News

Online Feature: Splitwaters: The one-stop shop for green H2 projects

Splitwaters is a Houston‐based electrolyzer manufacturer and engineering, procurement and construction (EPC) firm. The company aims to be a one-stop shop for green hydrogen (H2) projects. Splitwaters removes the coordination between electrolyzer manufacturers, engineering and construction companies and procurement markups.

The company recently signed an agreement with Akna Energy to build and operate a 20-megawatt (MW) green H2 plant by late 2025. This plant will be the first of many that Akna plans to build with Splitwaters in and around the U.S.

Splitwaters will provide a complete turnkey solution for the green H2 plant, supply the electrolyzers and be responsible for the engineering, procurement, construction and commissioning (EPCC) of the plant. Zentech Inc. of Houston, Texas, with its more than 40 yr of engineering and project management experience, is the engineering partner for Splitwaters.

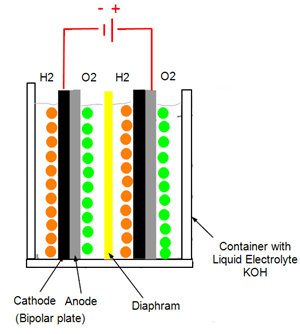

Splitwaters’ alkaline electrolysis module uses bipolar technology, consisting of a series of cells arranged side by side, forming a stack. The liquid electrolyte (KOH) is pumped via the electrolysis stack, where the product gases are formed. H2 is produced at the cathode and oxygen is produced at the anode. Biphasic mixtures, H2 or oxygen plus electrolyte, are conducted to their respective gas-electrolyte separator, responsible for water vapor and KOH removal.

Deepak Bawa, CEO of Splitwaters, answered a few questions about Splitwaters, including how they reduce capital expenditure (CAPEX), the 20-MW green H2 plant, their alkaline electrolyzer and the company’s plans for the future.

How do you reduce the CAPEX of green H2 projects?

We reduce the CAPEX by 30% by being a one-stop shop with our custom-tailored modularized solutions. What happens traditionally is when you are working with an electrolyzer company, you have to have a detailed engineering company, and a construction company. When you use an engineering, procurement and construction (EPC) company, they markup the procured items by at least 15% and the coordination work between the detail engineering company and the electrolyzer company takes a lot of time, effort, and capital from the client side.

Additionally, these green H2 projects are somewhat new to the market, so they are treated as first-of-a-kind. Generally, EPC companies offer unit rate contracts or time and material contracts. Instead, we offer a lump sum turnkey (LSTK) contract and remove the coordination effort required between the electrolyzer company, the engineering company, and the construction company. In the U.S., 50% of the CAPEX goes to the construction portion of the project. We developed a design to reduce the stick-built construction to less than 20% to remove the uncertainty surrounding a project, reducing the CAPEX by 30%.

What kind of electrolyzers do you manufacture?

We manufacture alkaline electrolyzers. I just returned from India, and I am in talks with the Indian government to establish our gigafactory there. There are many incentives in India to build our high-value fabrication center there, plus we will have another factory to manufacture electrolyzers, and the balance of plant (BoP) equipment in Houston. We will divide the module and electrolyzer work between India and Houston factories, and we can take those modularized solutions to any location, no matter how remote.

Can you tell us about your modular solution and its capacity?

Our capacity ranges from 1 MW−200 MW without compromising anything. We can put all the green H2 plant equipment on the truckable modules. These modules can be transported to the project site and have a plug-and-play configuration. These modules can withstand extreme weather conditions and can be moved later to another site, if required, at a minimal cost. As these modules will be built in our fabrication centers, we can control the timeline and budget easily. That is why this solution is so lucrative to the market.

Tell us about your low electrolysis cell degradation. Why do your electrolyzers have a longer lifespan?

Our degradation is much less than 1%. Alkaline electrolyzers have been in the market for a long time for chlorine manufacturing and we do not believe in reinventing the wheel but have improved the alkaline electrolyzer and its metallurgy. The lifecycle of an alkaline electrolyzer is typically 8 yr−10 yr, but our electrolyzer stack ranges from 12 yr−15 yr. The degradation is improved by improving the metallurgy. We are offering a proven and highly optimized solution to the market because nobody wants to put their money into a science project where they are not certain to make a profit.

You recently signed an agreement with Akna Energy. Do you have any other agreements in the works?

This is the first project we announced, and we have more than 300 MW of products in the pipeline where we will make green H2 and eFuels. The eFuels (green methanol, eMethanol, and green ammonia) are based on green H2, and we can add value by executing the whole project under one roof. We are pursuing these projects in North America, the UK and Europe.

Do you see yourself expanding to other regions?

There is a lot of interest in India, and as the market grows, we will consider it since we manufacture our electrolyzers in the country. I have met with a lot of public and private sector representatives on my last visit there. Although there is a lot of interest, but we have to see how it develops in the near future.

We will manufacture in India and the U.S. and cater to North American, UK, and European markets right now. Things can change depending on how other markets evolve.

For more information, email: dbawa@splitwaters.com