package for the Future—to invest in H2 technology research, to speed up the adoption of H2 technologies into various industrial markets to expediate the decarbonization of those industries, and to establish more partnerships with international markets. For example, the Package for the Future program provides €7 B to expedite H2 technology adoption in the German market and another €2 B to foster international partnerships/green H2 imports.22

However, in March, Germany’s new H2 strategy was released to the media. According to different media reports, Germany’s new H2 strategy (expected to be released this year) raises the country’s H2 demand to between 95 TWh and 130 TWh by 2030—the 2020 report forecasts domestic H2 demand to reach between 90 TWh and 110 TWh within the same timeframe. The report also calls for the doubling of domestic green H2 production to 10 GW by 2030, as well as the reliance on imported green H2 of between 50% and 70% of domestic H2 demand within the same timeframe.23

To help meet projected H2 demand in Germany, numerous H2 projects have been announced in the country. These projects focus on a wide array of producing and/or utilizing green H2 to decarbonize various industrial sectors of the German economy. These projects include billions of euros to build new H2 production capacity, more than €5 B to establish Wilhelmshaven as a H2 hub, > €1.5 B to use green H2 to decarbonize German steel production (e.g., Salzgitter’s Salcos project, STEAG’s HydrOxy Hub Walsum project), building green ammonia import infrastructure (e.g., Brunsbüttel, Wilhelmshaven, Port of Hamburg, Rostock), building and converting existing pipeline infrastructure to transport H2 to domestic demand centers (e.g., H2ercules project, Clean Hydrogen Coastline project), the development of numerous H2 fueling stations to help decarbonize the German mobility sector, utilizing H2 for mass transit (e.g., H2-powered trains being used in the Berlin-Brandenburg metropolitan region), and building new gas-fired combined heat-and-power plants to run off H2.

To encourage additional H2 concepts, the Federal Ministry of Digital and Transport launched the HyLand—Hydrogen Regions in Germany competition in 2019. The program’s concept is to provide advice, funding and other technical/project assistance to regional H2 developments, with the goal of helping Germany reach its net-zero targets by 2050. The first two rounds of the program—which were separated into three different categories (HyStarter, HyExperts, HyPerformer) based on the stage in the project’s/concept’s development—awarded 55 regions (25 in HyLand 1 and 30 in HyLand 2) with project funding/assistance.24 These projects are imperative to creating an integrated H2 ecosystem within Germany.

The Netherlands. The country’s H2 strategy aims to start up 500 MW of green H2 production capacity by 2025, increasing to 4 GW by 2030. To ramp up domestic green H2 production, the Netherlands has announced more than 50 H2 projects. This initiative includes the development of the world’s largest offshore-to-H2 project (the North of the Wadden Islands project, or Ten noorden van de Waddeneilanden) that will provide renewable energy and feedstock to produce green H2. The H2 will be connected partly to Gasunie’s H2 network project, which links five industrial clusters to each other and to neighboring H2 areas and H2 storage facilities.

The Port of Rotterdam will also witness a green H2 transformation. Several companies and consortiums have announced plans to develop green H2 infrastructure at the port and surrounding areas. For example, the Port of Rotterdam has cleared available land for the development of both green H2 production plants and green ammonia import facilities. The additional green H2 will help decarbonize different industrial sectors in the country, including being used in bp and Neste’s refineries (e.g., the MultiPLHY and HyCC H2-Fifty projects).

Spain. Adopted in 2020, Spain’s H2 roadmap targets the installation of 300 MW–600 MW of electrolyzer capacity by 2025, increasing to 4 GW by 2030. The country has already reached its first goal, with numerous additional green H2 production facility projects under development. These additional projects will help Spain in reaching its ambitious 2030 targets:

- More than €3 B to develop the Andalusian H2 valley to provide green H2 for low-carbon fuels production (e.g., Cepsa’s advanced aviation biofuels program) and for use in shipping and long-haul transport

- The development of various H2 valleys and corridors (e.g., Basque H2 Corridor, H2 Valley of Catalonia, H2 Valley of Murcia)

- bp’s €2-B green H2 initiative to replace natural gas used at its Castellón refinery with green H2 (i.e., the HyVal project)

- New pilot projects to increase green H2 in steelmaking

- The > €3.4-B, 2-GW Spanish Hydrogen Network (SHYNE), which is a 33 company consortium dedicated to building a H2 ecosystem in Spain.

