Articles

H2 shipping and market expansion in Europe, South Korea and Japan

Editorial Comment

TYLER CAMPBELL, Managing Editor

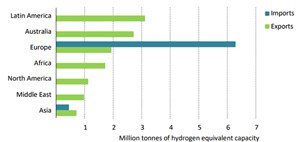

According to the International Chamber of Shipping, the heavy industry sector will dominate global hydrogen (H2) demand up to 2050, beginning with the South Korean, Japanese and European markets.1 Transporting energy commodities has long been a cornerstone of maritime shipping, which handles 36% of global primary energy. The expansion of H2 and H2-based fuel trade is expected to significantly support the global H2 economy by enabling access to lower-cost production and improving energy security (FIG. 1).

This shift will facilitate a faster transition to a net-zero economy and address potential supply bottlenecks in high-demand areas. Maritime infrastructure will be crucial for connecting H2 demand centers, such as Japan and South Korea, with suppliers like Australia.1 Global H2 trade could generate $460 B in annual benefits by 2050, primarily through reduced capital (CAPEX) and operational costs (OPEX). However, challenges such as high freight costs and legal issues might influence shifts in the value chain, potentially relocating certain industries to areas with better H2 production conditions. For example, the production of ammonia, which is essential for fertilizers, could be impacted.

H2 is important to much of Western Europe due in large part to its role in the chemical industry. This region provides substantial contributions to global chemical and pharmaceutical markets. Ports such as Amsterdam, Rotterdam, Antwerp and Zeebrugge are crucial to the trade of crude oil, coal and liquified natural gas (LNG), and are positioning themselves to be important H2 hubs.

Northwest Europe (Denmark, France, Norway and the UK) consumed an average of 6.3 million tons per year (MMtpy) of H2 over the past decade, accounting for about 5% of global and 60% of European demand.1 The demand is primarily driven by the refining and chemical industries, with around 40% of Germany's H2 used for refining. The region's major demand sources include ammonia production and refineries, while other industries and new applications contribute less.

By 2030, South Korea plans to consume 3.9 MMtpy of H2, with more than half of it coming from imports. This will require 79 terawatt-hours (TWh) of electricity and between 19 gigawatts (GW) and 25 GW of electrolyzing capacity. By 2050, the country aims to produce 5 MMtpy of H2 (3 MMtpy of green H2 and 2 MMtpy of blue H2) and import 23 MMtpy. This will escalate electricity demand to 851 TWh and require 203 GW–266 GW of electrolyzing capacity.2

South Korea plans to advance H2 logistics by developing liquid H2 carriers, cryogenic H2 storage and solid H2 for energy storage and transport. By 2030, the country will introduce tank lorries for liquid and liquefied H2 and develop H2 pipelines, starting with major sources and eventually expanding to a nationwide network.

Japan is expected to become the second-largest market for H2 imports, following South Korea. Currently, Japan uses around 2 MMtpy of H2, predominantly for oil refining (70%), with the remainder used for ammonia and methanol production.

The Japanese government’s Basic Hydrogen Strategy, updated in 2023, shows that Japan intends to domestic H2 consumption to 12 MMtpy by 2040 and 20 MMtpy by 2050.3 The key sectors for H2 use will be power generation (5 MMtpy–10 MMtpy), steel production (7 MMtpy) and transportation (6 MMtpy).

Japan’s Green Growth Strategy plans for renewables to supply 50%−60% of electricity by 2050, with the rest provided by nuclear, thermal plants with carbon capture, and H2/ammonia-fueled generation. By 2030, H2 and ammonia are expected to make up 1% of the primary energy mix and electricity supply. Japan also aims to co-fire fossil fuels with ammonia and to commercialize ammonia-fueled power by 2050.

The global H2 market is on a trajectory of rapid expansion, driven by the need for cleaner energy sources and supported by strategic investments in infrastructure and technology. As Europe, South Korea and Japan advance their H2 agendas, their efforts will be crucial in shaping the future of global energy. H2T

LITERATURE CITED

1 International Chamber of Shipping, “Turning hydrogen demand into reality: Which sectors come first?” July 2024, online: https://www.ics-shipping.org/wp-content/uploads/2024/07/Turning-Hydrogen-Demand-Into-Reality-Which-Sectors-Come-First.pdf

2 Australia’s National Science Agency, “Hydrogen RD&D collaboration opportunities: The Republic of Korea,” January 2022, online: https://explore.mission-innovation.net/wp-content/uploads/2023/03/H2RDD-Korea-FINAL.pdf

3 New Zealand Foreign Affairs & Trade, “Japan: Hydrogen strategy – November 2023,” November 2023, online: https://www.mfat.govt.nz/en/trade/mfat-market-reports/japan-hydrogen-strategy-november-2023#:~:text=The%20Hydrogen%20Strategy&text=Japan's%20revised%20strategy%20intends%20to,hydrogen%20six%20fold%20by%202040.