Articles

Next generation ultra-low iridium anode catalyst development

Special Focus: Electrolyzer Technologies

W. THORNHILL, Ames Goldsmith Ceimig, Dundee, Scotland

Over the last 3 yr, the author’s company has carried out a cross-company development program using teams of scientists from the U.S. and the UK to develop a state-of-the-art, next-generation catalyst fit for the iridium demand profile in 2050. At the end of 2022, more than 30 countries put hydrogen (H2) policies in place to decarbonize their energy requirements to hit net zero by 2050.

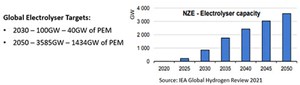

These policies indicate ambitious targets globally for electrolyzer production—an estimated 100 gigawatts (GW) must be installed by 2030, increasing to an estimated 3,585 GW of electrolysis by 2050 (FIG. 1). Of this production, it is expected that 40% will use proton exchange membrane (PEM) technology. With the recent introduction of the Inflation Reduction Act (IRA) in the U.S., and the REPowerEU H2 roadmap in the European Union (EU) coupled with the new EU Green Deal Industrial Plan, these volumes look to become a reality.

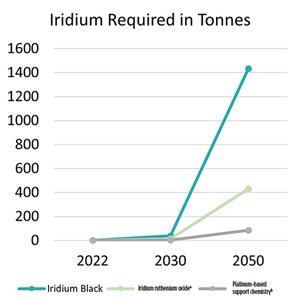

Historically, approximately 8 Ttpy of iridium is mined as a byproduct of platinum production. By many metrics, the current loading of iridium in PEM electrolyzers is 1 g/kilowatt (kW)−2.5 g/kW. If the low end of this estimation is set at 1 g/kW, assuming the use of a catalyst such as iridium black (> 98%), then this equates to 40 Tt of iridium required by 2030 for 40 GW of PEM electrolysis and 1,430 Tt of iridium required by 2050 for 1,430 GW of PEM electrolysis. This level of iridium usage is not achievable and causes many people to question the viability of PEM electrolysis as a long-term solution in the fight against climate change.

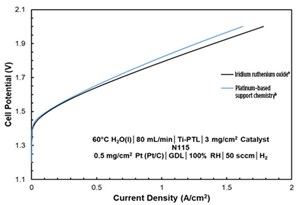

The author’s company produces an iridium ruthenium oxide, which contains only two-thirds iridium and has an extremely high surface area, meaning a smaller amount can achieve the same activity level. Designed as a true alloy of the two metals at the nanocrystal scale, this results in improved catalyst durability. Testing and in-use feedback show the technology offers equivalent performance to iridium oxide, with lower degradation rates.

Typically, only 0.3 g/kW of iridium is required when using an iridium ruthenium oxide; therefore, only 12 Tt of iridium would be required by 2030 for 40 GW of PEM electrolysis, and only 430 Tt of iridium would be required by 2050 for 1,430 GW of PEM electrolysis (FIG. 2).

This is a significant improvement in iridium demand and means that a viable product is available that is produced at scale and can achieve the demand rates well into the mid-2030s. However, improvement in iridium loadings is still needed beyond this period. Another technology route being developed is to optimize iridium use by depositing a thin layer of iridium nanocrystals on the surface of a support, much like how platinum is deposited on carbon for use in fuel cells.

Many companies have been using supports selected for their durability in the highly oxidized current densities and low pH found at the anode of the electrolyzer. Carbon is not a viable support in these conditions, and supports such as titanium oxides (TiO2s), tin oxides and doped variants of these oxides have been the focus of many companies. While this technology will aid in limiting the amount of iridium required, the reduction is limited to around 45% of the catalyst (FIG. 3). This is due to the requirement of the catalyst layer to conduct electricity across the membrane surface. When using non-conductive support, such as TiO2, the metal on the surface is required to provide conductivity and catalysis, requiring a high metal loading.

The author’s company has developed a novel platinum-based support system and iridium deposited on the system can be reduced to less than 15% iridium.a,b This new grade has been shown to be fully stable in anode conditions. Accelerated stress tests have shown equivalent performance to competitor iridium oxide grades. The accelerated stress tests were designed to simulate up to 100,000 hr of use.

Adopting this grade should result in iridium loadings of < 0.06 g/kW, meaning the 1,430 GW of PEM electrolysis required by 2050 will only require 86 Tt of iridium. Considering the ramp-up in production, this should be readily achievable, especially if coupled with developments in the recycling of PEM components.

Some may question using an expensive platinum-based support system, but this has been carefully considered. Platinum has a proven track record of stability in electrolyzer anode conditions and is used to protect porous transport layers and flow plates.

The selection of platinum-based support also aids future iridium mining. Iridium only accounts for 2%−4% of the mining basket, so companies will not mine for iridium alone. Including a more significant proportion of platinum in the product prompts the production of iridium. As industry advances, this is an essential factor as platinum demand reduces over the coming decades with the decline in internal combustion engine vehicles.

Despite the relatively high cost of platinum, the support and adoption of this new grade should reduce platinum group metals (PGMs) costs for electrolyzer manufacturers by two-thirds based on current PGM prices. Analysis by the International Renewable Energy Agency showed that the anode catalyst makes up 2.7% of the total electrolyzer cost; using iridium deposited on a platinum-based support chemistry would reduce this to < 0.9% of total PEM electrolysis costs, making it more competitive with alternative electrolysis methods.H2T

NOTES

a HyPer WE550

b HyPer WE53

About the author

WAYNE THORNHILL has been the Sales Manager with the Ames Goldsmith Corporation for 4 yr. Ames Goldsmith is a specialty and precious metal chemistry company with a division focussing on silver and platinum group metals. Ames Goldsmith is focused on making PEM technology a viable option for the fight against climate change. As a precious metal chemical manufacturer, the company can do this in three ways: by scaling production in line with the growing market, developing next-generation catalysts (which minimize the requirement for these rare metals) and creating bespoke recycling loops for H2 equipment. The work Ames Goldsmith is doing now will see PEM succeed at the demand levels forecast in 2050.