Articles

Doubling down on progress to make the H2 ecosystem a reality

H2 Storage

K. ROCKAWAY, Mitsubishi Power Americas, Orlando, Florida

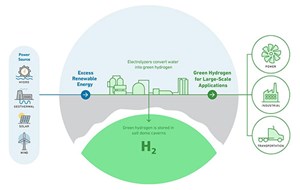

We are close to achieving large-scale energy storage and power generation with clean hydrogen (H2)—yet so far away simultaneously. Clean H2 holds the promise of a zero-carbon fuel with affordable, long-duration storage. It can help decrease reliance on fossil fuels and ensure resource adequacy during the months when renewable supply is unable to meet demand. It is the right choice for our time, as we can use today’s curtailed wind and solar power to electrolyze water into green H2, utilizing the real-time oversupply of H2 and storing it for future use.

However, visualizing when our H2 future becomes a full-fledged reality is challenging, even for the most informed energy stakeholders. Bold and comprehensive planning is needed to expand clean H2’s role significantly, and the scale of necessary changes can affect our depth perception. Indeed, that future can still feel decades away.

However, what is clear is that many of the building blocks are already present. Electrolysis dates back more than 200 yr, closely followed by the first H2 fuel cells producing energy through electrochemical means a few decades later.1,2 A promising location to store H2, underground salt caverns, has been used for natural gas since the 1960s.3

Our speed to a H2 society depends on how much we advance and accelerate existing building blocks, but the quick wins must be leveraged even as we take a long view on the progress.

The quick wins. It is instructive to separate a H2 economy into its major components: production, storage, transportation and usage. Transforming the entire value chain is a vast undertaking that requires public and private partnerships, likely decades in the making. However, it is easier to see the meaningful near-term impact across these smaller pieces.

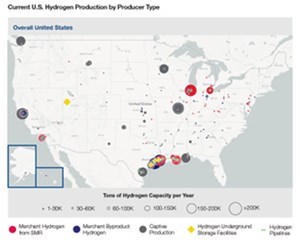

According to government data compiled by the Energy Futures Initiative, the U.S. produced roughly 1.3 quadrillion Btus of H2 on an energy basis in 2021, or about 1% of the country’s total energy production, largely from steam methane reformation (SMR) (FIG. 1).4,5

For renewable-powered electrolysis to overtake SMR as the predominant form of H2 production, electrolyzer manufacturing must expand orders of magnitude beyond current capacity. However, the basic technology is already here. Additional manufacturing resources and innovation are needed to automate the processes to realize increased production capacity.

Of course, that is easier said than done. Getting suppliers to build gigawatts (GW) of electrolyzer capacity will require more than a handshake and a leap of faith. This will require contracts and capital. Pricing volatility (e.g., shipping and commodities) can undermine even the most steadfast partnerships, especially in an industry where project financing requires price surety for mos or yr to come.

Then comes the broader supply chain. Much of the global electrolyzer manufacturing occurs in China across a relatively small supplier base. As the U.S. tries to reestablish domestic supply chains, tariffs on imported Chinese goods could raise unit costs and introduce additional volatility.

Despite this, higher-volume orders are moving ahead. In April 2022, a contract to supply 40 H2 electrolyzers for a single facility was awarded. This is one of the largest such contracts to date and could double the annual production levels of clean H2 worldwide.

Clean H2 is historically higher priced than H2 derived from natural gas, although fluctuations in gas prices can periodically shift that calculus.6 However, with larger orders pumping revenue into the supply chain, economies of scale can emerge to drive down pricing for green H2 in the long term. Thanks to the U.S. Inflation Reduction Act (IRA), clean H2 could become the cheapest form of H2.

As with H2 production, H2 storage also has quick-win potential. Underground capacity is currently the best option, with salt caverns being especially promising due to their general impermeability. Significant potential exists for storage in available capacity near traditional infrastructure concentrations used for other fuels (e.g., the U.S. Gulf Coast) or in untapped salt reserves away from such infrastructure.

