News

Wood Mackenzie: eFuels offer long-term solution to key energy transition transport sectors, but journey needs to start now

The widespread development and use of synthetic fuels is still at least a decade away and depends on the successful deployment of other technologies, but companies that position themselves now are best positioned for success, according to the latest “Horizons” report by data and analytics company Wood Mackenzie.

The report, “Adding fire to e-fuels” states that e-fuels are a synthetic alternative to fossil fuels and can decarbonize difficult-to-electrify sectors without the need for the early scrapping of long-life equipment. This means e-fuels can offer a solution to power critical segments of transportation such as ships, long-haul aircraft and heavy-duty commercial vehicles.

The report states that e-fuels—which are also known as electrofuels, eFuels, synthetic fuels, Power-to-X (PtX), Power-to-liquids (PtL) and renewable fuels of non-biological origin (RFNBOs)—are produced by combining electrolytic (green) hydrogen (H2), made by electrolyzing water using renewable electricity, with captured carbon or nitrogen. An e-fuel can be considered carbon neutral if the emissions released into the atmosphere during its combustion are equal to (or less than) the captured carbon dioxide (CO₂) used to produce it.

“Identifying pathways from legacy fuels into low-carbon alternatives is a perennial challenge for incumbent energy players,” says Murray Douglas, Vice President of Hydrogen Research at Wood Mackenzie. “E-fuels offer companies an intriguing prospect at the intersection of electrons and molecules, and the potential to capitalize on existing technical, commercial and marketing capabilities makes it an appealing, if challenging, opportunity for many.”

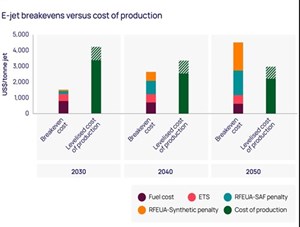

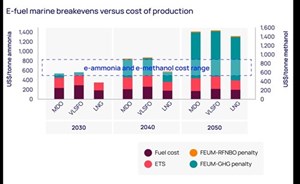

Challenges abound for large-scale deployment. The report also states that commercial viability is the key challenge in scaling up e-fuel production with the high costs of both green H2 production and CO₂ capture. The subsequent conversion process to the final e-fuel product is both energy and capital intensive—delivery costs must also be considered.

“There is no shortage of offtakers seeking low-carbon fuels, but the gap between cost of production and willingness to pay is sizeable,” Douglas says. “Each e-fuel has an incumbent fuel it aims to displace, all of which are much cheaper, and this means their success will be dictated by policy to mandate volumes, place a cost on emissions and lower production costs.”

Douglas adds that current conversion technologies differ depending on the final e-fuel desired, but the key challenge for all of them is in integrating green H2, carbon or nitrogen, and their subsequent conversion in a large-scale commercial e-fuel production facility.

Policy makers must wield both carrot and stick. The report states that most e-fuel proposals aim to source CO₂ from a variety of feedstocks, with biogenic sources with a low cost of capture, such as biogas and ethanol plants, dominating. However, as the production of e-fuels grows, the available molecules from such facilities will become scarcer and more dispersed. Costs will rise as e-fuel producers scour for feedstock while looking to scale.

This means that in the long-term, global policy makers must set the standards for where e-fuel producers source CO₂. In Europe, point-source CO₂ capture from fossil fuel power generation will only be permitted until 2036 and from other fossil fuel industries until 2041. Consequently, large volumes from net CO2 removal technologies—direct air capture (DAC) and bioenergy with carbon capture (BECC)—will be required.

“Globally, governments are going to have to take a holistic approach where incentives and penalties are introduced to ensure e-fuel production will be able to ramp up to a scale that will be required,” Douglas says.

The report concludes that producers who can pair low-cost renewables and biogenic CO₂ sources will have first mover advantage. However, putting this type of complex and technology-heavy production model in place is a lengthy process that must start now for large-scale production to be in place by the mid-2030s.

“E-fuels are undoubtedly one of the longer-term plays in the energy transition,” says Douglas. “However, companies that set a strategic direction quickest can position themselves to capture the most attractive elements of the value chain and take those learnings forward.”