News

Energinet's market dialogue on H2 infrastructure has been closed

Energinet's market dialogue on H2 infrastructure in spring 2024 confirmed a large potential for the transport need for H2 in the Danish market of up to 6.9 GW in 2050. In accordance with the political agreement from April and on the basis of the market dialogue, the booking requirement for the project has been updated and mapped out geographically. The schedule has also been updated.

During Energinet's market dialogue in spring 2024, Energinet received a total of 30 responses from 15 market participants. The projects are located along the H2 backbone with clusters around Fredericia, Esbjerg, and Holstebro. Most of the projects involve the production of H2 for export to Germany.

Overall, the market dialogue indicates a potential demand for transport needs of H2 totaling 4.9 GW in 2032, potentially increasing to 6.9 GW in 2050. However, the responses come from projects with significantly differing degrees of maturity, and Energinet thus assess that there is an immediate transport need with high maturity of approx. 0.8 GW in focus year 2031 related to the southernmost part of the pipeline (from Esbjerg to the German border). In addition, transport needs totaling approx. 1.3 GW in 2031 have been reported from projects directly linked to the tendered offshore wind power areas in the North Sea, which cannot be matured further until the offshore wind concessions have been awarded.

Energinet's market dialogue consisted of four parts: 1) Background information about the respondent, 2) information about the H2 project (purpose, location, schedule, and need and willingness to pay for transport capacity in the H2 backbone), 3) need for H2 storage, and 4) a maturity assessment. The maturity assessment was developed with input from industry organizations and in dialogue with the Danish Energy Agency (DEA) and the Danish Ministry of Climate, Energy and Utilities. The maturity assessment includes 12 milestones in four categories: Land rights and permits, utilities (electricity, water, possibly carbon), technology, and finances.

The responses are deemed to be preliminary entries as the market dialogue is not legally or financially binding and because, among other things, the final transport costs and a large number of other project aspects are still being prepared.

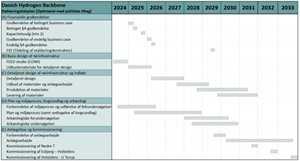

Energinet is currently preparing a front-end engineering design (FEED) study assisted by COWI, which will be used in combination with the results of the market dialogue to prepare a conditional business case and conditional section 4 application, cf. Act on Energinet. Energinet plan for the conditional business case and section 4 application to be submitted to the Danish Ministry of Climate, Energy and Utilities by the end of Q1 2025. The approval will, for example, be contingent on the outcome of the capacity sale (step 2 of the user commitment process) in the second half of 2025, where market participants must meet a booking requirement, as set out in II. Sub-agreement on pipeline H2 infrastructure. Energinet's final business case, which will form the basis for a final section 4 application, is expected to be finalized in early 2026.

On the basis of the market dialogue and within the politically determined framework, Energinet have recalculated the booking requirement for the project. The booking requirement has also been mapped out geographically. Please note that the booking requirement may still change before going towards the final section 4 approval, for example due to the results of the ongoing FEED study and the financial framework for Energinet. The underlying assumptions for the updated calculations are described in more detail in Appendix 1.

Updated and geographically mapped out booking requirements:

- 'The Seven' (lines 1+3): [0.8] GW

- 'The Lower T' (lines 1-3): [0.9] GW

- 'H2 backbone without storage' (lines 1-4): [1.2] GW

- 'Full H2 backbone' (lines 1-5): [1.4] GW

This means that, in addition to 0.8 GW for ‘The Seven', an additional 0.1 GW must be booked to trigger the section towards Fredericia (2), 0.4 GW to trigger the section to both Fredericia and Holstebro (2+4), and 0.6 GW to trigger all remaining sections incl. those to the storage facility in Lille Torup (2+4+5).

The government has indicated that it is still willing to give Energinet access to government co-financing of a full or reduced H2 backbone if, after the capacity sale, Energinet can, among other things, satisfy the condition that a government financial contribution is found financially responsible and will not entail or constitute expenditure for the government, cf. 2nd sub-agreement. The booking requirement is one of several prerequisites for the project to receive government funding, cf. 2nd sub-agreement.

In the maturation application in spring 2023, Energinet presented a schedule that supported the political declaration of intent of 24 March 2023 to have a cross-border H2 infrastructure between Denmark and Germany commissioned in 2028.

Several activities on the critical path have proven to be more extensive and time-consuming than originally anticipated. Therefore, Energinet now assess that the ‘Lower T’ can be commissioned by the end of 2031 at the earliest, and the interconnections to Holstebro and Lille Torup by the end of 2032 and 2033, respectively.

The primary reasons for the updated schedule:

Increased project complexity (technical, market and system operational) delayed the launch of the maturation project, and for the same reason its results will be available later than initially expected.

Changed user commitment process (two steps instead of one). In the schedule in Energinet's feasibility study, it was assumed that the need for user consent could be met through completion of one booking step in an 'open season', as known from the expansion of the methane system. Energinet found that binding commitments could be collected no earlier than 2025. This assessment was, among other things, based on signals from Danish developers that a number of necessary clarifications would still remain outstanding in 2024, meaning that any capacity contracts would have to contain a number of conditions that would, dilute the investment signal. On that basis, Energinet decided to move the capacity sale to 2025 (now step 2) and introduce a step 1 in 2024 to support the offshore wind tender process and Energinet's own conditioned business case. It should be noted that step 2 will take place in the autumn of 2025, when the offshore wind concessions have been awarded and the Danish Utility Regulator's (DUR) approval of the terms of the capacity sale is in place.

Longer planning and environmental process: The schedule for 2028 included a precondition for an 18-month planning and environmental process, which is now no longer considered realistic. In the new schedule, provisions have been made for the establishment of a legal basis so that Energinet obtains an approved environmental impact assessment within a process time of 40 months from notification to approval.

Energinet are aware of the great importance of timely access to H2 infrastructure for the business foundation of Danish H2 exports and are working intensively to comply with the many assumptions of the updated schedule together with relevant authorities, such as the Danish Energy Agency and the Danish Safety Technology Authority, cf. attached Appendix 2. Energinet also refers to the Danish Ministry of Climate, Energy and Utilities' press release, which states that the government will work with initiatives that can counteract parts of the delay and make Energinet's new schedule more robust so that the first section of the H2 pipeline with connection to Germany can be commissioned at the end of 2031 and the connections to Holstebro and Ll. Torup at the end of 2032 and 2033 respectively, cf. above

The schedule requires a close cooperation between Energinet and the German partner Gasunie. The parties are in continuous dialogue about the two H2 infrastructure projects – Danish H2 Backbone in Denmark and Hyperlink 3 in Germany – with a view to concluding the necessary binding contract between the two companies. The two project organizations have a common understanding of the great importance that the cross-border link will have for the development of the future H2 market. The mutual ambition is to have the connection ready at the same time on both sides of the border.