Articles

Is decentralization key to unlocking H2 in public transport?

Special Focus: H2 Mobility, Pipelines and Transportation

A. PUSCEDDU, IMI Remosa, Cagliari, Italy

The challenges and opportunities around hydrogen (H2) fuel are well known. Even casual observers of this challenging market know it is still expensive to produce at scale and the high-volume infrastructure necessary to expand its use is lacking. At the same time, many experts agree that H2 is set to play a major role in the future energy mix, providing it can be made with low-carbon and renewable sources of energy.1

What is less clear are the priorities and opinions of those with a stake in the success of H2, such as the operators of public transport. This was a knowledge gap the author’s company sought to address with its latest research report “The Road Ahead,” which compiled the views of > 300 senior decision-makers working in the sector across Europe.

Transport was selected for three key reasons. First, despite the absence of a centralized fueling infrastructure, many companies in the regions polled by the author’s company (i.e., the UK, Germany, Italy) are already actively investing in H2-powered fleets as a means to meet decarbonization targets. Secondly, H2 offers promising solutions to some of the limitations of current battery-electric vehicles, including issues related to weight, driving range and pressure on the electrical grid. Finally, the costs of decentralized electrolysis and storage are now beginning to fall, though there is little research into this aspect of the H2 economy.

In other words, with this research, the author’s company was looking to gauge H2’s status within UK, German and Italian public transport as it transitions away from traditional fuel sources.

At the same time, the research also sought to determine how onsite generation fits into today’s market, particularly as a means to break some of the bottlenecks faced by operators and local authorities.

Filling the gaps. As it stands, battery fleets are embedded within public transport to a far greater degree than H2-powered variants. They dominate short-haul freight and last-mile fulfilment, having been helped by a shrinking total cost of ownership.2

Long-haul freight and transit, however, remain largely unsuitable for today’s electric vehicles. Extended travel distances, uneven terrain, heavy payloads and slow charging times all remain difficult obstacles to overcome without major improvements to both the batteries themselves and the infrastructure necessary to charge them when running low on the road.

Conversely, H2-powered transport faces fewer of these obstacles—in theory, at least. Vehicles equipped with fuel cells or H2-assisted internal combustion engines are generally lighter and can refuel quickly at highway stations, much like conventional petrol or diesel fleets. Perhaps most importantly, refueling does not require a connection to the electrical grid.3

Given this split and its implications for decarbonization, the research first looked at the sector’s general perception of H2.

Despite the success of electric vehicles (EVs) to date, respondents still believed that the fuel had a role to play, particularly in areas where EVs currently fall short. Almost 90% of the sample, for instance, said H2 would be effective in overcoming the limitations of battery technology. Of that number, more than a third said it would be very effective.

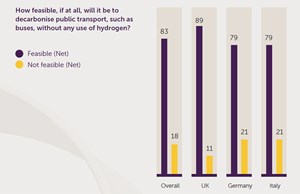

These were promising signs but also an incomplete picture. While H2 is generally considered to be a valuable tool for the energy transition, a large number of respondents (83%) nevertheless said that it would be either somewhat feasible or entirely feasible to decarbonize public transport without the use of H2 (FIG. 1).

These findings highlight a clear contradiction. On one hand, the sector anticipates that H2 will eventually address many of the limitations associated with EVs. On the other, there is a strong belief that EVs will dominate the transport market throughout the energy transition despite their shortcomings.

This uncertainty likely stems from the relatively slow deployment of H2 technologies in transport, contrasted with the rapid growth and mainstream success of EVs. However, as the industry gains more experience with H2 and better understands its most effective applications, these perceptions can be expected to shift.

Sustaining success. Prior to the author’s company’s research, orders for H2-powered fleets continued to be announced, even with fueling infrastructure in its earliest stages of development.4 These orders signaled a base level of enthusiasm for a future transport sector that is at least partly powered by the fuel. However, it was clear that questions remained.

Two in particular seemed to stand out: What would sustain the sector’s interest in H2? And, more importantly, what would it need to embed the fuel across operations long term?

Unsurprisingly, financial incentives were considered critical for making H2 a lasting success. Almost three-quarters of respondents (73%) said they would consider onsite H2 production to fuel their fleet if there was sufficient funding in place; 24% said they would not. These splits were almost identical across the UK, Germany and Italy.

The ability to store H2 safely was also considered key in moving forward. Overall, 72% said that storage safety was a significant barrier to their deployment of H2-powered vehicles. Just more than a fifth (24%) said it was not a concern. At 76%, the UK had the highest percentage of people who said it was a barrier or concern, followed by Italy and Germany at 73% and 66%, respectively.

