Articles

Spain could achieve its ambitious goal of 12 GW of electrolysis by 2030

H2 Hubs and Infrastructure

M. HOLGADO, Spanish Hydrogen Association (AeH2), Madrid, Spain

In 2024, important progress was made in the hydrogen (H2) sector in Spain. The revised version of the National Energy and Climate Plan (NECP, or PNIEC in Spanish) was released, significantly increasing ambitions for renewable technologies. The role of renewable H2 stands out, with ambitious goals for 2030 that include:

- Achieving 12 gigawatts (GW) of installed electrolysis capacity (the previous goal was set at 4 GW in the “Renewable H2 Roadmap” published in 2020)

- A target of 74% renewable fuel of non-biological origin (RFNBO) for industrial H2 consumption [elevating the target from the mandatory 42% set by the European Commission’s Renewable Energy Directive III (RED III)]

- A target of 17.26% of advanced biofuels and RFNBO consumption in the transport sector.

Additionally, Spain aims to achieve a 100% renewable electricity grid by 2050, with an intermediate goal of 81% in 2030.

For several years, Spain has been enthusiastic and had high expectations about the role that renewable H2 would play in the energy transition and the decarbonization of the country’s economy. However, as projects continue scaling-up, most struggle to reach a final investment decision (FID), and news spreads of projects being postponed or even cancelled.

These news stories do not mean the end of H2 but are merely part of the maturation process the sector is experiencing—this is characteristic of any emerging industry. The market is acting as a natural selection mechanism, highlighting technologically and economically viable initiatives and projects that stand as fundamental pillars of H2's future as an energy vector. This process simultaneously allows the clear identification of the challenges that remain, setting the priorities for Spain to focus on in 2025 to continue leading this transformation and maximizing H2's positive impact on the global energy transition.

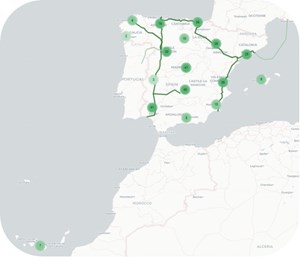

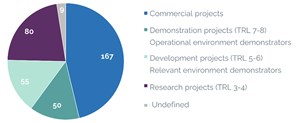

The AeH2 tracks all H2 projects that its members lead or participate in (FIG. 1). The 2024 update of the censusa shows that Spain has 361 projects at different development stages across the entire H2 value chain, with a technology readiness level (TRL) of 3 or higher. The growing interest in renewable H2 has led to initiatives from research to large-scale commercial projects.

While Spain is in the spotlight for its potential to produce cheap renewable H2 due to the country’s renewable energy resources, the 80 research and development (R&D) projects (TRL 3-4) and more than 100 demonstrators (TRL 5-8) gathered in the censusa show that Spain also has excellent technological capabilities. As a country, Spain could be a great H2 producer and a major H2 technology developer. All four main electrolysis technologies [alkaline, proton exchange membrane (PEM), solid oxide electrolysis cell (SOEC) and anion exchange membrane (AEM)] are being researched by Spanish companies, research centers and universities, which are also examining various H2 applications in industry, mobility and the production of derivatives.

The censusa also presents 167 commercial projects that could reach 13.6 GW of installed electrolysis capacity by 2030, aligning with national objectives. However, the country’s real potential is even greater: if all registered projects were to be executed (including projects in the early stages of development that do not yet have an expected date of entry into operation), Spain could achieve up to 23 GW of installed capacity, solidifying its position as a global leader in renewable H2 development (FIG. 2).

To achieve this outstanding potential, the country will need time—Spain only has 31 megawatts (MW) of electrolyzers in operation and most of the projects tracked in the censusa are in early development stages. The barriers that project promoters are facing must also be reduced or eliminated. A recent report includes an annex list, prioritizing the barriers to completing projects after surveying the AeH2’s members.1 The responses classify securing the offtake as the main barrier to FIDs, followed by insufficient public funding, and an unclear and complex normative framework.1

To solve these challenges, the country must focus on stimulating demand, promoting public support to the entire H2 value chain, accelerating the transposition of RFNBO targets set in RED III and reducing complex bureaucracy in project permitting.

The Spanish government strongly supports H2, which is proved by the €3 B from the Recovery and Resilience funds that it has devoted to developing H2 technologies and deploying projects in Spain, through several calls for investment in the last 3 yr. Six calls supporting pioneer H2 projects and H2 value chain development initiatives laid the foundation for public support to the sector in Spain. In the last quarter of 2024, a H2 valleys call opened with a €1.2-B budget to promote the large-scale production and consumption of renewable H2 through the creation of new H2 valleys or clusters. The country is eagerly expecting its resolution (1Q 2025), as it will contribute to drive the H2 ecosystem in Spain and decarbonize key sectors (FIG. 3).

Another important portion from the €3-B budget will support Spanish Important Projects of Common European Interest (IPCEIs): four in the first wave (Hy2Tech), seven in the second (Hy2Use) and two in the last wave (Hy2Move). These IPCEIs will provide a decisive boost to the sector, not only for Spain but at a continental level, enhancing industrial and technical capacities, and helping promote Spain as a central player in the European H2 landscape. Furthermore, the country achieved recognition at the first European Hydrogen Bank auction: 46 out of the 130 proposals received were located domestically, and three out of the seven winning projects were Spanish.

Finally, Spain's adherence to the auction as a service mechanism for the second call of the European Hydrogen Bank, with an allocation of €280 MM─€400 MM, reaffirms the country’s commitment to solidifying its position as a leader in renewable H2 production in Europe. This step will not only contribute to achieving the objectives of the EU’s Net-Zero Industry Act, but will also strengthen Spain’s positioning as a global reference in the energy transition, driving strategic projects with high economic, technological and environmental impact.

Takeaways. The progress made throughout 2024 has not only clarified the path Spain must follow as a country in this new year, but it has also underscored the immense potential of our technological and industrial capabilities, and the ambition of our administrations and international organizations, reflected in concrete initiatives. However, this progress has also highlighted the barriers that remain to be overcome. Consolidating renewable H2 as a pillar of the energy transition requires continued determination to break down these barriers and ensure the sustainable and competitive development of this key industry for the energy transition.

As 2025 begins, it is essential that Spain focuses its efforts on accelerating renewable H2 development. Projects must reach their FID and become operational as quickly as possible if the country wants to achieve the goals set by the NCEP. To do so, Spain must redirect support toward measures that consolidate demand and establish a clear and stable regulatory framework that instills confidence in the sector. Spain has the necessary capabilities to lead this emerging market, but like any industry in the process of consolidation, time, a firm commitment to innovation and a shared vision between the public and private sectors will be required. With optimism and determination, Spain can tackle the challenges ahead, achieve the established objectives and seize this unique opportunity to decarbonize key sectors and advance the energy transition. H2T

NOTE

a AeH2’s Hydrogen Project Census

LITERATURE CITED

1 AeH2, “Analysis of AeH2’s 2024 Project Census,” November 2024, online: https://aeh2.org/wp-content/uploads/2025/01/Main-insights-from-AeH2-Census-of-Projects-2024.pdf

About the author

MARINA HOLGADO is a chemical engineer and energy engineer with an MSc degree in renewable energies, fuel cells and H2. She started working in the hydrogen sector in 2018 at the Spanish SME ARIEMA Energía y Medioambiente as an engineer, H2 consultant and technical support to the Spanish Hydrogen Association. From 2020─2023, Holgado worked as the coordinator of the International Energy Agency Hydrogen Technology Collaboration Programme (IEA Hydrogen TCP). Holgado is the Technical Director of AeH2.