Articles

The future of H2: A regional outlook—Part 1: Africa, Asia and Canada

Special Focus: Regional Outlook

L. NICHOLS, Vice President, Content/Editor-in-Chief

Over the past several years, the world has been engaged in an energy transition. According to the United Nations, more than 70 countries have set ambitious net-zero emissions goals,1 and many have enacted new regulations and initiatives to meet those targets. These pathways include, but are not limited to, the broader adoption of electric vehicles (EVs); utilizing new low-/zero-carbon fuels (e.g., blue/green H2) to decarbonize power, transport and heavy industry; increasing investments in renewable energy; increasing the percentage of biofeedstock blending in transportation fuels; incorporating the use of carbon capture and storage (CCS) or carbon capture, utilization and storage (CCUS); and boosting the production of biofuels and alternative/renewable fuels, among others.

One pathway to help economies decarbonize is the use of low-/zero-carbon H2. Undoubtedly, H2 will play a major role in global decarbonization activities since it is well-suited to provide clean energy to the transportation industry, power and buildings, and processing sectors. Most industry analysts forecast a stark rise in H2 demand over the next 25 yr. According to the International Energy Agency (IEA), global H2 demand was approximately 91 MMt in 2021.2 Several industry forecasts show global H2 production reaching anywhere between 300 MMtpy and 650 MMtpy by 2050. For example, the International Renewable Energy Agency (IRENA) forecasts global H2 production increasing six-fold to nearly 620 MMtpy by 2050.3 Conversely, bp’s Energy Outlook 2023 forecasts global H2 demand reaching between 300 MMtpy and 460 MMtpy within the same timeframe—total H2 demand is based on an accelerated and net-zero scenarios.4

With the stark rise in global H2 demand, a significant amount of capital investments are needed to satisfy forecasted consumption. These investments include capital-intensive H2 production projects, electrolyzer manufacturing, pipeline conversion and construction, and H2 refueling infrastructure.

The following is a brief overview of H2 capital projects, strategies and initiatives being implemented throughout Africa, Asia and Canada.

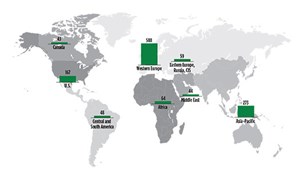

Active projects. Gulf Energy Information’s Global Energy Infrastructure (GEI) database has been tracking H2 projects globally for more than 2 yr. Since the database’s inception in early 2021, active H2 projects have increased more than 10-fold to nearly 1,300 (FIG. 1)—a nearly 380% increase in project announcements.

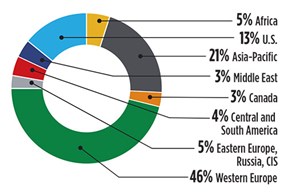

Most active projects are in Western Europe, followed by Asia and the U.S. (FIG. 2). These three regions account for 80% of active H2 projects globally, with Western Europe accounting for nearly 50% alone. In total, these projects represent a total capital expenditure of more than $1.13 T. Most projects—nearly 70%—are in the planning/proposed stage. The following is a breakdown of active H2 projects by status:

- Planning/proposed: 69%

- Feasibility study: 17%

- Front-end engineering design (FEED): 7%

- Under construction: 7%.

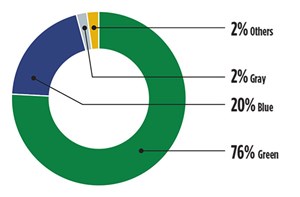

When broken down by production route, 76% are green H2 projects, followed by blue H2 pathways (FIG. 3).

As detailed in the individual regional reports of this analysis, hundreds of billions of dollars will be invested by the end of the decade—many of these projects will also contain an element of CCS or CCUS technologies to help limit emissions—to significantly boost wind and solar power generation capacity to fuel the massive amount of electrolyzers that will be put into operation over the same timeframe. The electrolyzer market has increased substantially over the past 2 yr. According to the IEA, total installed electrolyzer capacity eclipsed 1 GW in 2022, with projects in the pipeline that could increase installed capacity to 134 GW–240 GW by 2030.5

AFRICA

Most projects in Africa are centered in four countries: Egypt, Morocco, Namibia and South Africa. These four nations account for more than 70% of active projects in the region, with Egypt holding nearly 40% market share in active H2 projects. The following is a breakdown of active H2 project market share in Africa by country:

- Egypt: 38%

- South Africa: 13%

- Morocco: 11%

- Namibia: 9%

- Other: 29%.

