Articles

Houston’s future as a global center for clean H2 manufacturing, recycling and electrolysis

Special Focus: Regional Outlook

R. MCINTOSH, Partners in Performance, Boston, Massachusetts; and R. HUNT, Partners in Performance, Alberta, Canada

Houston, Texas, could become a global hydrogen (H2) energy hub as outlined in a recent report authored by the authors’ company. Its strategic advantages make it an optimal location, specifically in manufacturing equipment necessary for future H2 production and distribution infrastructure throughout the U.S. and the world. Houston’s existing status as a global hub for planning and manufacturing energy systems makes it an essential element in any larger-scale national plan for transitioning to a H2 economy.

Through a series of interviews and consultations with >100 global and local market players, various factors were assessed to determine the city's potential as a H2 hub and equipment manufacturer and confirm Houston’s strengths and growth opportunities for providing the “picks and shovels” of the green H2 gold rush, including businesses with relevance to the supply chain, companies integrating components for large-scale electrolyzer systems, and public authorities and institutions needed to create supportive conditions.

Key findings. To maintain its leadership role as a global center for the energy industry, Houston can look to establishing a global H2 energy hub—transitioning and growing the city’s industrial manufacturing base to create H2 electrolyzers, storage and delivery infrastructure.

Texas and the Gulf Coast region are likely H2 hubs for production, demand and manufacturing. Houston’s global energy-focused firms and engineering, procurement and construction (EPC) contractors see H2 mega-projects as a natural evolution with less business volatility than oil and gas.

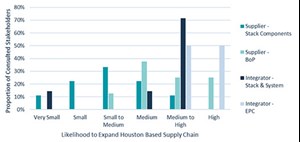

Almost all balance of plant (BoP) H2 equipment manufacturers view Houston as a center for manufacturing and demand and a key site for long-term expansion. They are waiting to see where the most supportive policies for hub centers may emerge, as many are smaller companies who cannot afford to plan their growth incorrectly.

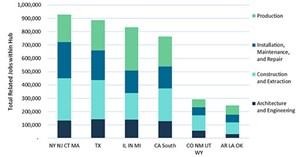

In the analysis, stack component manufacturers emerged as the group least likely to relocate. Many groups manufacturing essential parts such as bipolar plates or electrolyzer membranes are Europe-based with limited capital for expansion—they are waiting on new location expansion plans to see where the market surge is occurring. That said, gaining access to these critical supply chain elements will be a central goal for Houston’s H2 manufacturing industry to ensure growth and market prominence (FIG. 1).

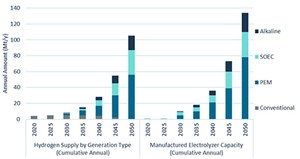

Manufacturing growth validation. U.S. green H2 generation is predicted to exceed 100 MM tons per year (tpy) by 2050, approximately 20% of the global market (FIG. 2). Electrolyzer technology growth will vary based on advances and demand for future technologies. While the overall market potential for all technologies is substantial, the manufacturing capacity for electrolyzers, balance of plant (BoP) equipment and electrolyzer components is limited. A limited-time, first-mover opportunity is emerging for key manufacturing centers to rise to market pre-eminence, but rapid development is needed.

Houston is well suited for this role because its existing manufacturing base is large, sophisticated and transitioning to electrolyzer and BoP equipment production. Houston’s status in the world energy community was never based on its access to resources but rather on its ability to supply equipment and planning to best utilize resources regionally, nationally and globally. Playing to those strengths will be essential as Houston distinguishes its role in a future H2 economy, and manufacturing presents significant cost savings through the rapid improvement cycles that agglomeration provides.

Corporate location. Market players have expressed a strong willingness to move to Houston or expand their existing footprints. The threshold for this demand varies between individual companies, but all perceive Houston as a global market full of business opportunities. New players see it as a place to gain access to finance, market connections and EPC support, while existing oil and gas value chain players understand they will need to get ahead of the transition.

H2 opportunity zones and policy advantages. Houston supports corporate relocation due to the abundant availability of warehouses, land and logistics support, easy permitting, incentives and a business-friendly environment. The most recognized advantage is Houston’s integrated energy economy. Agglomeration economies occur when companies in related industries are located close enough to reduce business costs through proximity. For Houston to maintain the same clout in the H2 space as in oil and gas, zones must be developed to agglomerate H2 companies.

During interviews with manufacturers, subject matter experts (SMEs) reported a preference for converting existing manufacturing facilities over greenfield builds. Houston’s existing innovation and manufacturing centers can form initial points for concentrated H2 development and manufacturing. Zones with existing manufacturing resources ready for conversion, tax benefits for development and space for growth were identified in the analysis (FIG. 3).

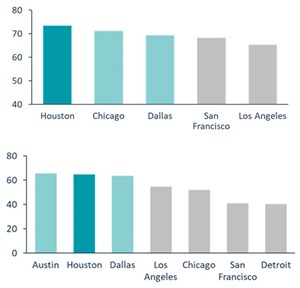

Houston’s business-friendly reputation is crucial to companies’ willingness to establish a manufacturing presence (FIG. 4). Concerns industries had with taking a back seat to oil and gas have been allayed by the supportive environment, which has led to success for start-ups in health and information technology (IT).