UK. In December 2022, the UK’s Department for Business, Energy and Industrial Strategy announced an updated H2 strategy for the nation. The country’s new roadmap calls for H2 production of up to 10 GW by 2030 [with half being from electrolytic generation (i.e., green H2)], doubling the previous H2 strategy announced in mid-2021. The UK government also plans to help fund H2 projects through various subsidy programs, such as the Hydrogen Production Business Model and the Net-Zero Hydrogen Fund. These programs have been partly responsible for the significant increase in active H2 projects—the UK’s updated H2 strategy details approximately 20 GW in its H2 projects pipeline through 2037.

According to the GEI database, the UK is the market leader in active H2 projects in Western Europe, holding nearly 25% market share. These projects vary across the H2 value chain, including H2 production capacity, pipelines, infrastructure, fueling, and industrial and residential sectors. Several of the more notable projects are listed below:

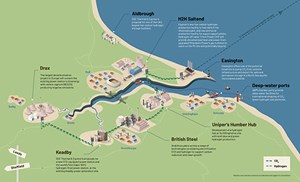

- Zero Carbon Humber: Part of the UK East Cluster, this capital-intensive project’s focus is to decarbonize the Humber region, which is the most carbon-intensive industrial region in the UK. The initiative consists of several different projects, including the H2H Saltend and H2NorthEast projects, decarbonizing the UK steel industry, and utilizing H2 for power generation and green H2/ammonia for export, among other projects (FIG. 10).

- Net-Zero Teesside: Also part of the UK East Cluster H2 and carbon capture cluster, the initiative is a collection of different projects to decarbonize the Teesside region through H2 production and carbon capture projects. These projects include bp’s plan to produce more than 1 GW of H2 via the H2Teesside and Hygreen Teesside projects, NZT Power’s use of H2 to provide low-carbon H2 for electricity generation, and other various H2 projects to decarbonize industrial operations.

- HyNet Northwest: This initiative is a collection of H2 production, transportation and storage to decarbonize the northern and northwest region of Wales. The low-carbon H2 will enable customers to switch from fossil fuel-fired power generation to lower carbon forms of energy (e.g., H2). These projects will be complemented by carbon capture solutions to help further reduce carbon emissions.

Several other H2 projects will be used to decarbonize different sectors of the UK’s economy. These include utilizing low-carbon/green H2 to power homes (cooking and heating) in places such as Fife; new green H2 fueling centers for buses, long-haul and passenger vehicles; replacing natural gas with green or blue H2 in industrial operations; new/converted infrastructure for H2/ammonia exports; and several pipeline projects to provide H2 to various demand regions of the UK.

Other Western Europe. In Q1 2022, Denmark pledged to install upwards of 6 GW of electrolyzer capacity to help the nation wean off fossil fuels. The additional green H2 will be used in several industries, including in power-to-x plants, green fuels production (e.g., IPECI Green Fuels for Denmark initiative), green ammonia production and for power/fuels in the marine industry and mobility sector.

Belgium has announced plans to become a European H2 import hub. The country’s goal is to import several hundred tons per year of green H2 that will be used to decarbonize sectors of Belgium’s economy, with the surplus exported to neighboring countries, primarily Germany. The country also plans to increase green and blue H2 production capacity (e.g., Equinor and Engie’s 1-GW H2BE blue H2 project in Ghent).

Finland has ambitious plans to significantly scale up domestic green H2 production capacity. Finland’s goal is to supply up to 10% of green H2 demand in the EU, as well as grow the use of green H2 in the nation’s transport sector, reaching 3% market share by 2030. In 2022, Finland’s Finance Minister announced plans to develop three H2 valleys within the country. For example, the BalticSeaH2 valley project plans to create an integrated H2 value chain in Finland and Estonia.