Egypt has ambitious plans to become a green H2/ammonia production hub in the region—Egypt’s government has announced plans to capture 5% of the global H2 market by 2040.6 Most of these projects are being developed in the Suez Canal Economic Zone (SCZone). Since mid-2022, the SCZone has witnessed more than $50 B in green H2/ammonia project announcements. These investments include the production of blue and green H2, waste-to-H2, renewable power infrastructure (e.g., wind/solar farms) and green fuels.

Due to its location, South Africa can benefit greatly from renewable power production from wind and solar. The country plans use to its natural resources to decarbonize various industries within its borders, including power generation—South Africa presently relies on coal for approximately 80% of its electricity needs. In its Hydrogen Society Roadmap report, the government of South Africa identified 70 action plans to decarbonize the nation. These included pathways to decarbonize energy-intensive industries (e.g., cement, mining, steel, oil refineries) and heavy-duty transport; enhancing the nation’s power grid with green power; boosting the production of H2 production and fuel cell components; creating a green H2 export market; and increasing the role of H2 in various industries.

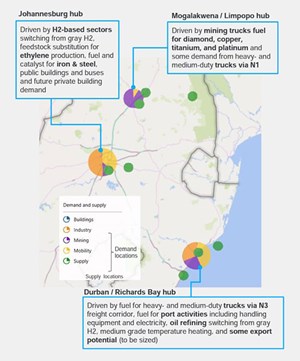

To increase the production of green H2, South Africa’s Department of Science and Innovation released the report South Africa Hydrogen Valley Final Report. This report detailed the potential development of three domestic H2 hubs—Johannesburg, Durban/Richards Bay and Mogalakwena/Limpopo (FIG. 4)—and various projects to decarbonize various industrial sectors and transportation.

Namibia also plans to utilize its sunny climate to increase H2 production—the nation sees more than 300 d/yr of sunshine. Namibia will utilize solar power to produce H2 for both domestic consumption and export. The country’s most capital-intensive project is being developed by Hyphen Hydrogen Energy. The company’s two-phase, $10-B project will produce green H2 that will be converted into green ammonia for export, primarily to RWE AG in Germany. The project could ultimately produce up to 1 MMtpy of green ammonia.

Namibia may also be the site of Africa’s first H2-powered power plant. HDF Energy is investing nearly $200 MM to develop a power station that is run on clean H2. Once operational in 2024, the plant will help the nation mitigate power imports from neighboring countries, primarily South Africa—Namibia imports approximately 40% of its power needs. These two projects will enable the country to satisfy domestic power needs, as well as become the region’s first nation to be both carbon neutral and start up a H2 power plant.

According to the country’s Green Hydrogen Roadmap, Morocco has ambitious plans to significantly boost domestic H2 production. Doing so will help the African country mitigate fertilizer imports and increase renewable energy capacity market share in its energy mix. Morocco’s goal is to increase its renewable energy market share from less than 40% in 2022 to 52% by 2030 and up to 80% by 2050. Additional solar and wind projects will provide the country with both clean electricity and feedstock for green ammonia production. Companies such as Total Eren and OCP are providing Morocco with more than $25 B in green H2/ammonia projects.

Although Egypt, Morocco, Namibia and South Africa account for most active H2 projects in the region, other African nations are investing in green H2/ammonia projects, as well. Mauritania has nearly $75 B in green H2 projects under development. These capital investments could lead to the production of nearly 10 MMtpy of green H2 by the early- to mid-2030s.

Other nations such as Algeria, Angola, the Democratic Republic of Congo, Djibouti, Kenya, Uganda and Zimbabwe have all announced plans, Memorandum of Understandings (MoUs) and/or strategies to increase H2 production capacity. These projects will help Africa significantly boost the production of renewable power, green H2 and clean ammonia/fertilizer production, increase clean energy exports to regions such as Europe and help domestic job creation, among other benefits.

ASIA-PACIFIC

Much like the rest of the world, many Asian countries are pursuing net-zero goals. Asia is home to five of the 10 largest CO2 emitting nations (China, India, Indonesia, Japan and South Korea).7 To combat CO2 emissions, many Asian nations have instituted pathways/programs to reach net-zero goals by the mid-century. Most of these initiatives include heavy investments in H2 production, H2 infrastructure and H2 fueling (e.g., road transport, marine shipping).

