News

U.S. West Coast refinery demand for H2 increasingly met by merchant suppliers

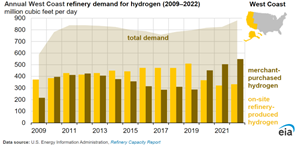

U.S. West Coast refiners are using more H2 purchased from merchant suppliers than from their own production. From 2012 to 2022, H2 purchased by refiners in the region increased 29% to about 550 million cubic feet per day (MMft3d). Over the same period, onsite refinery-produced H2 production from natural gas fell 20% to about 330 MMft3d. Merchant suppliers accounted for more than 62% of the H2 consumed by West Coast refineries in 2022.

H2 demand in the U.S. refining industry increased significantly from 2006 to 2010 as ultra-low sulfur diesel (ULSD) was phased in for all on-road diesel. H2 is particularly important in processing low-grade, sour crude oil slates with high sulfur contents. Refineries typically fulfill incremental H2 demand by either producing it themselves onsite through steam methane reforming (SMR) of natural gas or by purchasing it from merchant suppliers.

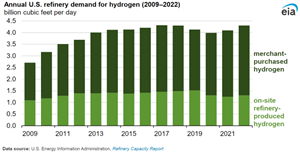

The trend toward greater use of purchased H2 is also evident nationwide but on a smaller scale. Merchant suppliers met 70% of U.S. refinery H2 demand in 2022, the highest percentage since we began publishing these data in 2009. For comparison, merchant suppliers met 63% of U.S. refinery H2 demand in 2019.

Merchant-supplied H2 for petroleum product and renewable diesel production originates from industrial processes where it is a byproduct; industrial natural gas producers use SMRs to convert natural gas feedstock into H2. These third-party industrial natural gas producers are sometimes outside of the refinery, but some own and operate the SMR units inside the refinery.

Byproduct H2 can be obtained from a chemical plant or other facility where H2 is not the main product. In the chemical industry, for example, the chlor-alkali industry produces H2 as a byproduct of chlorine production, and petrochemical plants release H2 as a byproduct of olefin production. According to an internal 2018 EIA study, byproduct H2 accounts for at least 50% of all H2 purchased by U.S. refineries and at least 30% of all H2 that refineries need that is not produced from byproduct reforming.

Refineries also use H2 coming off their own catalytic reformers; however, we do not collect these data because H2 input from refinery reformer units is counted indirectly as crude oil and unfinished oil inputs. We only collect data on H2 produced by SMR units.