In 2019, Italy adopted the Energy and Climate National Integrated Plan (Piano Nazionale Integrato Energia e Clima or PNIEC) that targeted reducing the country’s emissions by 55%—compared to 1990 base levels—by 2040. To help adhere to these emissions targets, the Italian government plans to incorporate green H2 into various industrial and mobility sectors within the country. Italy’s H2 strategy includes the development of two major H2 valleys in the regions of Rome and Puglia. These valleys will include H2 production plants (e.g., Brindisi, Cerignola and Taranto plants in the Puglia region, and a waste-to-H2 plant near Rome). In addition, Italian companies are investing in building H2 fueling stations throughout the country and using green H2 to power industrial operations—e.g., Eni will use green H2 to help decarbonize operations at its Gela biorefinery and Taranto refinery.

Norway is also developing domestic H2 infrastructure. These projects include the production of both green and blue H2 (e.g., FFI’s Holmaneset project, the Barents Blue ammonia project), and the development of new H2 hubs. The various H2 hubs—in places such as Agdar, Kristiansand and Sauda—will help provide clean fuels to decarbonize Norway’s maritime sector.

Published in 2020, Portugal’s National Strategy for Hydrogen outlined the objectives to increase the production and use of green H2 in the country’s energy mix. According to the report, Portugal aims to increase H2 consumption in both the domestic industrial and transportation sectors to 5% by 2030. This initiative includes the establishment of 2 GW–2.5 GW of H2 production capacity, the construction of 50–100 H2 fueling stations and 10%–15% H2 injected into the national gas grid. These projects are estimated to cost approximately €7 B.26

Sweden is investing in scaling up green H2 infrastructure, as well. The country plans to produce green H2 to decarbonize several industries, including using green H2 for steel and sustainable aviation fuel (e.g., H2 Green Steel, SkyFuel H2) production, to produce e-methanol to decarbonize the country’s shipping sector (e.g., FlagshipONE), and for export to neighboring countries such as Germany and the Netherlands (e.g., Northern Green Crane project), among others.

EASTERN EUROPE, RUSSIA AND THE CIS

Although representing only 5% of active H2 project market share globally, the Eastern European, Russia and CIS regions are investing in increasing the use of low- and zero-carbon H2. For example, the four Visegrád countries (Czech Republic, Hungary, Poland, Slovakia) have announced both domestic and cross-border H2 projects/initiatives. Published in December 2021, the goals of these four countries were laid out in the Cooperation Opportunities in Hydrogen Project Support and Development in V4 Countries working paper. According to the document, the V4 countries’ goals are to significantly increase the production of both low-carbon and green H2, the increased use of H2 in vehicles (e.g., buses) and marine vessels, the blending of H2 into the region’s natural gas infrastructure, the use of H2 for industrial and residential power generation, the development of H2 storage caverns, and other integrated H2 value chains.

For example, the V4 countries are developing the > €5.8-B Black Horse project, which envisions a robust integrated green H2 supply chain in the region. This includes a green H2 production capacity of 320 tpd from 40 different electrolyzers, more than 10,000 H2-fueled trucks and a green H2 fueling network, among other H2 infrastructure. To complement the Black Horse project, Polish refiner, PKN Orlen, has announced plans to invest nearly $2 B to develop 10 H2 hubs in the Czech Republic, Poland and Slovakia. These H2 hubs will be accompanied by more than 100 H2 fueling stations, low-carbon and green H2 production plants, and H2 fueling for buses and trains.

In the CIS, the most notable and capital-intensive project is Hyrasia One. The estimated $50-B project will include the construction of massive solar and wind farms in the steppes of southwestern Kazakhstan. In total, these renewable power assets will produce approximately 40 GW of renewable electricity, which will be used as feedstock to produce up to 2 MMtpy of green H2 or 11 MMtpy of green ammonia. If built, commissioning of the project is scheduled for 2030, with full capacity to be reached in 2032.

Despite being engaged in a war with Russia, Ukraine is actively considering developing two H2 valleys in the country. The two potential valleys—one in the Zakarpattia region and one in the Odessa region—could install up to 2.5 GW of electrolyzer capacity able to produce approximately 220,000 tpy of green H2. These two H2 valleys may also receive funding from the EU. However, at the time of this publication, no formal EU funding announcement had been reached.

