Articles

From benchtop to prototype: The discovery and development of novel catalysts for electrolyzers

Electrolyzer Technology

M. MAZZA, H2U Technologies, Los Angeles, California

As a carbon-free fuel capable of cleaning up many hard-to-abate sectors of the global economy, hydrogen (H2) will play an important role in future energy systems. Scaling the industry to meet the growing demand for clean H2 requires a rapid increase in manufacturing technologies that produce, transport, store and use this carbon-free fuel. One of these key technologies is the electrolyzer, a device that can produce green H2 from renewable electricity and water inputs. Proton exchange membrane (PEM) electrolyzers pair well with intermittent electricity sources (e.g., wind, solar). However, the PEM electrolyzer industry faces a significant barrier to scale: its reliance on rare, expensive iridium catalyst materials. Discovering alternative catalyst materials and implementing them in commercial settings will be key to relieving this bottleneck, allowing the H2 industry to grow to meet demand.

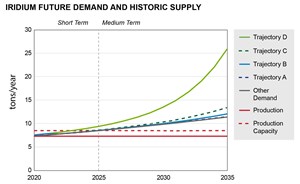

Iridium constraints. All commercially available PEM electrolyzer systems rely on iridium catalysts. Iridium is one of the scarcest elements on earth, with global production values of around 8 tons per year (tpy)–10 tpy (FIG. 1). If ~2 tpy could be shifted to a growing application like PEM electrolysis and at a conservative iridium loading of 0.25 kilogram (kg)/megawatt (MW) of electrolyzer capacity, iridium supply would constrain PEM electrolyzer manufacturing to approximately 8 gigawatts (GW)/yr.

By 2030, the International Energy Agency (IEA) anticipates a 170-GW/yr manufacturing capacity to achieve its net-zero emissions scenario.1 Iridium constraints would limit PEM electrolyzer production to approximately 5% of the necessary capacity. Because of its scarcity, iridium is also subject to high price volatility, as seen in the recent past, when prices rose to more than $6,000/ounce (oz) in early 2021.2 Other growing industries—such as the 5G smartphone market—rely on iridium, putting further strain on an already constrained supply. Innovative solutions are necessary to alleviate this constraint on the PEM electrolyzer industry.

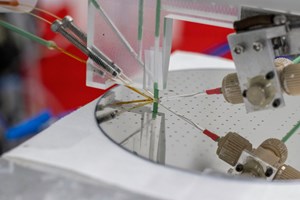

Discovering non-iridium materials. One solution to green H2’s iridium problem is diversifying the catalyst supply chain by discovering and developing alternative, iridium-free materials. Scientists have long acknowledged the iridium problem and are actively researching solutions in academic environments. Several potential catalyst alternatives have been discovered in laboratory settings. However, realizing a commercial product requires performance improvements of non-iridium materials and technique developments to incorporate and test materials in relevant environments. Improved, high-throughput techniques to rapidly scan large materials spaces will identify novel materials that can approach iridium in terms of catalyst performance (FIG. 2). Rigorous testing procedures that span from laboratory benchtop experiments through testing in applicable environments are the missing links to translating these promising materials into viable commercial products.

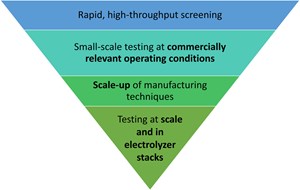

A thoughtful catalyst discovery and development process must be efficient and timely without sacrificing thoroughness. Achieving this goal requires a multi-step approach where each step brings the testing conditions closer to what would be seen in a commercial environment.

Discovery and testing process. The top of the flowchart in FIG. 3 is a broad search to ensure that promising materials are not missed in the initial screening. Once a material passes this phase, it must integrate into membrane electrode assemblies (MEAs) and validate at higher operational current densities over longer time periods and during on/off cycling to ensure compatibility with variable electricity inputs. Each step is important to ensure the successful transition into a commercial product. Leveraging a “funnel” approach strikes a strategic balance. While the search begins broadly enough to ensure promising materials are not missed, it progressively narrows down, focusing on the best candidates. This methodological selection process optimizes resource allocation, channeling efforts and investments toward catalysts with the highest potential for commercial success.

