News

Primary Hydrogen expands BC project portfolio

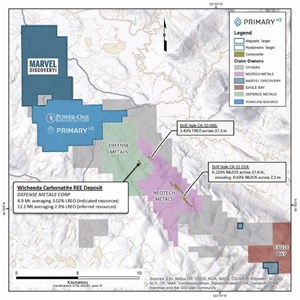

Primary Hydrogen Corp. announced execution of an Option Agreement with Power One Resources Corp. (Power One) to acquire a 75% interest in the Wicheeda North project in British Columbia. Primary intends to evaluate the natural hydrogen potential of the Project, given the presence of deep-seated faults, in addition to the potential to host significant rare earth mineralization.

“The Wicheeda North project expands Primary’s footprint in BC in addition to presenting significant potential for both natural hydrogen and rare earth minerals” commented Benjamin Asuncion, CEO of Primary Hydrogen Corp. “The Project lies within a Tier 1 mining jurisdiction with significant logistical and infrastructure advantages, as well as being on strike of a number of significant REE discoveries and projects.”

Wicheeda North Project, BC. The Wicheeda North project is comprised of nine contiguous mineral claims covering an area of 2,138 hectares (21.1 km2) in the northern Cariboo Mining Division. The Project is located 80km due north of the city of Prince George, 60 km east of the community of Bear Lake, and 10km northwest and along trend from the Wicheeda Rare Earth Element deposit of Defense Metals Corp. The Project has been subject to several exploration programs including a total of 693 line-kilometers of airborne electromagnetic, magnetic and radiometric geophysical surveys in addition to grid-based soil geochemical sampling totaling 870 samples. Despite only a small fraction of the property having been systematically explored, three areas of anomalous Rare Earth Element (REE) mineralization in the soils have been identified which remain open to expansion and ultimately drilling. The property has the potential to host REE mineralization because it occurs within a favorable geological belt known to contain carbonatite-hosted REE mineralization such as the Main Zone on the Wicheeda property located approximately 10 km to the southeast. The Wicheeda Rare Earths Project, which is owned by Defense Metals Corp., adjoins the Project to the southwest and is host to a February 2025 NI 43-101 pre-feasibility study (PFS) outlining a pre-tax NPV at 8% of $1.8 billion and IRR of 24.6%.