The role of storage—and, particularly, decentralized storage—takes on greater significance when looking at the sector’s short-term plans. For instance, a fifth (21%) said they had already purchased H2 vehicles, while 61% said they would be investing within the next two years. However, only a quarter of respondents (26%) said they already had access to permanent fueling infrastructure.

Gridlocked? The author’s company also sought to determine the sector’s attitudes to the grid, especially respondents’ view on its ability to deliver a sufficient volume of clean electricity to transport operators transitioning away from petrol and diesel.

Overall, 81% of respondents said they were confident in securing enough clean electricity from the grid, despite the challenges of increasing electrification. Just under a fifth (18%) were not confident.

While Europe’s grid is increasingly renewable, there is still some way to go before transport can rely on power that is confidently ‘green.’ The grid is also far from stable, and its current condition has left hundreds of projects stuck waiting for a connection.5

This is a challenge for the development of EVs and H2, though the latter is not solely dependent on the grid for mobility, particularly when the fuel is made using electrolyzers onsite.

Perhaps most telling of all, 93% said they were concerned about the capacity of their grid connection for both current and future fleet requirements. These results were also seen by region. In all countries polled, at least 88% said they were concerned. There was also a significant percentage of people in each country who said they were ‘very concerned’ about grid capacity. In Italy, for example, this figure was 52%.

Where does this leave the sector? Transport is not yet ready for large-scale H2 adoption, though interest in the fuel remains strong, even amid ongoing doubts about its effectiveness. This is most evident in the number of respondents already ordering H2-powered vehicles, often without having the necessary fueling infrastructure in place.

In this context, decentralized H2 production is likely to play an increasingly important role, especially as the development of a centralized refueling network remains uncertain. While decentralization is more compelling in sectors where operations are concentrated—like refining and heavy industry—transport presents an entirely different challenge. Its needs are more geographically dispersed, meaning H2 supply must be flexible but also distributed.

Decentralized production also offers a potential solution to Europe’s strained electricity grid. While many respondents expressed concerns about grid capacity, a significant number still believe EVs alone can decarbonize transport—an outlook that seems difficult to reconcile without major grid upgrades. Onsite electrolyzers, particularly those powered by renewables, can help bridge this gap.

This model is already being demonstrated in regions like the Orkney Islands, where localized H2 production is proving effective. Even in areas without abundant clean energy, producing H2 closer to where it is needed aligns well with the rise of distributed energy resources. Electrolysis powered by DERs reduces reliance on the grid and could accelerate the transition away from sole reliance on fossil fuels.

There can be little doubt this also presents a challenge, but it is a model that solves some of the key issues transport is facing, and these types of incremental gains are often what is needed to demonstrate proof of concept. This is why the author’s company is focused on expanding access to onsite electrolysis across Europe. H2T

LITERATURE CITED

1 International Energy Agency (IEA), “Hydrogen,” online: https://www.iea.org/energy-system/low-emission-fuels/hydrogen

2 Link, S., A. Stephan, D. Speth and P. Plötz, “Rapidly declining costs of truck batteries and fuel cells enable large-scale road freight electrification,” Nature Energy, 2024, online: https://www.nature.com/articles/s41560-024-01531-9

3 McKerracher, C., “Cheaper truck batteries usher in dawn of emissions-free rigs,” Bloomberg, September 24, 2024, online: https://www.bloomberg.com/news/newsletters/2024-09-24/cheaper-truck-batteries-usher-in-dawn-of-emissions-free-rigs

4 Collins, L., “Germany due to have more than 900 hydrogen buses by 2030, but over 7,000 battery-electric ones,” Hydrogeninsight, April 4, 2023, online: https://www.hydrogeninsight.com/transport/germany-due-to-have-more-than-900-hydrogen-buses-by-2030-but-over-7-000-battery-electric-ones-pwc-study/2-1-1430320

5 Kurmayer, N. J., “Europe’s industrialists want deep reform of power market to tackle €800b grid spending gap,” Euractiv, April 9, 2024, online: https://www.euractiv.com/section/energy-environment/news/europes-industrialists-want-deep-reform-of-power-market-to-tackle-e800b-grid-spending-gap/

About the author

ANDREA PUSCEDDU is the Business Development Director for Hydrogen at IMI. Prior to this, he served as Technical Director and a Design Engineer, developing valve and actuation systems for fluid catalytic cracking (FCC) and expander applications in refineries worldwide. He began his career in 2000 as a designer and structural analyst with a strong focus on finite element analysis and mechanical design. Pusceddu holds a degree in mechanical engineering from the University of Cagliari, where he also collaborated as a tutor in FEM applications. His career has spanned engineering leadership, software development for specialized calculations, and ERP system implementation, bridging deep technical expertise with strategic innovation in the energy sector.