The Advanced Clean Energy Storage Hub in Delta, Utah (ACES Delta Hub) is a utility-scale H2 production and storage hub in the U.S.7,8 The ACES Delta Hub is under construction and on track to produce approximately 9 MM barrels (MMbbl) of capacity that will be stored in underground salt caverns. Each cavern is the height of the Empire State Building, and these caverns have initial storage targets of 150 gigawatt-hours (GWh) of clean energy. H2 production will come from 220 megawatts (MW) of onsite alkaline electrolysis (FIG. 2).

In 2021, a H2 storage partnership was formed through a network of 13 salt holdings around the Gulf Coast, Virginia and New York.9 Creating approximately 15 MMbpy of capacity across all operations, it leases the resulting space to store crude oil, natural gas and natural gas liquids (NGLs). That roster will now include H2.

Powering ahead on H2 storage has ancillary benefits. Stakeholders will want to scale up all phases of green H2 projects—production, storage, transportation and usage—to avoid an imbalance of resources and capital. For example, large storage assets provide some buffer for building transportation and usage components. If demand for H2 does not match up perfectly with supply, caverns can serve the critical function of balancing and storing energy in the near term, enhancing the reliability of the broader system. Again, these are quick wins. We must leverage them even as we take a longer view of progress.

The longer view. Across the board, some aspects require a longer horizon, such as supply-chain development. Project activity increased after the IRA passed in 2022, but the timelines can run up against supply disruptions, especially if mitigations are not built in. Stakeholders will need years to develop a new domestic supply chain that is cost-competitive and flexible enough to expand capacity with the market.

Furthermore, there is the broader challenge of H2 usage. H2 is already used to generate electricity, but mostly in electrochemical fuel cells with nominal outputs. Power plants that use H2 fuel cells in the U.S. max out at 25 MW of capacity per facility.10 Conversely, a natural gas facility like Georgia Power’s Plant McDonough-Atkinson, just outside Atlanta, Georgia, produces 2.52 GW from three combined-cycle units.11 During testing on a natural gas turbine, a 20% H2 blend was verified. The test reduced CO2 emissions by roughly 7%.12 Moving green H2 into these domains—as a fuel, not a reactive element—is the key to realizing its full potential.

Broadly implementing large-scale power generation through H2-fueled turbines would be a first for the energy sector, but it will require progressive technological advancements. According to the Electric Power Research Institute, getting to a H2 economy that provides H2 into gas turbines for low- or no-carbon emissions will require many technological advancements. Still, these advancements appear achievable because several original equipment manufacturers and third-party vendors are working on viable options.13

The viability of those options may hinge on how well energy infrastructure is advanced. For example, the Intermountain Power Agency (IPA) will replace two coal units at the Intermountain Power Plant (IPP) with natural gas-fed turbines that will run a 30% H2 blend. Similar power generation is under development elsewhere, with projects slated to come online by the late 2020s. As blending and turbine technologies progress, the IPA plans to transition to 100% H2 by 2045.

The longer view may be decades out, but decarbonization can still be driven in the near term. The IPA intends to replace its powertrains, which will cut carbon emissions by more than 75, all while supplying 840 MW of reliable energy.14 When IPP transitions to 100% H2 fuel, carbon emissions will diminish entirely.

At Takasago Machinery Works in Japan, there is a center to validate H2-related technologies. The facility will test the combustor for its large-frame gas turbine on 100% H2. Production and storage technologies will also be examined, including electrolysis, methane pyrolysis (producing a solid-carbon byproduct that can be scavenged), above-ground H2 storage and short-duration electricity storage (FIG. 3).

It is still early. The long view requires an embrace of public partnerships. The IRA is an example of what works, having vastly improved the economics of producing green H2 for various applications, such as refining, transportation, energy exports and other industrial applications. From changing the tax code to favor a technology-neutral approach to adding credits for H2 production and standalone energy-storage investments, the IRA will enable H2 to compete on a level playing field with other clean energy technologies.