Job opportunities. One factor many firms identified as essential to their growth plans was Houston’s access to a highly skilled labor pool (FIG. 5).

A McKinsey and Co. report identified H2 as a potential employer of 180,000 people in the Houston area. The existing oil and gas workforce has skills in engineering, manufacturing, maintenance and more that can be directly transitioned to H2, and employers stated their employees are eager to transition. Programs to prime and connect this workforce to the H2 industry are an opportunity to distinguish Houston as a location where companies can grow with a ready capacity advantage. Leveraging Houston’s existing world-class energy industry ecosystem, including finance, services, engineering, manufacturing and construction, provides the means to accelerate H2 equipment development and production.

Research and development. Houston’s extremely strong background in energy research programs is appealing. Most university research programs are energy focused, with some substantially aimed at H2, which has received extensive R&D support through the U.S. Department of Energy (DOE), national laboratories, university programs, tech incubators and the private sector. National laboratories and universities are frequently the focal points of H2 research through their willingness to engage in long-term, profitable research. However, a major draw for players would be a national lab in Houston focused on H2 and advanced energy.

Pain points. The development of the H2 industry has made national headlines with its double-digit growth, but its expansion is only set to grow, with growth figures through 2040 being as high as 35%. This will likely create supply chain issues for manufacturing if they must quickly confront market issues. The report dives into these issues in greater detail, but the primary ones are:

- Investment challenges. To hit U.S. growth targets for the electrolyzer industry by 2030, $600 B will be required, while only $100 B is presently planned. This investment is predominantly slated for H2 production projects, electrolyzer stack manufacturers and system integrators. However, growth at all supply chain points and distribution/demand networks will be necessary. Houston’s status as a center of energy financing could be critical and is a primary argument for its hub status and ability to draw manufacturing.

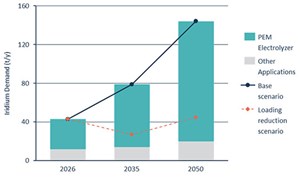

- Critical material shortages. Certain materials, such as iridium, carbon fiber (essential for many H2 storage technologies), nickel and platinum are expected to face price hikes and demand shortages as electrolyzer system manufacturing increases (FIG. 6). Gaining access to these resources will be critical to continued growth. However, some may see demand for electrolyzers alone outstripping world supply in short order.

- BoP scale growth. BoP elements in electrolyzer systems represent 60% of their value, and many are established technologies. Significant scaling is necessary through standardization and modularization to improve manufacturing capacity to see declines in cost and increased access to parts.

Key success factors. As stated in interviews, if a H2 hub cannot emerge in Houston, it cannot emerge anywhere. However, cities and states in other potential hub locations are pursuing aggressive measures to expand their research and manufacturing capabilities. As per the theory of economies of agglomeration, once a certain level of development is reached for an energy hub, its natural gravity makes it impossible to overcome as a natural headquarters. Although Houston has many advantages, if these are not utilized to develop manufacturing capacity quickly, another center may emerge and become difficult to dislodge.

Players, including local and state governments and business interests, can encourage and help Houston emerge as a manufacturing hub. The actions interviewers advised the city to take include:

- Coordinate to ensure the future supply of critical materials and components is available to drive unconstrained growth for market participants.

-

- Existing and new supply chains will require adjustments to meet the accelerated production of electrolyzers, and the key pain points identified in the report must be addressed to avoid significant blockages in manufacturing capacity.

- Establish zones for electrolyzer manufacturing with a strong competitive value proposition, R&D critical mass and clear incentives.

-

- This has been critical in Houston’s development as an oil and gas hub. This builds upon Houston’s strengths in agglomerating related companies in the energy sector.

- Focus on local development of the high-impact, high-value portions of the H2 equipment supply chain through stimulating demand.

-

- The expansion of R&D through key partnerships and the growth of foundational infrastructure in BoP, components and essential supply chain elements will ensure a competitive advantage and support agglomeration.

- Build acceptance and momentum with local stakeholders and the investment community.

-

- The development of regional connections and promotion of existing local and regional suppliers would showcase the commitment of Houston and build momentum.H2T

About the authors

ROBERT MCINTOSH has 14 yr of experience working with corporate and government clients to deploy advanced energy and efficiency technologies in the industrial and transportation sectors. He has engaged in green and blue H2 development, helping clients understand demand markets, electrolyte supply chains, site production capabilities and H2 transport in plants ranging from a few MW to > 1 GW in size.

ROY HUNT has 25 yr of experience working across mining, metals processing, oil and gas, refining chemicals and infrastructure. He has worked to improve project, operational and transaction performance through strategies integrating emergent risks and opportunities in energy transformation. This includes integrating emerging energy and technologies such as low-carbon H2 to leverage value.