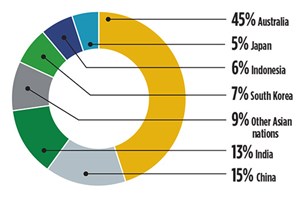

Active projects. The Asia-Pacific region accounts for 21% of active global H2 project market share. The region is investing more than $350 B in new H2 capacity and infrastructure over the next several years. At the time of this publication, the GEI database was tracking nearly 275 active H2 projects in the region. Australia accounts for nearly half of these projects, followed by China and India. A breakdown of active H2 project market share in Asia is shown in FIG. 5.

Although the Asia-Pacific region has announced many new H2 projects over the past few years, very few have reached a final investment decision (FID). In turn, more than 90% of the region’s H2 projects are in preconstruction phases, such as in feasibility studies, pre-FEED and FEED. Regardless, the region has allocated a substantial amount of capital to increase H2 production and infrastructure and boost its market share in electricity generation, transport, mining, shipping and within industrial processing operations, among others.

Australia. The island nation intends to become a major green H2/ammonia production hub for the Asia-Pacific region. Written in 2019, Australia’s National Hydrogen Strategy details nearly 60 joint actions that could propel the nation to be a leader in green H2 production. These include short-term initiatives such as advancing pilot projects, trials and demonstration projects; assessing supply chain infrastructure needs; and developing much-needed infrastructure for prospective H2 hubs in regions such as Kwinana, Gladstone, Pilbara and Whyalla, among several other locations. Australia’s long-term goals (i.e., from 2025) include scaling up operations, production and infrastructure to become a major player in regional and global H2 value chains.

However, since the country’s H2 strategy was developed several years ago, the Australian government is revising several aspects of the strategy to attract more investments into the sector. This announcement has come in light of the recent passage of the U.S. Inflation Reduction Act (IRA) and other nations around the world offering attractive tax breaks and subsidies to invest in renewables, green H2 production capacity and infrastructure in their respective countries. As of Q4 2022, the Australian government has allocated nearly AUD $530 MM (> USD $350 MM) of funding to various consortiums and companies to develop H2 projects/hubs domestically.

Despite stiff competition from other countries trying to attract H2 investments, Australia continues to be the leader in project development within the Asian region, accounting for more than $175 B in capital investments to 2035. These investments include major projects and hubs such as the nearly $70-B Western Green Energy Hub, the $36-B Asian Renewable Energy Hub, the $15-B Desert Bloom project, Fortescue Future Industries’ North Queensland Super Hub, the $10-B CQ-H2 project, and Sun Brillance’s Karrath and Murchison Hydrogen Renewables’ projects (each costing approximately $7 B), among several other multibillion-dollar projects that are under development in the country.

These projects will complement new H2 infrastructure under development in the country, including H2 fueling stations, blending with natural gas for electricity generation and for use to decarbonize domestic heavy industrial industries (e.g., mining, heavy-duty transport).

China. In 2022, China unveiled its H2 strategy to 2035. The country’s goals are to increase domestic green H2 production to 100,000 tpy–200,000 tpy by 2025, place 50,000 H2-fueled vehicles on the road within that timeframe and significantly build out H2 refueling centers within the country.8 Currently, China is the world's largest H2 producer; however, most of the nation’s H2 production is through coal gasification (i.e., gray H2), which is both energy and emissions intensive.

China has ambitions to increase green H2 production significantly as the cost of production decreases. The China Hydrogen Alliance forecasts Chinese H2 production to reach 35 MMtpy by 2030 and approximately 60 MMtpy by 2050.9

To reach these ambitious goals, the nation is significantly increasing capital investments in green H2 production projects. The GEI database is tracking more than $150 B in capital investments in China, with nearly 30 green H2 projects under development (FIG. 6). These projects, along with additional natural gas imports, will help China reduce coal-fired power generation, mitigate emissions and increase green ammonia production. They will also be complemented by additional H2 infrastructure—such as Sinopec’s west-to-east green H2 transmission pipeline from Inner Mongolia to cities in east China—and several partnerships to develop H2 refueling stations in major Chinese cities.

