News

EIA: Natural gas remains the largest source of H2 in long-term projections

(EIA)--In our recently published Annual Energy Outlook 2025 (AEO2025), we introduced our new H2 Market Module (HMM), which allows us to model the market for H2 in the coming decades.

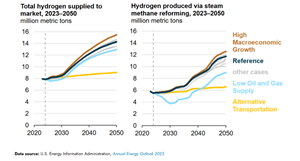

In most AEO2025 cases, we project H2 production will increase by around 80% in 2050 compared with 2024 and most H2 will be produced from natural gas in a process known as steam methane reforming (SMR). In most cases, we project less than 1% of H2 will be produced via electrolyzers, which use electricity to produce H2 from water, regardless of supportive policies.

In most of the cases we ran, we considered laws and regulations in place as of December 2024, which meant including tax credits implemented under the 2022 Inflation Reduction Act (IRA), such as the Section 45V Clean H2 Production Tax Credit designed to support H2 production generated by electrolysis from renewable electricity sources. More recently, the One Big Beautiful Bill Act modified incentives for H2 production and renewable electricity, which can be used to generate H2 during electrolysis. We did not take those changes into account.

To establish a historical baseline for the H2 module, we used estimates from our 2018 Manufacturing Energy Consumption Survey. In 2018, we estimated the size of the H2 market was 10 million metric tons (MMmt), equivalent to approximately 1,340 trillion British thermal units (TBtu) or about 1.8% of end-use energy consumed in the United States that year. Refiners and chemical manufacturers in the industrial sector consume almost all H2 in the United States as feedstock. Of this 2018 total, we defined 8 MMmt as market H2 and represented its supply explicitly in AEO projections using the HMM. Market H2 includes the following supplies:

- H2 produced for consumers via technologies such as steam methane reforming with and without carbon capture and sequestration (SMR, SMR + CCS) or electrolysis

- Byproduct H2 from other industrial processes that is delivered to a consumer and not self-consumed.

In the Reference case, we project this market grows to reach 14.3 MMmt by 2050, just over 1,900 TBtu or about 2.5% of total delivered energy in the United States. Of the total volume, about 12 MMmt—over 80%—is supplied by SMRs. H2 produced as a byproduct of industrial chemical processes, such as ethane cracking and propane dehydrogenation, is the next-largest supply source. SMR + CCS production supplies around 1.5 MMmt to 2 MMmt of H2 to the market at its peak in the 2030s, but by 2050, its contribution to U.S. supply is negligible because the tax credits subsidizing the deployment of this technology expire after 2045. Electrolysis contributes a negligible amount of H2 to market supply across the projection period in the Reference case despite assuming the availability of the 45V tax credit.

Several specific AEO2025 side cases demonstrate how key factors affect our H2 market projections:

- In the Low Oil and Gas Supply case, the high cost of natural gas feedstock makes SMR technology less economical compared with the Reference case, reducing the amount of H2 produced.

- The High Macroeconomic Growth case sees the largest volumes of H2 supplied to market due especially to stronger bulk chemicals growth, reaching 15.5 MMmt in 2050. H2 production via SMR and SMR + CCS, as well as H2 byproduct supplied to the market, all reach their highest levels in this case.

- The Alternative Transportation case removes several key policies from our projections and represents the lower bound of total H2 supplied to U.S. markets through 2050. Total H2 supplied hardly increases over the projection period. In all other AEO2025 cases, the transportation sector accounts for most of rising H2 consumption as H2 fuel cells in heavy-duty vehicles are deployed to meet policy standards. When these policies are not in effect, growth in H2 in the transportation sector is negligible.