News

India’s $2.1 B push for local electrolyzer manufacturing and green H2 production sees strong interest from large companies

India’s $2.1 B push to transform it into a global green H2 powerhouse has received a strong response from large strategic investors in the country’s private sector, but the scheme can be further improved to attract start-ups and global players, according to a new joint report released by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

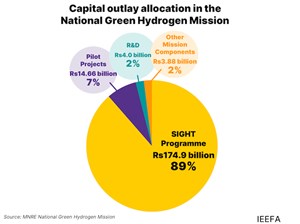

The report finds that large Indian corporations have evinced strong interest in the tenders issued for both electrolyzer manufacturing and green H2 production under the National Green H2 Mission’s Strategic Interventions for Green H2 Transition (SIGHT) program. For both tenders, the bids received by the Solar Energy Corporation of India (SECI), overseeing the SIGHT program, exceeded the capacity offered under the SIGHT program’s incentives.

“By leveraging India’s advantage in low-cost renewable electricity, the SIGHT program aims to achieve competitive domestic electrolyzer manufacturing and reduce the costs of green H2 production. The program has received an enthusiastic response from the industry,” said the report’s contributing author Vibhuti Garg, Director – South Asia, IEEFA.

“The program can be improved further to attract start-ups, be competitive for global players and create a supply chain and secure demand to ensure the industry’s long-term viability. If successful, it could help build India’s green H2 industry with benefits for a range of sectors, including agriculture, transport and manufacturing,” she added.

The SIGHT program offers $541 MM of incentives for companies to set up 1,500 megawatts (MW) of electrolyzer manufacturing capacity. SECI received bids for more than double the capacity target at 3,328.5 MW from 21 bidders. Eight companies were successful, including Reliance Electrolyzer Manufacturing, John Cockerill Green H2 Solutions and Jindal India, each securing 300 MW. The remaining capacity was divided between Ohmium Operations, Advait Infratech and Larsen & Toubro, HomiH2 and Adani New Industries.

“Most of the winning participants had prior tie-ups with electrolyzer technology companies, some even securing technology license agreements before bid submission, showcasing proactive strategies that contributed to their success,” said the report’s co-author Jyoti Gulia, Founder, JMK Research & Analytics.

Similarly, for green H2 production, SECI received bids that exceeded the offered capacity by more than 100,000 metric tpy. The SIGHT program is offering $1.57 B as incentives for setting up 450,000 metric tpy. However, SECI received bids for 551,500 metric tpy from 13 bidders. Winners include Reliance, Greenko, ACME, HHP Two (Hygenco), Torrent Power, CESC Projects, Welspun, UPL, JSW Neo Energy and Bharat Petroleum. However, almost 38,000 metric tpy of biomass-based capacity remains unallocated.

“Despite this enthusiasm, using green H2 to decarbonize domestic end-use industries remains uncertain due to challenges such as infrastructure limitations, regulatory ambiguities and the absence of clear mandates for its use,” said the report’s co-author Kapil Gupta, Manager, JMK Research.

“The winners will likely focus on export markets due to challenges and price concerns in the domestic market. The sector grapples with stringent safety regulations, technology changes, project delays, policy uncertainties and a need for robust H2 supply chain infrastructure,” he added.

The report highlights that while the SIGHT program is off to a good start with enthusiasm from the industry, its ambitious goals can be hurt by its short tenure (5 yr) and comparatively low subsidies.

“Government intervention in establishing standards, policies and regulations and streamlining offtake for demand creation is crucial for developing the domestic green H2 market. Without such measures, India will likely remain a marginal player in the global green H2 market,” said the report’s contributing author Charith Konda, Energy Specialist, IEEFA.

The report also calls for strengthening the regulatory framework by issuing a clear set of emission standards for the green H2 industry, greater funding support for research & development and the adoption of global standards for India’s H2 ecosystem.