India. The government of India has announced plans to become energy independent by 2047 and achieve net-zero emissions by 2070. To help achieve these goals, India has unveiled its National Green Hydrogen Mission. Approved by the country’s cabinet in January 2022, India plans to achieve a green H2 production capacity of 5 MMtpy by 2030 and 125 GW of renewable energy capacity at a cost of nearly $98 B in capital investments.10 India’s government has also announced more than $2 B in incentives to jumpstart green H2 production projects in the country.11 This move is an effort to reduce the cost of green H2 production in India—at the time of this publication, green H2 production costs in India was 300 rupees/kg–400 rupees/kg ($3.66/kg–$4.89/kg)11—and attract additional investments domestically. The country has also extended its transmission fee waiver for renewable energy to green H2 plants commissioned before January 2031. This incentive could reduce the cost of inter-state transmission charges, reducing green H2 production costs by 1 rupee–2 rupees ($0.01–$0.02) per unit of power transmitted.12

At the time of this publication, India held the third-largest market share in active H2 projects in the region, with most of the country’s domestic projects under development through green H2 pathways (FIG. 7). These facilities will not only provide zero-carbon emitting H2 feedstock for India’s hydrocarbon processing sector (e.g., refineries, petrochemical plants) and hard-to-abate industries such as steel and cement manufacturing, it will also enable the country to replace ammonia imports for fertilizer production with domestic, green alternatives by 2035.13

Japan. At the time of this publication, the government of Japan was revising the nation’s H2 strategy. The island nation’s goals are to increase H2 supplies by 1 MMtpy to 3 MMtpy by 2030, to 12 MMtpy by 2040 and up to 20 MMtpy by 2050. To accomplish this pathway to carbon neutrality, Japan plans to invest $113 B in public and private sectors to create domestic H2 and green ammonia value chains. The additional H2 and green ammonia production/imports will enable the country to slash emissions from heavy processing industries and power generation. For example, Jera, Japan’s largest power producer, is studying the use of ammonia as a fuel to co-fire with coal at its power plants, and the country’s steelmaking industry is conducting research on using green H2 to power electric furnaces to make high-quality steel.

Japan’s Agency for Natural Resources and Energy has announced a two-prong approach to increase the development of clean H2/ammonia value chains domestically. The first strategy includes subsidies to clean H2 and ammonia producers (i.e., green and blue H2) to help make H2 production cost competitive against coal and LNG. The second prong includes a support scheme to build industrial clusters for the use of clean H2/ammonia.14

Other Asian nations. Many other Asian nations are investing in their domestic H2 production value chains. These projects include the production of both blue and green H2/ammonia production routes; H2 infrastructure buildouts; utilizing H2 and/or ammonia to decarbonize heavy industry, transportation and shipping; and power generation.

Indonesia has announced plans to become carbon neutral by 2060. To reach this goal, the nation plans to significantly boost the use of renewables in the country’s energy mix. The additional solar and wind capacity provides the country with both renewable power generation capabilities and feed for electrolyzers to produce green H2. The additional H2 and clean ammonia supplies will help Indonesia decarbonize its power generation sector—several power generating firms are now testing co-firing of H2 and ammonia in their natural gas and coal-fired power plants—and create a regional ammonia production/export hub.

Although South Korea’s H2 ecosystem is currently based on gray H2 production routes, the government has created a pathway to increase green/blue H2 production to help decarbonize the country’s economy. According to South Korea’s Ministry of Trade, Industry and Energy (MTIE), the country has three major growth strategies to build out a domestic clean H2 supply chain: Scale-Up, Build-Up and Level Up.15 The following is a breakdown of each segment of this program (known as 3UP) according to South Korea’s METI:

- Scale-Up: This strategy includes expanding clean H2 demand domestically for power generation and transportation, increasing the deployment of H2-fueled heavy-transport vehicles (e.g., buses, heavy-duty trucks)—METI has announced an action plan to produce 30,000 H2-fueled commercial vehicles by 2030—and developing large-scale H2 production bases outside South Korea.

- Build-Up: This strategy focuses on developing a legal framework and building an installed asset base for H2 distribution infrastructure (e.g., H2 fueling stations, pipelines, H2/ammonia receiving terminals). For example, one of METI’s action plans is to build 70 liquid H2 fueling stations by 2030. The Build-Up plan also includes opening a H2 bidding market, H2 business laws and a clean H2 certification system.

- Level Up: This program focuses on advancing and optimizing technical innovation in the country’s H2 value chain and lifecycle from production to distribution.15

CANADA

In late 2020, the government of Canada released the Hydrogen Strategy for Canada, which detailed the role H2 will play in the region’s 2050 net-zero ambitions.

According to the report, Canada is targeting H2 to deliver up to 30% of the region’s end-use energy by 2050—this would increase domestic H2 demand to 4 MMtpy by 2030 and up to 20 MMtpy by 2050. The strategy is based on eight pillars—strategic partnerships, de-risking investments, innovation, codes and standards, enabling policies and regulations, awareness, regional blueprints, and international markets—that will ultimately lead to Canada’s H2 vision for 2050 (FIG. 8).