For these incentives to be most effective, we need other changes in the landscape. For example, the IRA provides a 10-yr horizon for regulatory certainty, but the time it takes to permit new projects can significantly cut into this timeframe. The 118th U.S. Congress has already hit the ground running on permitting reform, a critical parallel if we want to realize the IRA’s benefits for clean energy production fully. We will need to see ongoing collaboration between government agencies to ensure consistent application of these tax provisions. Finally, we must adapt existing infrastructure to use H2 so we can efficiently use the capital invested in power generation over the past decades.

We are still in the early stages of clean H2 energy. Much more regulatory action, commercial projects, permitting reform and scalable production is required. We need to spur more investment to drive down costs and accelerate research. Focusing on the long view is vital even as we execute quick wins and achieve near-term impact. If enough stakeholders collaborate and join the movement, we can realize the enormous potential of Earth’s lightest molecule to help accelerate the transition to net zero.H2T

LITERATURE CITED

1 U.S. Department of Energy Office of Scientific and Technical Information, “Overview of geologic storage of natural gas with an emphasis on assessing the feasibility of storing hydrogen,” September 2009, online: https://www.osti.gov/biblio/975258

2 Fuel Cell Works, “History,” online: https://fuelcellsworks.com/knowledge/history/

3 Sandia National Laboratories, “Overview of geologic storage of natural gas with an emphasis on assessing the feasibility of storing hydrogen,” online: https://www.osti.gov/servlets/purl/975258

4 Energy Futures Initiative, “The U.S. hydrogen demand,” February 2023, online: https://energyfuturesinitiative.org/wp-content/uploads/sites/2/2023/02/EFI-Hydrogen-Hubs-FINAL-2-1.pdf

5 Office of Energy Efficiency & Renewable Energy, “Hydrogen production: Natural gas reforming,” online: https://www.energy.gov/eere/fuelcells/hydrogen-production-natural-gas-reforming

6 Clean Energy Wire, “Rising gas prices make green hydrogen cheaper than grey hydrogen,” April 2022, online: https://www.cleanenergywire.org/news/rising-gas-prices-make-green-hydrogen-cheaper-gray-hydrogen

7 U.S. Department of Energy, “Advanced clean energy storage,” June 2022, online: https://www.energy.gov/lpo/advanced-clean-energy-storage

8 ACES Delta, “Delivering hydrogen, driving clean energy for the western U.S.,” online: https://aces-delta.com/about-us/

9 Mitsubishi Power Americas, “Mitsubishi Power and Texas Brine join forces on large-scale hydrogen storage solutions to support decarbonization efforts in the eastern United States,” May 2021, online: https://power.mhi.com/regions/amer/news/20210512.html

10 U.S. Energy Information Administration, “Hydrogen explained,” January 2022, online: https://www.eia.gov/energyexplained/hydrogen/use-of-hydrogen.php

11 Georgia Power, “Plant McDonough-Atkinson,” online: https://www.georgiapower.com/company/energy-industry/generating-plants/mcdonough-atkinson.html

12 Mitsubishi Power Americas, “Mitsubishi Power, Georgia Power, EPRI complete world’s largest hydrogen fuel blending at Plant McDonough-Atkinson,” June 2022, online: https://power.mhi.com/regions/amer/news/20220610

13 Electric Power Research Institute, “Taking gas turbine hydrogen blending to the next,” September 2022, online: https://power.widen.net/s/f8cmpbzmjv/epri-report-mcdonough-hydrogen-blending-validation-september-2022

14 Mitsubishi Power Americas, “Intermountain Power Agency orders MHPS JAC gas turbine technology for renewable-hydrogen energy hub,” March 2020, online: https://power.mhi.com/regions/amer/news/200310.html