The first step in this catalyst discovery and development process is high-throughput screening. The combinatorial space of possible catalyst elemental compositions and crystalline structures is vast, so rapid and targeted exploration is critical to reaching catalyst performance goals in the near term. In this initial testing phase, a rapid, high-throughput approach is best, as it minimizes time wasted on poor-performing materials and accelerates the discovery process.

The author’s company’s approacha enables scientists to make, characterize and quantify the catalytic activity of novel catalyst materials 10,000x faster than traditional methods. This initial screening step is done at a small scale and at lower current densities than would typically be seen in commercial operations. These adjustments from operational conditions allow for the speed necessary at this stage to rapidly find catalyst “hits.”

Once a catalyst passes this initial step, the focus shifts from the laboratory environment to the operational demands of real-world settings. The first step in testing begins with the synthesis of catalyst nanoparticles, ink preparation and integration into small-format (5 cm2–25 cm2) MEAs. The materials are then rigorously evaluated at catalyst test stations at higher operational current densities [1 ampere per square centimeter (A/cm2)–2 A/cm2] and under power cycling to evaluate how they will perform with variable electricity inputs such as wind and solar. Supportive diagnostic tools are leveraged to measure the dissolution of catalyst material into the electrolyte during operation, potential changes in cell resistance due to non-catalyst contributions, loss of material and/or changes in uniformity before and after testing.

If materials perform well under these conditions, they undergo long-term durability testing over thousands of hours in small-format test stations. Simultaneously, the team develops techniques to scale up integration processes and tests in large-format cells and stacks. The initial high-current screening and power cycling may provide scientists with enough confidence to move forward with additional scale-up, but durability testing is necessary to ensure successful operation in the field. Scaling to large-format testing involves developing new techniques to fabricate large-format MEAs and evaluating the evenness of coating across a single sample, and from sample to sample, using quantitative mapping techniques. After developing and validating methods, testing procedures in the large format are similar to those in the small format. At this stage, scientists can identify and resolve performance losses from the small format to the larger format that may be due to scaled-up integration methods. After the materials have been rigorously validated in large-format cells and stacks, they are ready to be deployed in commercial products.

Takeaway. Systematic, timely and efficient catalyst discovery and development processes are necessary to successfully implement novel catalyst materials in commercial settings. By employing a methodological approach, scientists reduce the delay between the initial discovery and the final implementation. This multi-step process allows for strategic resource allocation to focus time and money on the materials that are most likely to succeed. Furthermore, by putting each material through the same steps, scientists can apply lessons from one catalyst to future iterations. Viable alternatives to iridium must be discovered and implemented in commercial settings if PEM electrolyzer manufacturing is to scale to meet the demand for green H2.H2T

NOTE

a H2U Technologies’ Catalyst Discovery EngineTM

LITERATURE CITED

1 IEA, “Global hydrogen review 2023,” September 2023, online: https://iea.blob.core.windows.net/assets/ecdfc3bb-d212-4a4c-9ff7-6ce5b1e19cef/GlobalHydrogenReview2023.pdf

2 S&P Global Commodity Insights, “Iridium hits all-time high of $6,000/oz on supply issues, strong demand,” March 2021, online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/metals/031921-iridium-hits-all-time-high-of-6000oz-on-supply-issues-strong-demand

About the authors

MICHAEL MAZZA is the Director of Catalyst Engineering at H2U Technologies. Dr. Mazza joined H2U Technologies in September 2021, commissioning the catalyst discovery engine (CDE) and translating the CDE results to full cell testing. Prior to joining H2U Technologies, he received his PhD in chemistry from the California Institute of Technology, studying the surface chemistry of nanomaterials.