To increase H2 production, Canada plans to use mixed pathways. These pathways include electrolysis (green H2), fossil fuels (blue H2, which will include CCS or CCUS), gasification of biomass (green H2) and production as a byproduct from industrial operations. These routes will enable Canada to decarbonize several industrial sectors, including transportation (the nation plans to have more than 5 MM fuel-cell EVs on the road by 2050), mining, manufacturing, power, as well as utilizing H2 as a feedstock for the refining and chemical processing industries.

At the time of this publication, the GEI database was tracking more than 40 H2 projects in the region. At 32%, the province of Alberta holds the highest market share in active H2 developments. Alberta is followed by British Columbia (22%), Quebec (16%), Ontario (14%), Nova Scotia (8%), and Newfoundland and Labrador (7%), with other provinces accounting for 1%.H2T

LITERATURE CITED

1 UN, “Climate action,” accessed April 27, 2023, online: https://www.un.org/en/climatechange/net-zero-coalition

2 Bermudez, J. M., S. Evangelopoulou and F. Pavan, “Hydrogen: Energy system overview,” September 2022, online: https://www.iea.org/reports/hydrogen

3 IRENA, “Global hydrogen trade to meet the 1.5°C climate goal: Part 1—Trade outlook for 2050 and way forward,” 2022, online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jul/IRENA_Global_hydrogen_trade_part_1_2022_.pdf

4 bp, Energy Outlook 2023, 2023, online: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/hydrogen.html

5 Bermudez, J. M., S. Evangelopoulou and F. Pavan, “Electrolysers: Technology deep dive,” IEA, September 2022, online: https://www.iea.org/reports/electrolysers

6 Lewis, A., “Egypt signs framework deals in bid to launch hydrogen industry,” November 15, 2022, online: https://www.reuters.com/world/middle-east/egypt-signs-framework-deals-bid-launch-hydrogen-industry-2022-11-15/

7 Crippa, M., et al., “CO2 emissions of all world countries,” European Commission, Joint Research Center science for policy report, 2022, online: https://publications.jrc.ec.europa.eu/repository/handle/JRC130363

8 IEA, “China Hydrogen Industry Development Plan (2021–2035),” January 2023, online: https://www.iea.org/policies/16977-hydrogen-industry-development-plan-2021-2035

9 Nakano, J., “China unveils its first long-term hydrogen plan,” March 28, 2022, online: https://www.csis.org/analysis/china-unveils-its-first-long-term-hydrogen-plan

10 Government of India, National Green Hydrogen Mission, online: https://www.india.gov.in/spotlight/national-green-hydrogen-mission#:~:text=The%20National%20Green%20Hydrogen%20Mission,Green%20Hydrogen%20and%20its%20derivatives

11 Singh S. C., “India Oks $2 bln incentive plan for green hydrogen industry,” Reuters, January 4, 2023, online: https://www.reuters.com/business/environment/india-approves-2-billion-incentive-plan-green-hydrogen-industry-2023-01-04/#:~:text=NEW%20DELHI%2C%20Jan%204%20(Reuters,information%20minister%20said%20on%20Wednesday.

12 Singh, S. C., “India extends transmission fee waiver for green hydrogen plants,” Reuters, April 11, 2023, online: https://www.reuters.com/business/sustainable-business/india-extends-transmission-fee-waiver-green-hydrogen-plants-source-2023-04-11/#:~:text=The%20inter%2Dstate%20transmission%20charges,0.73)%2C%20the%20official%20said.

13 Martin, P., “China and India take diverging paths in green hydrogen transition,” Hydrogen Economist, April 26, 2023, online: https://pemedianetwork.com/hydrogen-economist/articles/strategies-trends/2023/china-and-india-take-diverging-paths-in-green-hydrogen-transition/

14 Komachi, H., S. Neilson and M. Voss, “Japan unveils green subsidy programme—Can it compete with the U.S. Inflation Reduction Act?” JDSupra, April 11, 2023, online: https://www.jdsupra.com/legalnews/japan-unveils-green-subsidy-programme-6441356/

15 South Korea METI, “Government announces new policies to boost hydrogen industry,” November 11, 2022, online: http://english.motie.go.kr/en/pc/pressreleases/bbs/bbsView.do?bbs_cd_n=2&bbs_seq_n=1120