Russia announced an ambitious H2 roadmap in 2021. This detailed plan focused on Russia capturing 20% of the world’s H2 market by 2030. The three-phase strategy aimed at exporting 200,000 tpy of H2 by 2025, increasing to 2 MMtpy by 2035 and between 15 MMtpy and 50 MMtpy by 2050. Since Russia is a major producer of natural gas, most of the country’s H2 goals center on blue H2 production with carbon capture.

However, the country has several challenges restricting these lofty goals. One, the country’s low-carbon H2 industry is in its infancy. A significant amount of capital must be invested to build H2 production capacity, pipeline infrastructure and to install carbon capture technologies. To help reach Phase 1’s goal of exporting up to 200,000 tpy of low-carbon H2 by 2025, the Russian government announced an infusion of approximately $125 MM to help build up its domestic H2 capacity over the next year.

Even if Russia were to quickly increase its domestic low-carbon H2 industry, the critical question is: Who will buy it? Due to Russia’s war with Ukraine, H2 markets in Western Europe are closed to Russian exports. Since pipelines to eastern Asian countries are in a nascent state, a significant amount of investment will be needed to transport low-carbon H2 to potential Asian (e.g., China) and Middle Eastern buyers. One solution would be for Russia to export H2 as low-carbon ammonia via marine transport to customers willing to purchase it. However, at the time of this publication, no major plans had been announced regarding this pathway.

The GEI database is tracking more than a dozen active H2 projects in Russia; however, many of these projects are still in early development phases.

CENTRAL AND SOUTH AMERICA

Due to the abundant use of renewable energy, countries in Central and South America are prime for utilizing this power system as a pathway to green H2 generation. At the time of this publication, more than a dozen Latin American countries had published either a full working H2 strategy or detailed framework. These initiatives will help these countries mitigate emissions, especially from high carbon-emitting sectors such as transportation and power/electricity generation.

However, implementing these programs is a separate challenge, especially with the significant costs that are associated with building up renewable energy infrastructure, green H2 production plants and other pathways to transport and provide zero-carbon H2 to various industrial, commercial and residential sectors. Regardless, several Central and South American countries have announced ambitious plans to scale up both the production and use of green H2 in their economies in an effort to drive down carbon emissions.

Brazil. In mid-2022, the Brazilian government passed a resolution establishing the country’s H2 strategy. The country’s National Hydrogen Program (PNH2) focuses on six areas of development to increase the country’s adoption of green H2: research and development, training the future H2 workforce, energy planning, developing a regulatory framework, enticing market growth and competitiveness, and increased international cooperation.27

According to H2 Brazil, the country has more than 40 active green H2 and green H2 pilot projects under development. Many of these projects are in potential H2 hubs in the states/ports of Bahia, Pecém, Pernambuco, Rio Grande do Norte and Port of Açu, among other regions. These projects represent more than $20 B in capital investments in the country.

Chile. The country has laid out a strategy to become one of the leading green H2 producers in the region. Chile’s National Green Hydrogen Strategy details three waves of green H2 innovation and deployment. Wave 1 (2020–2025) includes the domestic ramp-up and export preparation for green H2. This includes six prioritized applications—oil refineries, ammonia, mining haul trucks, heavy-duty trucking, long-range buses and blending into gas grids—to build local supply chains and experience in scaling up the country’s workforce and export abilities. Waves 2 and 3 (2025–2030 and beyond) focus on capitalizing on export markets and expanding green H2 production.

By the mid-2020s, Chile is targeting at least $5 B in green H2 investments, 5 GW of electrolysis capacity operating or under development (Chile plans to increase electrolysis capacity to 25 GW by 2030) and 200,000 tpy of H2 production in at least two H2 valleys in the country.28 These projects, along with the closing or retrofitting of all domestic coal-fired power generation plants, will help Chile reach its ambitious goal of a carbon-neutral economy by 2050.

Colombia. According to the country’s H2 roadmap, Colombia plans to build its H2 ecosystem on five pillars: emissions reduction, economic growth (e.g., a low-carbon H2 export economy), a fair energy transition, national goals and developing integrated H2 local communities. By 2030, Colombia aims to develop 1 GW–3 GW of electrolysis capacity, achieve competitive green H2 production costs (e.g., $1.70/kg) and produce at least 50,000 tpy of blue H2 production capacity via existing and/or planned domestic steam methane reforming capacity. The low- and zero-carbon H2 will be used to decarbonize several industrial sectors, as well as to fuel light- and heavy-duty H2 vehicles via several networks of H2 fueling stations. These projects are estimated to costs $2.5 B–$5.5 B.29

From 2030–2050, Colombia plans to increase the development and the deployment of green H2 to help decarbonize hard-to-abate sectors, along with increasing green H2 export opportunities around the world.

LITERATURE CITED

16 Martin, P., “EU proposes €4/kg subsidy cap for green hydrogen auction,” Hydrogen Economist, April 4, 2023, online: https://pemedianetwork.com/hydrogen-economist/articles/finance/2023/eu-proposes-4-kg-subsidy-cap-for-green-hydrogen-auction/

17 Parkes, R., “More generous than US | Green hydrogen could fetch ‘fixed premium’ subsidy of up to €4/kg in EU’s first competitive auction,” Hydrogen Insight, April 4, 2023, online: https://www.hydrogeninsight.com/policy/more-generous-than-us-green-hydrogen-could-fetch-a-fixed-premium-subsidy-of-up-to-4-kg-in-eus-first-competitive-auction/2-1-1430961

18 European Commission, “Hydrogen,” European Hydrogen Bank, online: https://energy.ec.europa.eu/topics/energy-systems-integration/hydrogen_en#european-hydrogen-bank

19 Day, P., “European Hydrogen Bank strategy to be tested at autumn auctions,” Reuters, April 27, 2023, online: https://www.reuters.com/business/energy/european-hydrogen-bank-strategy-be-tested-autumn-auction-2023-04-27/#:~:text=The%20European%20Hydrogen%20Bank%20(EHB,CfD)%20scheme%20introduced%20for%20renewables

20 European Commission, “Internal market, industry, entrepreneurship and SMEs: IPCEIs on hydrogen,” online: https://single-market-economy.ec.europa.eu/industry/strategy/hydrogen/ipceis-hydrogen_en

21 European Hydrogen Backbone, “Estimated investment and cost,” online: https://ehb.eu/page/estimated-investment-cost

22 German Government, The National Hydrogen Strategy, Federal Ministry for Economic Affairs and Energy, June 2020, online: https://www.bmbf.de/bmbf/shareddocs/downloads/files/bmwi_nationale-wasserstoffstrategie_eng_s01.pdf?__blob=publicationFile&v=2

23 Klevstrand, A., “Leaked document: Germany will need to import 50%–70% of its hydrogen by 2030, and that share will only grow,” Hydrogen Insight, March 10, 2023, online: https://www.hydrogeninsight.com/policy/leaked-document-germany-will-need-to-import-50-70-of-its-hydrogen-by-2030-and-that-share-will-only-grow/2-1-1416856

24 Federal Ministry of Digital and Transport, “HyLand—Hydrogen Regions in Germany,” online: https://www.hy.land/en/

25 UK Government, Hydrogen strategy update to the market: December 2022, Department for Business, Energy and Industrial Strategy, December 2022, online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1123751/hydrogen-strategy-update-to-the-market-december-2022.pdf

26 Government of Portugal, Portugal National Hydrogen Strategy (EN-H2): A new ally for the energy transition in Portugal, Republic of Portugal: Environment and Climate Action, 2020, online: https://kig.pl/wp-content/uploads/2020/07/EN_H2_ENG.pdf

27 Brazilian Government, “National Energy Policy Council: Resolution No. 6,” Ministry of Mines and Energy, July 2022, online: https://www.in.gov.br/en/web/dou/-/despacho-do-presidente-da-republica-419972141

28 Government of Chile, National Green Hydrogen Strategy, Ministry of Energy, November 2020, online: https://energia.gob.cl/sites/default/files/national_green_hydrogen_strategy_-_chile.pdf

29 Government of Colombia, Hydrogen Roadmap, Ministry of Energy and Mining, 2021, online: https://www.minenergia.gov.co/documents/5862/Colombias_Hydrogen_Roadmap_2810.pdf